Hertz Global Holdings, Inc. (OTCPK:HTZZ) announced today that it has launched a public offering of its common stock by certain stockholders of Hertz.The selling stockholders are offering 37,100,000 shares of Hertz common stock, of which Hertz intends to repurchase from the underwriters shares having an aggregate purchase price of between $250 million and $500 million (the "Repurchase"). In addition, a selling stockholder intends to grant the underwriters a 30-day option to purchase up to an additional 5,565,000 shares of Hertz common stock. The public offering price is expected to be between $25.00 and $29.00per share.

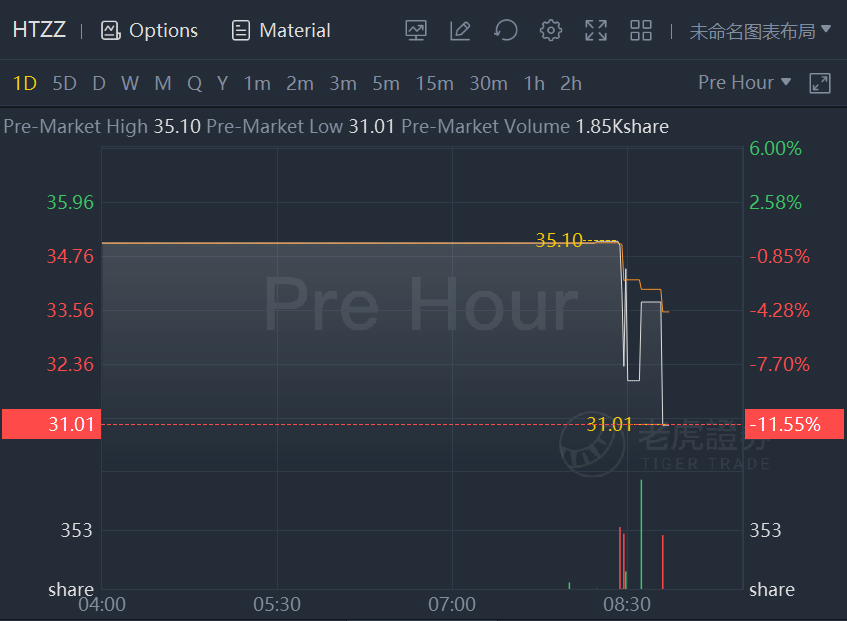

Hertz stock tumbled more than 11% in premarket trading.

Hertz will not receive any proceeds from the sale of shares by the selling stockholders. Hertz expects to fund the Repurchase with cash on hand. The Repurchase is subject to completion of the offering and the satisfaction of other customary conditions.

Hertz has applied to list on The Nasdaq Global Select Market under the ticker symbol "HTZ." Hertz's common stock currently trades on the over-the-counter market under the symbol "HTZZ."

Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, and Morgan Stanley & Co. LLC are acting as lead bookrunning managers for the proposed offering. Barclays Capital Inc. and Deutsche Bank Securities Inc. are acting as additional bookrunners, and Guggenheim Securities, LLC is acting as co-manager for the proposed offering.