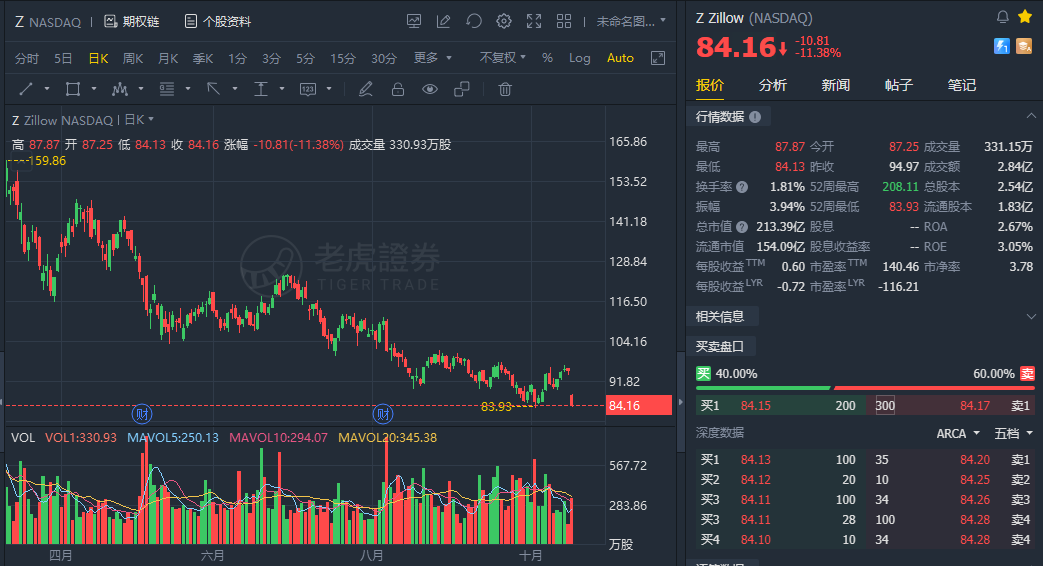

Zillow slipped over 11% in early trading after after the online real-estate company told Bloomberg that it won’t purchase homes for the rest of the year, saying that it was “beyond operational capacity.”

Related: Zillow Gets Outplayed at Its Own Game

Zillow, it seems, has over-flipped.

The company that has prided itself on its technology to outsource a lot of human work is suddenly referring the work right back to humans. Zillow Group’s automated home-flipping business has stopped pursuing new home acquisitions temporarily, Bloomberg reported on Sunday. In a statement for this article, a Zillow spokesperson said in an email it is “beyond operational capacity in [its] Zillow Offers business.” Zillow said it is now connecting homeowners looking to sell their home to its local Premier Agent partners.

The pause seems to be a case of poor planning—a surprising lapse for a company that has been in the online real-estate business for nearly 17 years. Rather than a cash issue, Zillow is saying it experienced supply constraints having to do with on-the-ground workers and vendors. Leave it to atechnology companyto develop an algorithm to predict home values, but mismanage the human aspect of its business.

To add insult to injury, Zillow’s biggest competitor seems to be handling high volumes just fine.Opendoor TechnologiesOPEN+2.52%said it is “open for business and continues to scale and grow,” noting it has worked hard over the past seven years to ensure it can continue to deliver as it expands. While Zillow long predates Opendoor as a company, it mainly offered an online marketing platform for agents before adding iBuying in 2018.

Zillow said it purchased a record number of homes in the second quarter at 3,805, but that still paled in comparison to the 8,494 homes Opendoor purchased in the same period. It doesn’t seem as though the near-term business hascompletely flopped: The company says it is continuing to process the purchases of homes from sellers who are already under contract as quickly as possible. That means home purchases could still continue to grow sequentially in the fourth quarter, even with the pause. Zillow hasn’t publicly commented on its fourth-quarter buying forecast, but has said its third-quarter outlook implies a “step up” in purchase activity.

Rather than flip out, iBuying investors may want to look at Zillow’s news as an opportunity for its competitors. Opendoor is now active in 44 markets, including all but two of Zillow’s 25 markets. Zillow’s pause therefore spells a golden opportunity for Opendoor. Zillow hasn’t yet said when it will resume new home purchases, but an email from a Zillow Offers Advisor to an agent seen by the Journal suggests the pause will last through the end of 2021 at the least.

Zillow’s mismanagement also highlights a key strength for smaller competitorOfferpad Solutions.OPAD+0.73%Led by a former real-estate agent, that company has longtouted its ground game. Offerpad, which is now a publicly traded company after closing its merger with a special-purpose acquisition company in September, seems to have been ahead of the curve in terms of understanding how many workers to employ and where, which repairs need to get done and how to execute them efficiently. An analysis by BTIG Research shows Offerpad’s contribution profit per home sold was over 4.7 times that of Zillow’s last year.

But the news is also a signal that investors may want to start to tread more lightly around what has thus far been a banner year for the sector. The reality is that iBuyers have incredible amounts of market data, can plan acquisitions and inventory months in advance and have a number of levers to pull to slow or accelerate the business, according to Mike DelPrete, a real estate tech strategist and scholar-in-residence at the University of Colorado Boulder. Given that, it is unusual that Zillow’s pause happened so suddenly and across all its markets.

The U.S. real-estate market has finallystarted to cool a bit. On Friday, Redfin reported the median home sale price rose 14% year-over-year in September—the lowest growth rate since December 2020. Meanwhile, closed home sales and new listings of homes for sale both fell from a year earlier, by 5% and 9% respectively.

Thus far, no other major iBuyer has said it was pausing new acquisitions this year. As Mr. DelPrete notes, it is possible Opendoor and Offerpad began to slow their own buying commitments as the market started to change, whileZillow missed the signs. More likely, Zillow, which has consistently prophesied what it calls the “Great Reshuffling” amid a permanence in remote work, just neglected to do its own reshuffling on the ground.