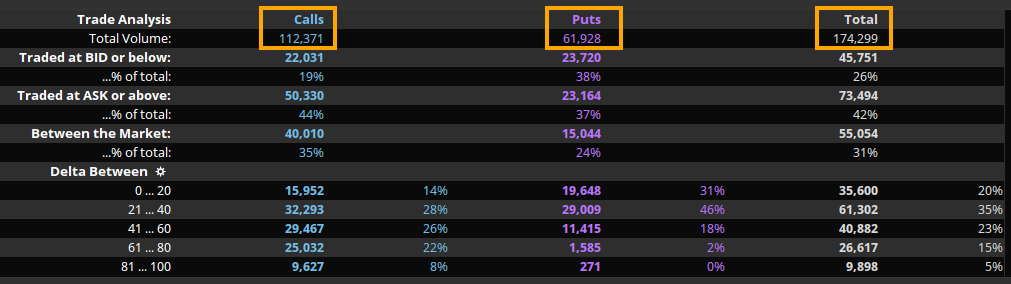

What Happened:Wells Fargo & Company is having a strong day, rising 2.74% on strong option flows with over 174,000 options traded, printing over 112,000 calls and 61,000 puts (image below).

Today's option flows represent an 11% increase in the total options as the stock had approximately 875,00 calls and 758,000 puts at the open of trading today. A large portion of today's flows is due to the heavy monthly expiry on Dec. 17 with over 41% of those options closing tomorrow.

Why It Matters:Large option expiries increase volatility with all of the options being monetized, rolled or hedged. This forces dealers to adjust their delta and gamma hedges thus increasing volatility.

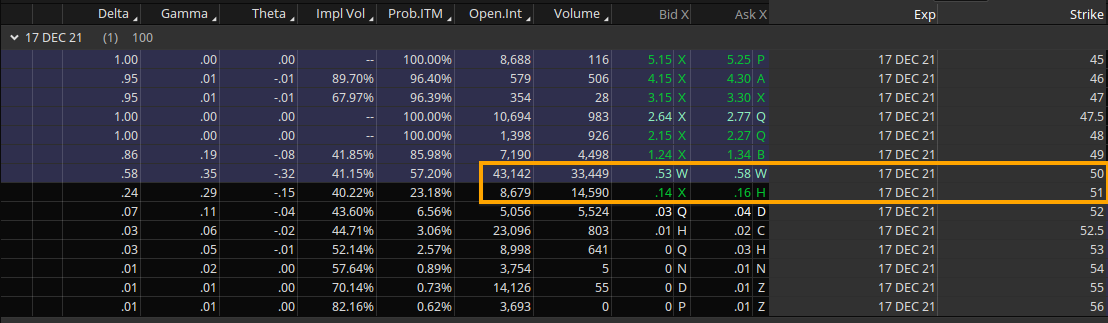

For the rest of the week, the stock looks supported around the $50 strike as the largest open interest is at the $50 strike along with the largest flows for the $50 and $51 calls (image below).

What's Next:Option traders should expect an increase in volatility on the Friday op-ex and to start next week.

Looking beyond towards the Jan. 21 expiry, the stock is seeing strong volumes between the $50 and $52.5 strikes with robust open interest between the $50 and $55 strikes.

On the other hand, if the stock starts to lose these recent gains, there is decent open interest on the put side down towards the $40 strike where the stock should find support as dealers will likely start to unwind their short hedges.