U.S. stocks rose on Thursday, rebounding from three straight days of losses as technology shares staged a comeback.

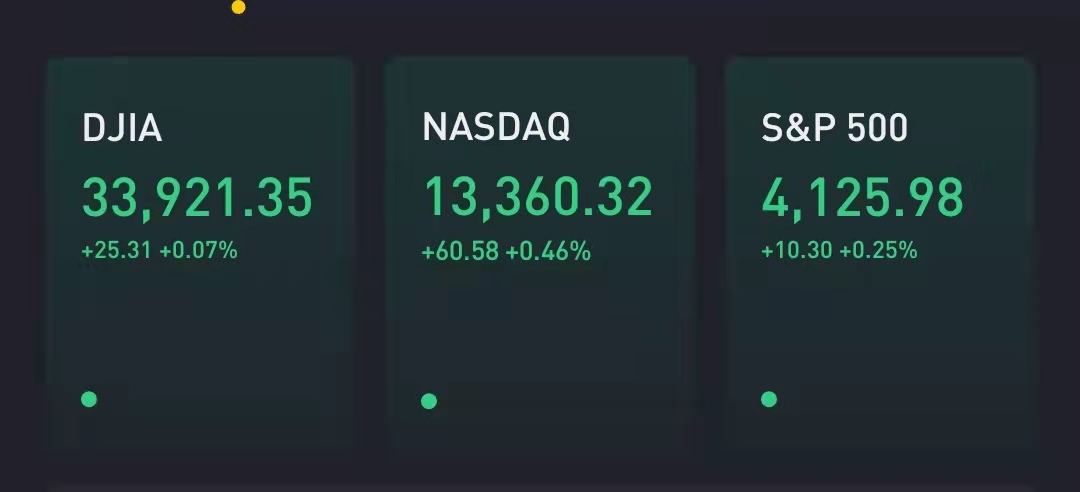

The S&P 500 gained 0.3% and the tech-heavy Nasdaq Composite climbed 0.5% as the so-called FAANG stocks all traded higher. The Dow Jones Industrial Average rose 25 points.

Investors cheered a better-than-expected jobless claims report on Thursday. The number of first-time claims for unemployment benefits for the week ended May 15 came in at 444,000, the Labor Department reported Thursday. Economist surveyed by Dow Jones had been expecting 452,000 new claims.

Stocks' rebound followed a roller-coaster session on Wall Street triggered by a sudden drop in bitcoin, which led to a sharp sell-off in many speculative areas of the market. Cryptocurrency-linked shares, including Tesla,Coinbase and MicroStrategy, led the market decline as bitcoin tanked as much as 30% at one point Wednesday.

After touching nearly $30,000 at its low, bitcoin made back some of those losses later Wednesday. The stock market closed well off its lows as bitcoin rebounded.

On Thursday, the cryptocurrency was slightly higher at around $40,000, according to Coin Metrics. Coinbase shares were higher in early trading Thursday after Wedbush said to buy the crypto-exchange despite the volatility.

“Crypto, after all, is the poster child for liquidity-induced speculation and the fact that this is now deflating ... lends credence to the sense that risk markets are now starting to adjust to the looming prospect of peak-liquidity,” a JPMorgan strategist said in a note.

The S&P 500 slid 1.6% at its session low in the previous session but recouped most of the losses to close down just 0.3% as the bitcoin stabilized. The blue-chip Dow finished the session about 160 points lower after plunging 580 points at one point. The tech-heavy Nasdaq Composite ended the day flat, erasing a 1.7% drop.

Wednesday was the third straight day of losses for the Dow, which is down 1.4% for the week. The average lost about 1% last week as the market rally to highs stalls.

Shares of Cisco dropped 3% Thursday after the tech conglomerate issued weaker-than-expected earnings guidancefor the current quarter.

On Wednesday, investors also digested the Federal Reserve’s minutes from April that hinted at considering tapering its asset purchase programs in upcoming meetings.

“A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” the Fed minutes said.