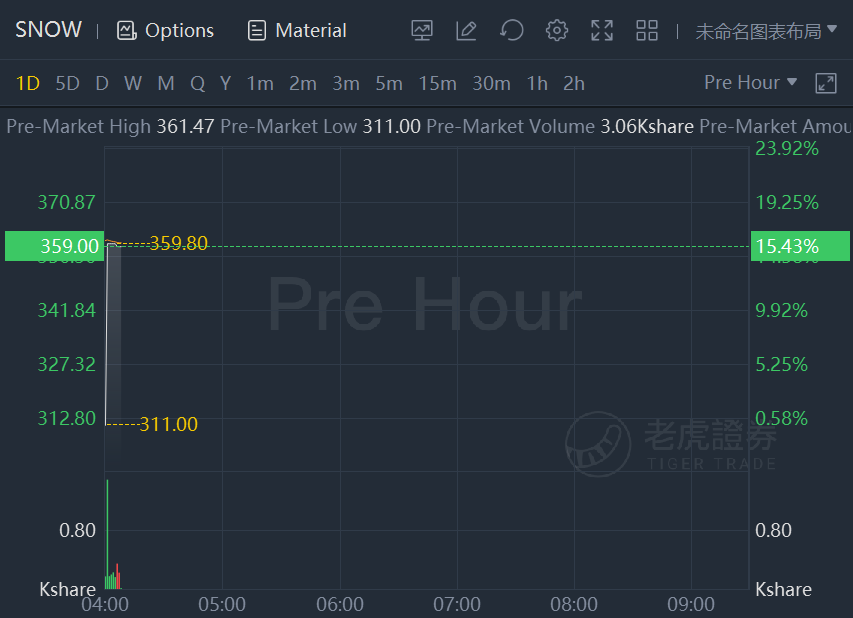

Snowflake stock jumped 15% in premarket trading after the company posted better-than-expected quarterly results.

For its fiscal third quarter, ended Oct. 31, Snowflake (ticker: SNOW) reported revenue of $334.4 million, up 110%, well above the Street consensus call for $305.6 million. Product revenue was $312.5 million, up 110%, and well ahead of the company’s guidance range of $280 million to $285 million. Adjusted free cash flow was $21.5 million, and free cash flow was $9.5 million. Operating margin was 3%, beating the guidance target of -7%.

Remaining performance obligations were $1.8 billion, up 94%. Net revenue retention, a measure of repeat business, was 173%. The company now has 5,416 total customers, 148 with trailing 12-month product revenue of more than $1 million. That is up from 4,990 total customers, and 116 above $1 million in revenue, one quarter earlier.

For the fourth quarter, Snowflake sees product revenue of $345 million to $350 million, up 94% to 96% from a year ago. For the January fiscal year, the company now sees revenue of $1.126 billion to $1.131 billion, up 103% to 104%, with an operating margin of -4% and an adjusted free cash flow margin of 8%.

“Snowflake saw momentum accelerate in Q3,” CEO Frank Slootman said in a statement. He noted that product revenue was up 174% in the Europe, Middle East and Africa region, and 219% in the Asia-Pacific-Japan region on a year over year basis.