潘钟华 – 4月14日2020年

www.pzhconsultants.com

我们在2020年3月24日所发表的“市场下滑放缓的迹象- 4个关注图表”市场汇报里,预测市场在经历了好几星期的猛烈抛售后,有可能已达到一个支持水平。美联储宣布无限量化宽松(又称“ QE Infinity”),以及一系列其他措施,例如向外国央行提供美元掉期信贷额度等,似乎已经平息了融资市场的恐慌。

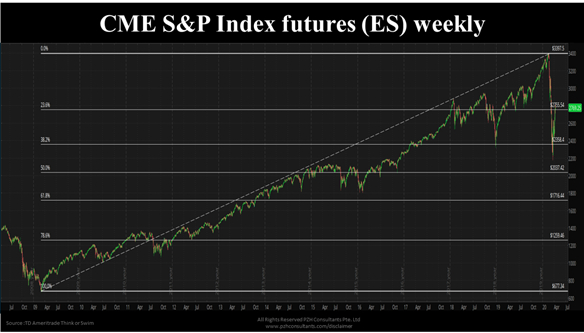

自那时以来,市场的反弹幅度可说是同样的激烈。标普500指数期货在3月23日达到的2174的低点后反弹至4月13日达到的2818高点。从低点跳了足足30%。从技术上而言,比之前的低点升出20%以上,代表着新牛市的开始。但是,正如我们在3月24日预期跌势会放缓一样,我们现在提醒大家不要对市场过分的乐观。

熊市通常会经历大幅度的反弹

首先,从技术角度来看,熊市通常会经历大幅度的反弹。前阵的抛售趋势是鉴于空前的,那我们必定预料到接下来的反弹也应该是非常猛烈。从低点超过20%只是一个技术上的问题。这次的反弹已达到了熊市下跌幅度的50%。在此我必须警告大家,因为**病毒封锁带来的经济影响才刚刚逐渐显示出来。到目前而言,法国预计第一季度国内生产总值将萎缩6%,而德国第二季度经济预计将萎缩近10%。在过去的三周中,美国的失业救济人数达到了1600万。加拿大3月份的失业率已达到7.8%。我们不应该希望这次的危机有如往常一般的经济衰退。

毫无疑问地,美联储与其他央行的全力拯救行动已成功地防止世界金融市场崩溃。但是,他们解决的只是融资问题。只有解除封锁并与成功地实施各国政府所宣布的财政措施,才有能使世界经济复苏。至今已经有迹象表明一些政府计划解除封锁。但是,病毒的蔓延是否会因封锁的解除而再次扩展,这是个一大未知数。

另一个问题是政府拯救资金分配到各经济领域的效率。宣布与施行措施本身是两回事。各政府必须在众多公司(尤其是中小型企业)倒闭和失业率上升之前,及时把急需的资金注入。一旦失业率上升,重新寻找就业不是一夜之间的事。如果封锁还未解除,那便是雪上加霜。这次的经济危机的规模与影响范围的之广大,意味着V形复苏的可能性是极微小的。资金流回到股票市场只需要几秒钟的时间。但企业需要较长的时间来重新重整业务。劳动资源也需要较长的时间来寻找就业机会。这和资金的高度流动性大有不同。

金融市场的观点经常翻来覆去,但这不改变经济的复苏,将是个艰巨过程的事实

大家还在预测**对公司收益以及随后各公司净值的影响。未来几周的企业收益发布季节将为市场提供良好的指示。鉴于股市已大幅反弹,和即将发布的盈利公告,我们预测市场应该会开始平仓,锁定盈利。总来而言,未来的情景还是难于预测。大幅度的反弹不足为奇。金融市场的观点经常翻来覆去,但这不改变经济的复苏,将是个艰巨过程的事实。

Market Update: Is the bull market resurrected?

By Thomas Poh – 14 Apr 2020

On the 24 Mar 2020, we published a market update titled: “Signs of Market Consolidation – 4 Interesting Charts” calling for the market to have found a potential base after the relentless selloff starting in the early part of March.The announcement of the Federal Reserve’s decision to embark on Unlimited Quantitative Easing, a.k.a “QE Infinity” as well as a host of other measures, like the provision of USD swaps credit lines to foreign central banks, seemed to have restored stability in the funding markets.

The market’s reaction since then was arguably just as fierce on the rebound.The S&P 500 index futures hit a high of 2818 on the 13th of April vs the low of 2174 registered on the 23rd of March.This is represents a 30% jump from the low.Technically, an increase of more than 20% from the previous low represents the start of a new bull market.However, as we had anticipated for the selloff to abate on the 24th of March, we would also now advise caution against over-optimism.

“Bear markets are known for sharp rebounds”

Firstly, from a technical point of view, bear markets are known for sharp rebounds.Given the unprecedented pace of the selloff, we should expect that the short squeeze to be also fast and furious.Surpassing 20% from its low is just a technicality.From the bear market point of view, this bounce represents slightly more than a 50% retracement from the low.This is where we urge caution because the economic impact resulting from the ** lock downs are only just beginning to surface.

As it is, France is expecting Q1 GDP to contract by 6 percent while Germany’s economy is expected shrink by close to 10 percent in Q2.US jobless claims have hit 16 million over the last 3 weeks.Canada’s unemployment rate has reached 7.8% for the month of March.One should not be expecting a global recession of the garden variety.

No doubt the Fed, together with other central bankers, had pulled all the stops to prevent the world financial markets from capsizing.They have succeeded in this aspect.However, what they had solved is only the plumbing issue.Clearing the chokes, so that liquidity can flow to the areas that badly needs it.

Resuscitating the world economy can only be done when the lock-downs are lifted AND coupled with the successful implementations of the fiscal measures announced by the various governments.There are already signs of some governments planning to lift the lockdowns.However, there is a risk that the rate of pandemic spread will pick up again after they have been lifted.

The other concern is the efficiency in the dispensation of the government fiscal funds into the economy.It is one thing to announce a bold newspaper headline.Getting the money to the main street in time, before companies (SMEs especially) close down and unemployment spirals, is another matter.Once unemployment spirals, it will take a much longer time for the labour force to be re-allocated (assuming the lock down has been lifted in the first place).

“The flow of labour, unlike the flow of funds, is an inefficient process”

An economic recession of this scale and scope simply do not justify a V-shape recovery scenario.While it takes seconds for funds to flow back into the stock market, it takes much longer, for businesses that had survived, to regain their footing and for new companies to replace the bankrupted ones.The flow of labour, unlike the flow of funds, is an inefficient process.

All these lead to the next question, which is the impact of ** on companies’ earning and subsequently their new fair value stock prices.The coming corporate earnings release season over the next few weeks will give the market a good indication of this.Given that the stock market has rebounded sharply, one would expect money to be taken off the table in view of the upcoming earning announcements.

In conclusion, it is of our opinion that we are far out of the woods.The big technical rebound is not unexpected in terms of its occurrence and magnitude.However, big uncertainties lay ahead coupled with an arduous economic recovery journey.Wall Street’s viscosity in its views is seldom shared by the main street.We should take heed of that.

Disclaimer:www.pzhconsultants.com/disclaimer

$SP500指数主连(ESmain)$ $道琼斯指数主连(YMmain)$ $NQ100指数主连(NQmain)$ $恒生指数主连(HSImain)$

精彩评论