Target Corp. Chief Executive Brian Cornell says the retailer continued to show the same strength heading into the back end of the year as it did during the front end, reporting third-quarter earnings and revenue that blew past Street expectations.

Net income totaled $1.49 billion, or $3.04 per share, up from $1.01 billion, or $2.01 per share, last year. Adjusted EPS of $3.03 was ahead of the FactSet consensus for $2.82.

Revenue totaled $25.65 billion, up from $22.63 billion a year ago and also ahead of the FactSet consensus for $24.61 billion.

Digital sales were up 29%. And comp sales growth, which the company says was driven by traffic, was up 12.7%. The FactSet consensus was for growth of 8.2%.

“With a strong inventory position heading into the peak of the holiday season, our team and our business are ready to serve our guests and poised to deliver continued, strong growth, through the holiday season and beyond,” Cornell said in an earnings statement.

Target says inventory is up more than $2 billion compared with last year. Target was one of the major retailers that chartered its own ships to bypass global supply chain bottlenecks.

Cornell talked up the agility of the Target team and its supply chain network during a call with media, saying the company worked hard at “maintaining inventory flow,” opting for alternative ports and taking other measures to keep the system moving.

Walmart Inc.,which announced its third-quarter earnings on Tuesday, also highlighted its inventory position, with U.S. merchandise levels up11.5% ahead of the holidays.

Target’s same-day services continued to be valuable with activity up 60%, and more than 95% of sales both online and at physical locations fulfilled by stores.

For the fourth quarter, Target expects comp sales to grow high-single digit to low-double digits compared with previous guidance for a high-single digit increase. The FactSet consensus is for 7.2% growth.

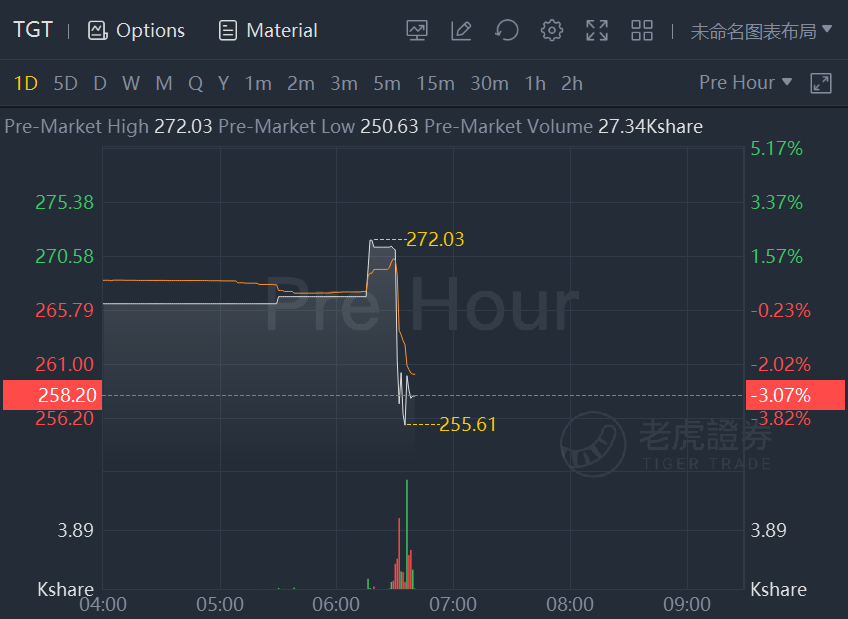

Target stock fell more than 3% premarket after the earnings release, but has skyrocketed nearly 51% for the year to date, outpacing the S&P 500 index,which is up 25.2% for the period.