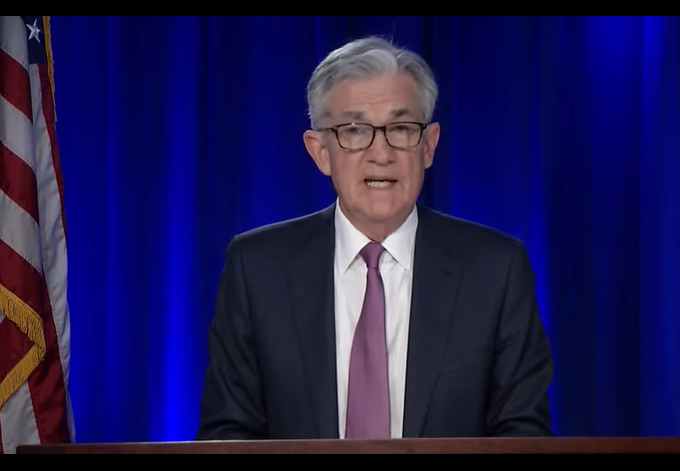

- Following strong GDP growth in the first half of the year, "household spending and business investment flattened out this quarter," as labor market issues and supply bottlenecks weighed on the economy, Fed Chair Jerome Powell said during the FOMC's post-decision press conference.

- Supply constraints have been longer lasting than originally anticipated, Powell said. The timing of resolving supply bottlenecks remain uncertain, he said.

- "Economic growth should pick up this quarter," he said, resulting in strong growth for the year.

- Unemployment was 4.8% in September, which he said understates labor market conditions, he added.

- 3:26 PM ET:Press conference ends.

- 3:25 PM ET:"People are quitting their jobs at all-time record numbers," but they went to other often better-paying jobs, he said. "We expect labor force participation to pick up, but we don't know the pace," Powell noted.

- 3:17 PM ET:There's no news on the supplementary leverage ratio for banks. The Fed is looking at way to address liquidity issues through that channel, he added.

- 3:15 PM ET: The Fed will address balance sheet issues in future meetings, he said. In other words, whether it will reinvest or reduce the overall size.

- 3:10 PM ET:Powell says, " I don't think we're behind the curve," adding that the Fed is prepared for a range of eventualities. "We will adapt as appropriate."

- 3:04 PM ET: The Fed's role in climate change issues relates to its mandates, Powell said, and "there's also a financial stability question." "We're not the people to decide the national strategy on climate change." That's for elected officials, he said.

- 3:02 PM ET: "The risk, for now, appears to be skewed toward higher inflation," Powell said. "Bottlenecks should be abating. They haven't gotten better overall, and we're aware of that."

- 2:56 PM ET: "We don't meet the liftoff test, because we're not at maximum employment," Powell said. The economy met the test for tapering asset purchases, but the FOMC didn't discuss when it might raise rates.

- At 2:52 PM ET, all three major U.S. stock averages are in the green: the Dow rises 0.2%, the Nasdaq increases 0.8%, and the S&P gains 0.5%. 10-year Treasury yield slips back to 1.57%.

- 2:52 PM ET: Powell explains the meaning of "transitory" in that "it won't become a permanent feature of life."

- 2:43 PM ET:"At this point we don't see troubling increases in wages," but the Fed will be monitoring it carefully. He attributes the inflationary pressures to supply bottlenecks and demand, not due to the tight labor market.

- 2:42 PM ET: The U.S. could reach maximum employment next year. "It's within the realm of possibility," Powell said.

- Update at 2:39 PM ET: "We don't think it's time yet to raise interest rates," Powell said. The focus of this meeting was on tapering asset purchases.

- "We should see inflation moving down by second or third quarter (of next year)."

- Earlier, the Federal Reserve kept interest rates near zero and set its plan to start the taper.

It's difficult to predict future of supply issues on inflation: Powell press conference

Tiger Newspress2021-11-04

免责声明:本文观点仅代表作者个人观点,不构成本平台的投资建议,本平台不对文章信息准确性、完整性和及时性做出任何保证,亦不对因使用或信赖文章信息引发的任何损失承担责任。

369

举报

登录后可参与评论

- Nez·2021-11-04Ok noted3举报

- 47776e2c·2021-11-04👌2举报

- JT2021·2021-11-04[微笑]3举报

- MHh·2021-11-04Interest rate remain low. That is all the market needs to continue to [Call] ? Supply bottlenecks will likely continue for at least a couple more months…11举报

- JLSE·2021-11-04👌👌👌2举报

- Kevin92·2021-11-04Like2举报

- ML808·2021-11-04Understand3举报

- Lanying·2021-11-04O4举报

- Gladys8jk·2021-11-04Ok3举报

- EHG·2021-11-04Like3举报

- IYYew·2021-11-04👍3举报

- KYHBKO·2021-11-04good summary of key points. with this over, market will start to work around the coming tapering. no adjustments to the current low interest rates is good for growth stocks. this means that investors can use leverage at low interest in anticipation of future earnings. should the interest rates be raised, leveraged investors will turn to assets providing more immediate returns.The Fed is caught between the rock and hard place as the inflation rate is stubbornly high due to supply chain challenges. it needs to take timely action before the inflation goes out of control. much of the market do not see inflation as transitory as the measurement applied has omitted important factors.3举报

- MCHo·2021-11-04Like4举报

- ASMH·2021-11-04Like3举报

- Rudyy·2021-11-04Like3举报

- 天天有錢賺·2021-11-04Latest4举报

- DMC8·2021-11-04Like pls6举报

- Dem0171c·2021-11-04Latest7举报

- Desoupie·2021-11-04Like pls [Bless]11举报

- newbe1001·2021-11-04Ok9举报

热议股票

关于我们·老虎社区守则·老虎社区账号管理规范·老虎社区服务协议·老虎社区隐私政策

公司名称:北京至简风宜信息技术有限公司

违法和不良信息投诉:010-5681-3562(工作时间9:30-18:30)

© 2018-2024 老虎社区 版权所有

营业执照:91110105MA01A4U55R

ICP备:京ICP备18016422号