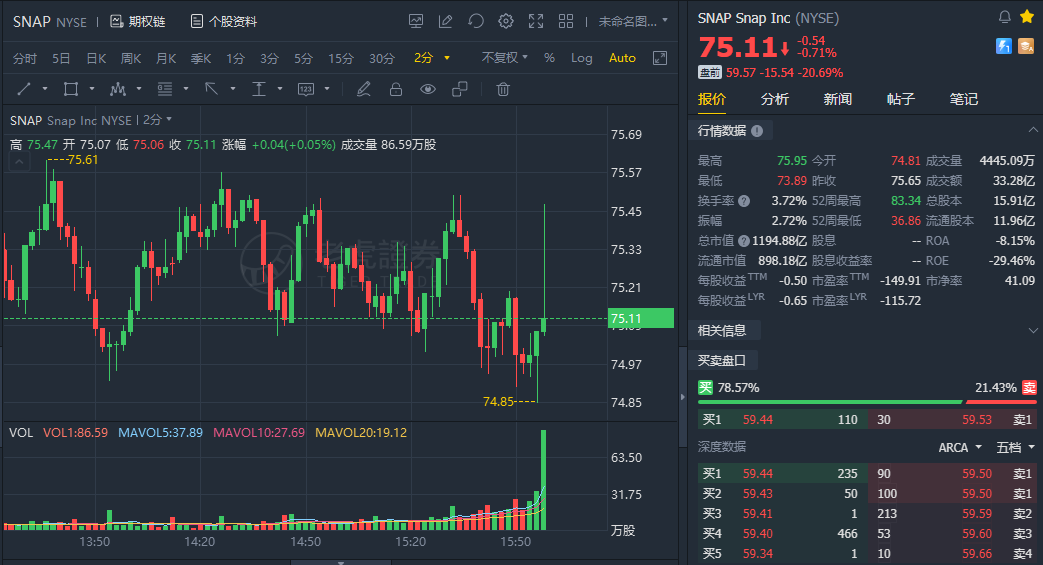

(Oct 22) Snap Inc nosedives 20% as revenue misses amid iPhone privacy changes.

- Snap stock has tanked 20% per-market trading Friday as third-quarter revenue missed analyst expectations, indicating some hit to numbers from the high-profile changes to Apple iPhone privacy.

- Revenues rose 58% from last year but landed at $1.07 billion vs. expectations for $1.1 billion.

- Operating loss widened, to $180.8 million from a prior-year loss of $167.9 million.

- Other income and significantly lower interest expense resulted in a net loss that improved to $72 million. Adjusted EBITDA rose 209%, to $174 million.

- In operating metrics, daily active users rose 23% year-over-year, to 306 million. The company pointed to Y/Y growth in DAUs that has been over 20% for four straight quarters.

- “We’re now operating at the scale necessary to navigate significant headwinds, including changes to the iOS platform that impact the way advertising is targeted, measured, and optimized, as well as global supply chain issues and labor shortages impacting our partners," says CEO Evan Spiegel.

- Operating cash flow turned positive, reaching $72 million vs. a year-ago -$55 million; that moved through to free cash flow, up to $52 million from -$70 million a year ago.

- Meanwhile fourth-quarter revenue guidance was light as well: for $1.165 billion-$1.205 billion, vs. consensus for $1.36 billion.