Roarrr!!!

Dear Tigers 🐯,

Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

An updated tip :)

For tigers who are selected for two times, you will be added to the "suggested follows" list which will be exposed for all tigers. It will add to the possibility of gaining more followers.

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1. Congrats to those who mentioned us in their articles

@TraderNeo @MilkTeaBro @WYCKOFFPRO have mentioned Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. Personal column recommendation

@oldwen has started a fresh new column to discuss how COVID-19 will affect different sectors of the economy and how people can tailor their investment portfolio differently. This week's content is one analytical discussion about the future of chip shortage.

@WYCKOFFPRO has one continuous series of articles about forecasting the bullish market in the near future and the introduction of two proxies as a reference to help confirm the exact timing. We are urgently looking forward to witnessing the upcoming posts!!

3.We also start to categorize the selected 10 posts. Let's take a closer look at those brilliant posts and welcome to leave your comments below! ❤️

Market trends and industry news:

Recovery of the world II

In conclusion, the recovery of the world is well underway but the recovery of the global chip shortage still seems to be at least a year or so away. This brings about a good perspective of the fragility of the current supply chain and explains why countries like US and China are desperate to bolster its chip production and sustainability amongst increasing trade tensions. The effect of the resolution of the chip shortage on EV makers and tech companies might be something to consider when organising personal investment portfolio as well.

Premature selling?

Nonetheless, let’s consider the thought of premature selling. There are a few key events and outcomes to consider, and look forward to. First, Q3 earnings. Only then we will know whether the stocks current valuation is justified and whether the companies guidance signal a positive or negative outlook.Second, Fed meetings. Only when the precise timeline of when the Fed is going to taper and by how much, helps provide a more rational approach in deciding on what to do with the current stock portfolio.Third, the outcome of Evergrande. Last but not least, the U.S. easing of travel restrictions for vaccinated international visitors is a positive sign that promotes economic growth.

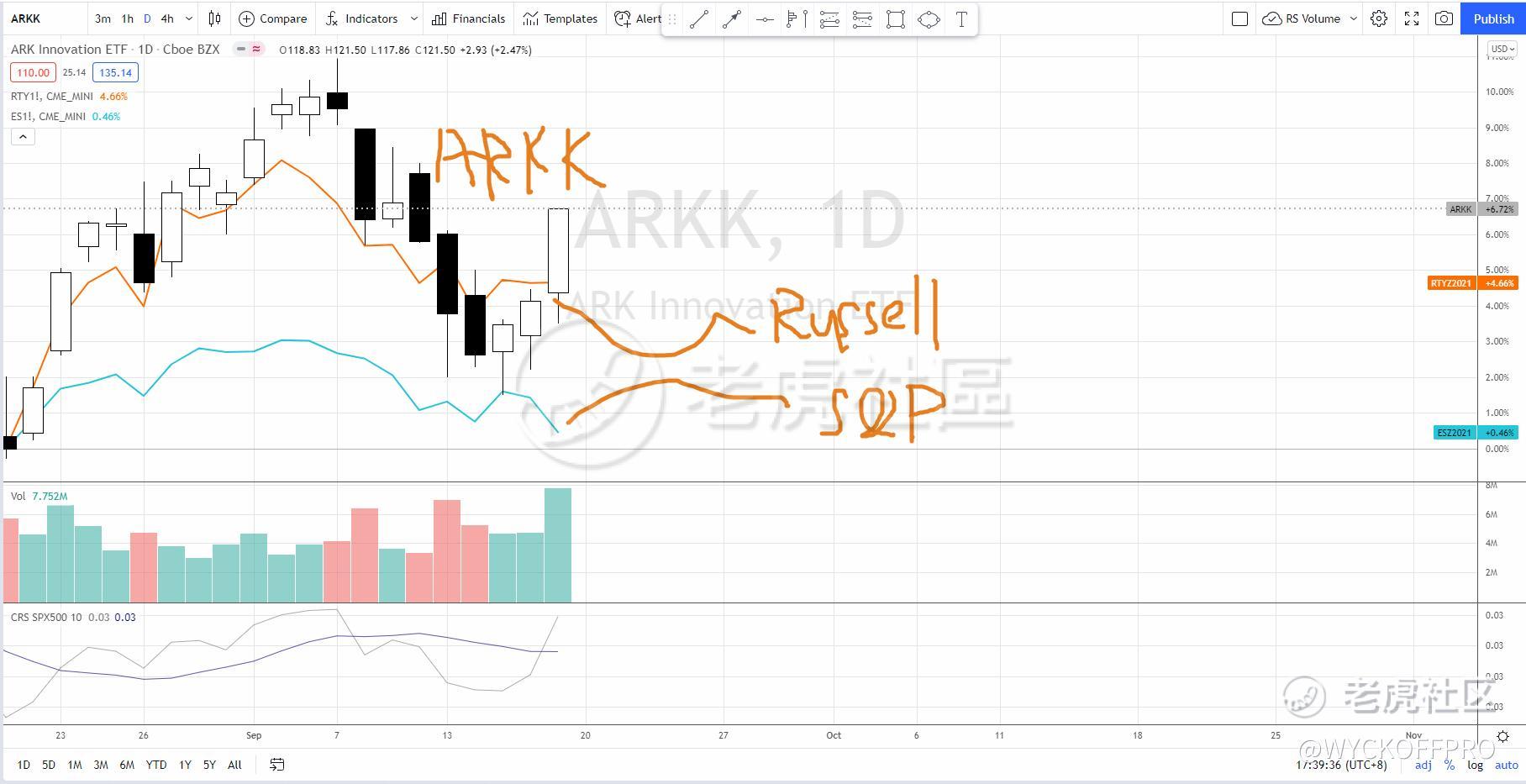

Market is going down - beginning of selloff or rotation?

My current directional bias is to the downside yet a reversal above 4440 could violate the bearish case. If it shows inability to rally up, S&P 500 is likely to test the lower support near 4350.This potential down move might not be as sharp and furious as I anticipated last week, rather it could take days to develop with "grinding down" price action.

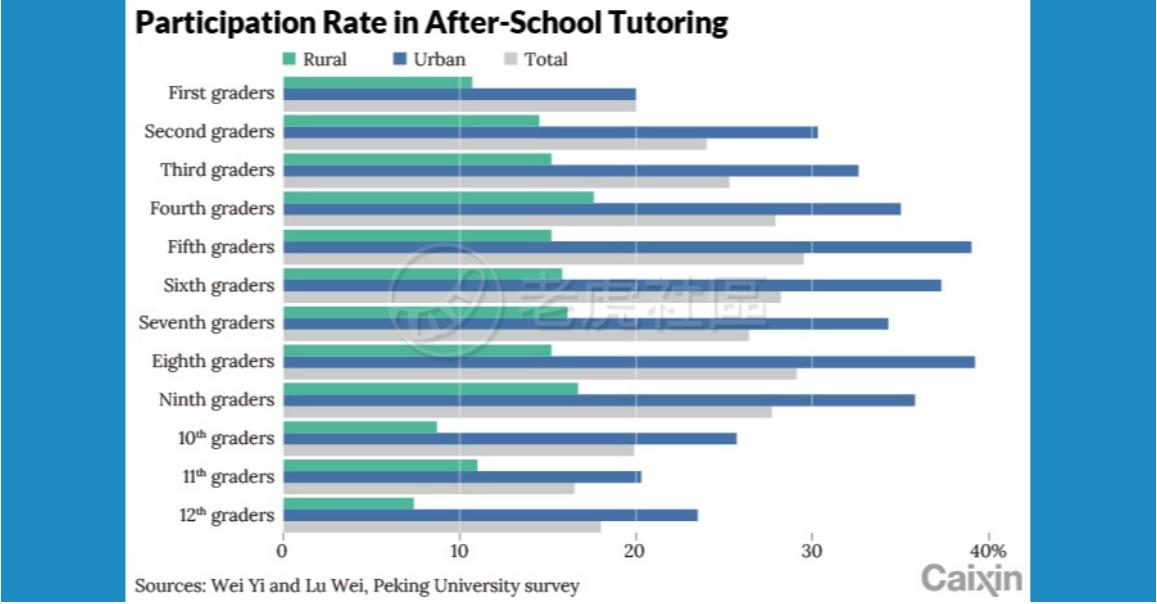

Opportunities Ahead on China Education & Tutoring Industry

Opportunities Ahead on China Education & Tutoring Industry

I think there are some good opportunities around if you are looking within this sector.

Most of the worst news regarding the non-profit have been priced in and companies are likely already pivoting to the new business and opportunities abound in the new world.

But these companies are still beaten down recently due to sentiments and there are even companies that are unfairly beaten as a collateral even as they are mostly not too related...

Stock opportunities:

Technical analysis S&R of PLTR

The box below the current price of 26.55 has a zone between 24.12 (lower price of the band) & 26.51 (upper price of the band). And for now, it is quite close to reaching this zone..So beware, if the price enters this zone & breaks below the average price (25.52) in the zone..I have to consider selling off this stock (if I decided to cut from holding this long term)

introduction about one safe ETF(SPTM)

SPTM is a part of the SPDR Portfolio ETF line up, a collection of core-exposure funds that track S&P indexes. The Fund tracks the S&P Composite 1500 Index. SPTM Top 10 Holdings include Apple, Microsoft, Amazon, Facebook, Alphabet, Tesla, Nvidia, Berkshire Hathaway Class B and JP Morgan. The Total Top 10 Weighting is 26.21%.

I have just bought CLF.

Currently, as anyone would agree, the companies fundamentals have been shaky. However, looking at future growth and cashflows model, we get a derieved average of 33.86. Any price under that is undervalued for this business in the short term.

Apple is a buy and hold stock; not so much of a stock to trade.

@JinHan

Humans hate major changes and like comfort hence the more products that Apple develop, the “stickier” the customers will be. This will lead to something called “recurring revenue” which is a good thing for Apple as they will have better visibility/ certainty of cash flow, and that’s a key to good investments!

Personal investing experience:

Always Cut Your Losses Sharp

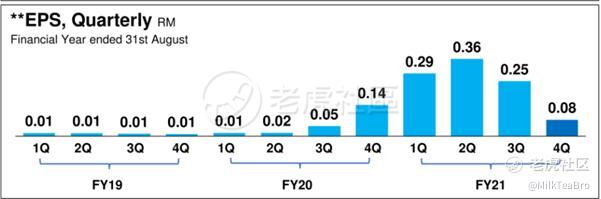

FY2021 Q4 earning per share dropped from Q3 0.2544 MYR to Q4 0.0759 MYR. it missed my expectation. I decided to cut loss.

In SG market, many stocks P/E are less than 10, for glove industry, growing was uncertain, even I can accept P/E=10 for Top Glove, the price=0.98 SGD. When I entered the Top Glove at SGD 1.58, I believed that Covid-19 variant spread widely, and Top Glove good earning can last much longer. Obviously my judgement was wrong. No choice, it is not attractive anymore to me, cut loss.

investing experience of AP4.SI

investing experience of AP4.SI

Of course they will be people who says demand for gloves is still high, which I agree and that Riverstone, who's business is mainly in cleanroom gloves, is difficult to break into given all the stringent criteria for qualification. One must keep in mind that in due course there will be abundance in supply and it will hit a plateau. With the many other players in market and abundance of capacity, it will be back to cut throat prices again.

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1. Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards

精彩评论