The Dow Jones Industrial Average rebounded for a second day Tuesday after a key inflation reading showed consumer prices rising less than expected.

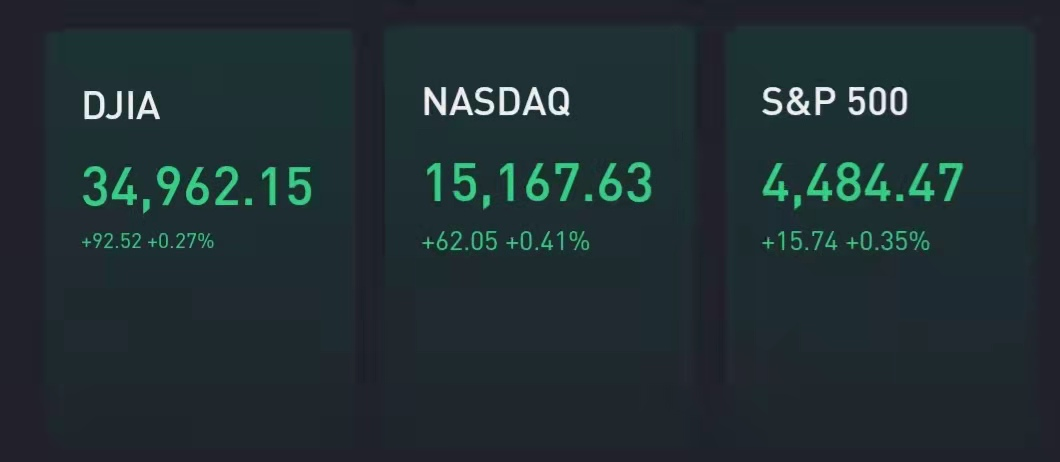

The blue chip index jumped about 92 points, or 0.3%. The S&P 500 rose 0.4% and the Nasdaq Composite added 0.4%.

The August consumer price index, while still showing a significant jump in inflation, came in less than feared. August CPI jumped 0.3% month-to-month, or 5.3% from a year earlier, below the 0.4% increase and 5.4% annual gain expected respectively by economists polled by Dow Jones.

The less volatile core reading excluding food and energy costs showed just a slight gain, up 0.1% and below the 0.3% consensus increase expected by economists.

"The important piece of the news is that we're showing sequential improvement, which is exactly what we need to see," said Art Hogan, chief market strategist at National Securities.

The Federal Reserve is monitoring key economic indicators like inflation readings as it decides when to taper its pandemic-era easy monetary policy. The Fed begins a two-day policy meeting on September 21.

"I believe the Fed will talk about tapering in September and not announce it until the November meeting and then put it in place before the end of the year," Hogan said.

Apple shares ticked slightly higher ahead of an event Tuesday where it's expected to announce new versions of the iPhone, AirPods and Apple Watch.

The major averages are all down at least 1% for September, and RBC doesn’t see the S&P 500 surging into the end of the year. The firm raised its year-end target for the benchmark index to 4,500 on Monday, up from a prior target of 4,325. The new target is less than 1% above where the index closed on Monday. The firm also introduced a 2022 year-end target of 4,900.

“We continue to think the S&P 500 will experience a bout of volatility/meaningful pullback before the year is up, a call that we’ve been making for the past several months due to elevated equity market sentiment and positioning,” the firm wrote in a note to clients.

“While we take the reasons for a pullback seriously, we also see economic recession risks as low, reducing the likelihood of a full growth scare, and intend to treat it as a buying opportunity,” RBC added.

On Monday, the Dow and S&P both advanced for the first time in six sessions as investors bet that some recent selling looked overdone. The Dow gained about 260 points, or 0.76%, after at one point during the session rising nearly 1%. The S&P advanced 0.23%.

Stocks linked to the economic reopening on Monday – including airlines and cruise line operators — rebounded slightly after the seven-day daily U.S. Covid case average declined to around 144,300, down from roughly 167,600 cases per day at the beginning of the month.

“In the near-term, we expect increased stock market volatility, although long-term investors should use pullbacks to add to stock exposure,” noted Richard Saperstein, chief investment officer at Treasury Partners. “The next six weeks tend to be seasonally weak for stocks, which is an additional worry for a stock market that is already facing elevated valuations and a lack of near-term upside catalysts,” he added.

The National Federation of Independent Business will also release its latest survey on Tuesday, which will provide investors with a pulse on how small businesses are faring.

In Washington, House Democrats proposed new tax hikes to pay for the $3.5 trillion spending package. A summary from the Ways and Means Committee showed that the plan calls for top corporate and individual tax rates of 26.5% and 39.6%, respectively.