Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

A tip:

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1. @wywy @我i168 @WYCKOFFPRO @TraderNeo @Wayneqq @IcySilver have mentioned @Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. Congrats to Tigers @wywy @Forexbae @Doxo @SunnyTan @Ange恩慈 ! Their posts are the first time selected in the "🏆 Posts of the Week". Thanks for sharing your insights on stocks and markets with us.

Market trends and industry news:

1. MACD illustrate diminished upward momentum suggests gold price to be traded lower in short-term

Tiger: @SunnyTan

As the market expects inflationary pressure to rise rapidly as global economy recovers from Covid-19 pandemic, investors shifted their portfolio from risky assets into safe-haven gold. In the US, supply chain disruption, raw material shortages and ongoing stimulus from US government is expected to lift inflation rate further. Last Friday, the US Congress has approved a $500 billion infrastructure plan which is expected to create more jobs that may reflect higher consumer spending and inflation rate in the near-term.

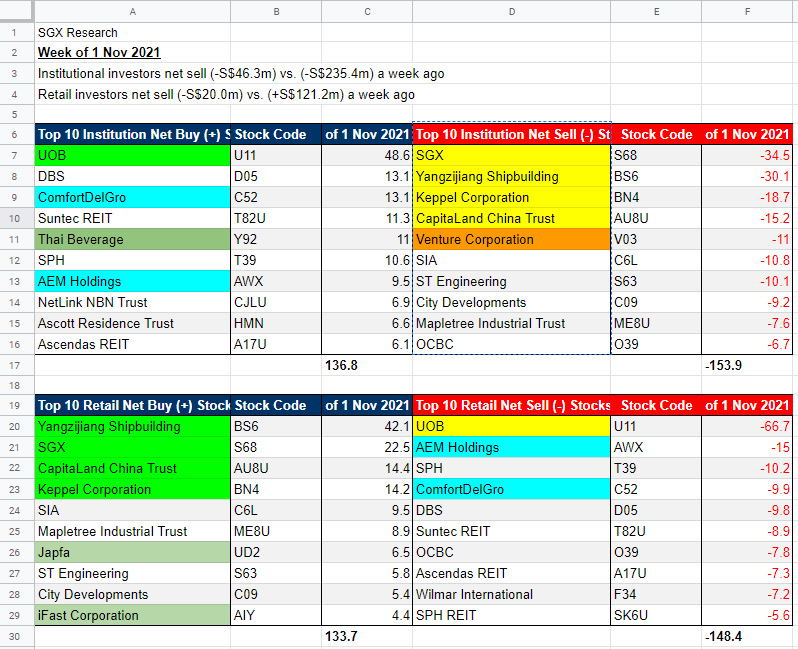

Tiger: @我i168

Here are the Institution buy & sell at SGX for the week of 1 Nov 2021, and some of my observations...

3. A Bargain you can't Ignore — This Laggard Breaks All Time High & Outperforms Nasdaq Last Week

Tiger: @WYCKOFFPRO

In this case, despite the volatility is getting lower, the volume is expanding on every down wave, suggesting lots of selling. Yet, what’s the results? A higher low throughout from Aug till Nov 2021. This suggests that there was supply absorption going on while the selling happened.

4. The Curious Case of Market Up, Fear Gauge (VIX) Up

Tiger: @TraderNeo

It is reasonable to imply that with both the VIX and S&P 500 $S&P 500(.SPX)$ moving in the same direction, a reversal could be on the horizon as the market rally appears unconvincing. The market rally can be said to be real and convincing when the VIX declines along as the market climbs higher (by the way, you can look at S&P 500 vs VIX charts that prove this point). Oh It is also worth mentioning that options trading tend to pick up speed at the end of the year which could also explain the strange moves in the VIX.

5. How to invest in Crypto...while NOT investing in it

Tiger: @Ange恩慈

As such, prudent investors might want to consider diversifying or investing in less risky alternatives while still riding on the trend.

1. Large-Cap Blockchain Companies

2. Public-listed Companies heavily invested in Crypto

3. Listed Crypto Exchanges

4. ETFs

5. Financial Institutions

Tigerpedia:

6. Demystifying Options Part 3

Tiger: @Wayneqq

If you speculate that the stock price will go down, you will buy PUT option at a strike price lower than the stock price and wait for the stock price to drop. Once the stock price drops, the option premium will increase. The bigger the drop, the higher the premium you will get. When the premium reaches an amount you are happy with, you will close (sell) your option contract and take profit. The difference in the premium you pay when you buy PUT option and the premium you will take back when you close (sell) your PUT option will be your profit.

Stock opportunities:

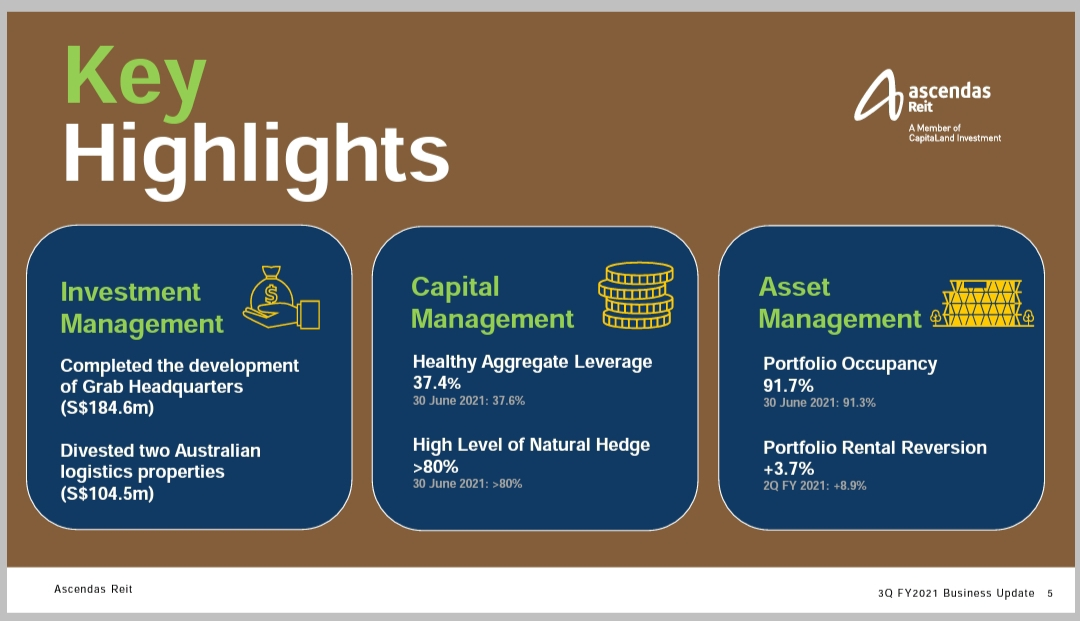

Tiger: @wywy

...I am positive on the outlook. With the recent dip in price, I am looking to invest more for my retirement portfolio

8. Unity software - Are you ready for the Metaverse?

Tiger: @IcySilver

Unity chart has been in a very nice up trending channel since May 2021. The volume since Feb till June 2021, seems to suggest accumulation phase. The breakout in Aug 2021, was pivotal for Unity to continue the quite aggressive up moves. It is very likely the price will challenge all time high $175, if the upcoming Q3 2021 earnings result is positive.

Tiger: @Forexbae

It seems like it’s respecting the support on the ichimoku cloud and the graphical overlap support. Plus it’s at the support of the stocastics indicator so….im looking to get in for a buy. It’s at the 50% Fibonacci retracement level at 155.8. I’ll probably take profit at 172.1 where the 61.8% Fibonacci retracement area is and placed my stop loss at 141.2. I might just move my SL somewhere tighter if it really manages to break the ichimoku cloud to have a better risk and reward but for breathing space, tentatively it’s at 141.2.

10. What makes you think that they are holding on to their Meta shares?

Tiger: @Doxo

Do not be disheartened by the daily price action. And in fact some technical analysis has price going down to $4.30 range. All these are the processes and interest from the public. BlackRock recently purchase close to 14mil shares. That doesn't mean price will rise up. BlackRock can lent shares to shorts too. This is business to them. But ultimate end results is WIN to blackrock because they can do something to rise up the stock price as well. There's simply no doubt that they too want a tremendous gain on this ticker. This is what blackrock could see it would. That's why they invested in Meta.

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1. Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards.

精彩评论