U.S. stock futures dropped in pre-market trading Tuesday after a whipsaw previous session as investors continue to fret over fast-approaching rate hikes and a lackluster start to earnings season.

Market Snapshot

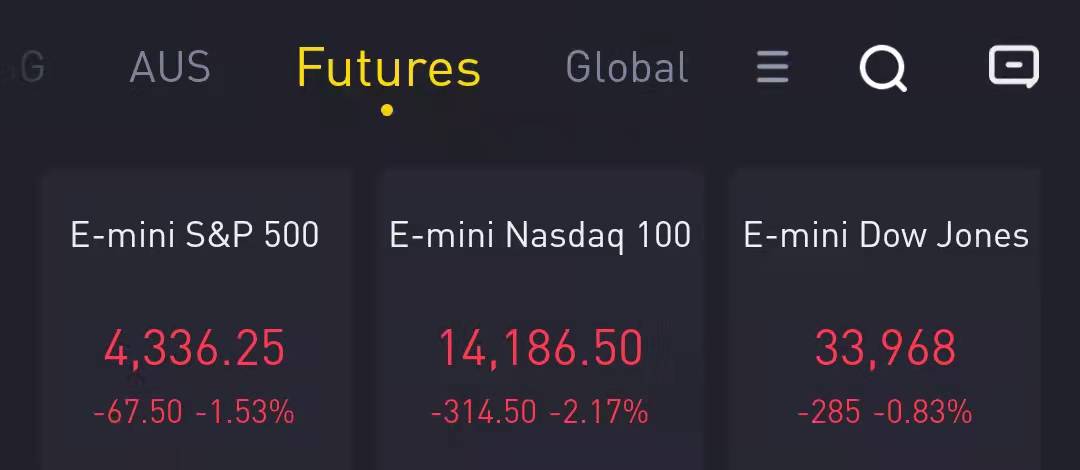

At 07:55 a.m. ET, Dow e-minis were down 285 points, or 0.83%, S&P 500 e-minis were down 67.5 points, or 1.53%, and Nasdaq 100 e-minis were down 314.5 points, or 2.17%.

Pre-Market Movers

3M – 3M rose 1.9% in the premarket after reporting quarterly earnings of $2.31 per share, 30 cents a share above estimates. Revenue also topped estimates, and 3M said its business improved during December as supply chain issues, omicron and other concerns abated.

Johnson & Johnson – Johnson & Johnson beat estimates by a penny a share, with quarterly earnings of $2.13 per share. The company gave an upbeat full-year forecast, however fourth-quarter revenue came in below analysts’ forecasts. Its shares fell 1.6% in premarket trading.

General Electric Co – GE slid 2.8% in premarket action as fourth-quarter revenue fell below Street forecasts. Quarterly earnings came in at 92 cents a share, compared to a consensus estimate of 85 cents a share. The company also forecast improved cash flow for 2022.

American Express – Record card spending helped American Express report better-than-expected profit and revenue for the fourth quarter. Earnings came in at $2.18 per share, well above the $1.87 a share consensus estimate.

Polaris – The recreational vehicle maker beat estimates by 13 cents a share, with quarterly profit of $2.16 per share. Revenue also topped consensus. Profit was lower than a year ago as Polaris dealt with higher costs for components and logistics.

IBM – IBM beat estimates by 5 cents a share, with quarterly profit of $3.35 per share. Revenue also beat estimates on strength in IBM’s cloud computing business. IBM shares experienced some volatility in after-hours trading after the company declined to give an earnings forecast, but shares recovered to gain 1.5% in premarket trading.

LM Ericsson Telephone – LM Ericsson Telephone reported better-than-expected quarterly earnings, with the Swedish telecom equipment maker benefiting from the accelerating rollout of 5G networks around the world. Shares surged 5.5% in the premarket.

Logitech International SA – Logitech International SA sales fell 2% for its latest quarter, with the maker of computer peripheral equipment facing tough comparisons to elevated pandemic-induced demand a year ago. Logitech raised its sales forecast for the current quarter, however, and its shares jumped 4.5% in premarket trading.

PetMed – PetMed fell 9 cents a share shy of consensus estimates, with quarterly profit of 21 cents per share. The pet products seller’s revenue also came in short of analysts’ forecasts. The stock dropped 2.7% in the premarket.

Zions – Zions shares rose 1.1% in the premarket after beating top and bottom line estimates for its latest quarter. It’s the latest in a series of upbeat reports from regional banks.

Allscripts Healthcare Solutions – Allscripts Healthcare Solutions issued preliminary quarterly earnings and revenue numbers that exceeded Wall Street forecasts. The provider of physician practice management technology also announced a new $250 million share repurchase program. The stock surged 8.6% in premarket action.

Market News

Nvidia is quietly preparing to abandon its purchase of Arm from Softbank after making little to no progress in winning approval for the $40 billion chip deal, according to people familiar with the matter.

The U.S. health regulator revised on Monday the emergency use authorizations for COVID-19 antibody treatments from Regeneron and Eli Lilly to limit their use, as the drugs are unlikely to work against the Omicron coronavirus variant.

Sweden's Ericsson on Tuesday reported fourth-quarter core earnings above market estimates, helped by higher sales of telecom gear as more countries roll out 5G networks offsetting a loss of market share in mainland China.

Amazon and Netflix are amongst platforms partnering with Indian manufacturing home Clear Slate Filmz Pvt. to push out motion pictures and net collection price about four billion rupees ($54 million) because the battle for content material heats up in one of many world’s largest leisure markets.

Germany expects to receive 3.8 million doses of Novavax's newly approved COVID-19 vaccine Nuvaxovid by March 20, the health ministry said on Tuesday, as the government looks to persuade unvaccinated Germans to get a shot.

Verizon Communications Inc said on Tuesday it added more wireless subscribers that pay a monthly bill than expected during the fourth quarter as the telecom operator's rapid deployment of its 5G services roped in more customers.