Pre-market overview

U.S. stocks fell in the pre-market trading, and the U.S. 10-Year Government Bond Yields dropped again in Asias hours, pulling down the prices of commodities with crude oil falling up to 5%. China Concepts Stocks rose slightly in the pre-market trading.

In the secondary market, there are two types of US funds willing to make investments in China. Thereinto, one of them has liquidated or been gradually liquidating their holdings. According to the daily operations of the Ark Funds, it has been reducing its positions in China Concepts Stocks including Tencent, and has never increased its positions, although the afore-mentioned stocks have rebounded to some extent recently. A more pleasing signal appeared lately is that the Ark Funds has stopped lightening up Chinese stocks.

On July 1st, a total of 10 Chinese stocks listed in the U.S. are covered by the Ark Funds, including 8 China Concept Stocks and 2 Hong Kong stocks traded in U.S. over-the-counter (OTC). Based on the closing price of the day, these 10 stocks totaled $1.8 billion, as shown in the following figure.

About Its Positions

As a fund that is not active enough to invest in Chinese stocks, it is hard to say that the size of $1.8-billion position is small. The largest mutual fund that invests in emerging markets is the Invesco Developing Markets Fund, which has an investment of $15 billion in China, covering China Concepts Stocks, Hong Kong Stocks and A shares. Therefore, Ark's investment in China is not trivial.

The Ark Funds claims to be technology-based, but it seems that the Funds does not fully trust China's technology. By analyzing its holdings on Chinese stocks, the most positions held by the Ark Funds now are stocks of e-commerce which owns vast purchasing power, rather than those of technology companies. Cathie Wood, an American investor as well as the CEO & CIO of Ark Invest, once praised Baidu's driverless technology on TV, while their position in Baidu’s stock is not so large. Then, here comes the new energy vehicles of China. The investment target of the Ark Funds is not the Chinese EV trio including Li Auto, NIO Inc. and XPeng Inc., but NIU Technologies. The electric vehicles produced by Niu Technologies are good sellers in New York, while another three makers have not yet expanded into the United States. Once again, it reflects Cathie Wood's skeptical attitude towards China's "technology".

Let’s look into the lightening of the Ark Funds

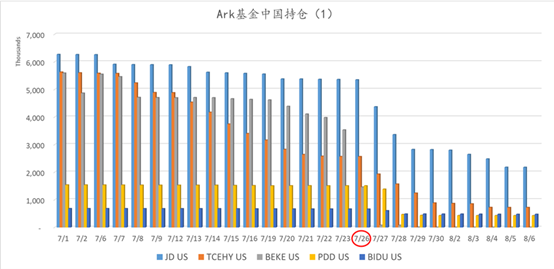

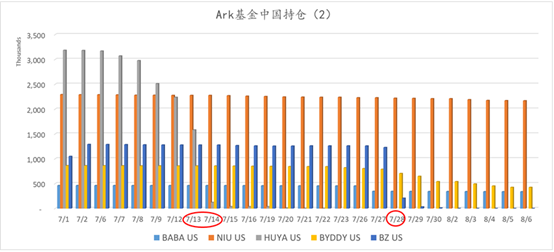

10 stocks are chosen to analyze their share changes. 5 stocks with the largest positions on July 1 (JD, TCEHY, BEKE, PDD, and BIDU) are shown in Figure 1, totaling $1.5 billion, accounting for about 80%. Another 5 stocks are BABA, NIU, HUYA, BYDDY, and BZ, totaling $300 million, accounting for about 20% (Figure 2). Key dates are marked below.

The Ark Funds cleared all its positions in HUYA on July 13 and 14 (marked in the Figure above). The news of the failed merger between Huya and DouYu was announced on July 12, but the Ark Funds did not substantially lighten up its position on the day, and continued the pace in the past few days.

Another marked date is July 26 (Figure 1). The Chinese education stocks plummeted over 50% on Friday, July 23. On that day, few people realized that a chain reaction had occurred, and Chinese stocks listed in Hong Kong would slump in the following week. The Ark Funds failed to realize it, either. On July 26, the Ark Funds had to lighten up its positions. The top 5 largest positions were all reduced by Ark, with Ke Holdings standing in the breach. This reflects Cathie Wood's suspicion of high-growth companies in China.

The third marked date is July 28, as shown in Figure 2. In this round of turmoil, the Ark Funds only lightened up its positions in the stocks of BOSS Zhipin (Kanzhun Limited), which is also a company with a relatively small market value. Meanwhile, Cathie Wood is still very insistent on the investments in NIU Technologies.

In the past week, the prices of China Concepts Stocks still hovered at a low level, but the Ark Funds no longer lightened up their positions. At present, there are only 7 stocks left. Based on the closing price last Friday, the position is $450 million, which is a 75% decrease compared to that of July 1.