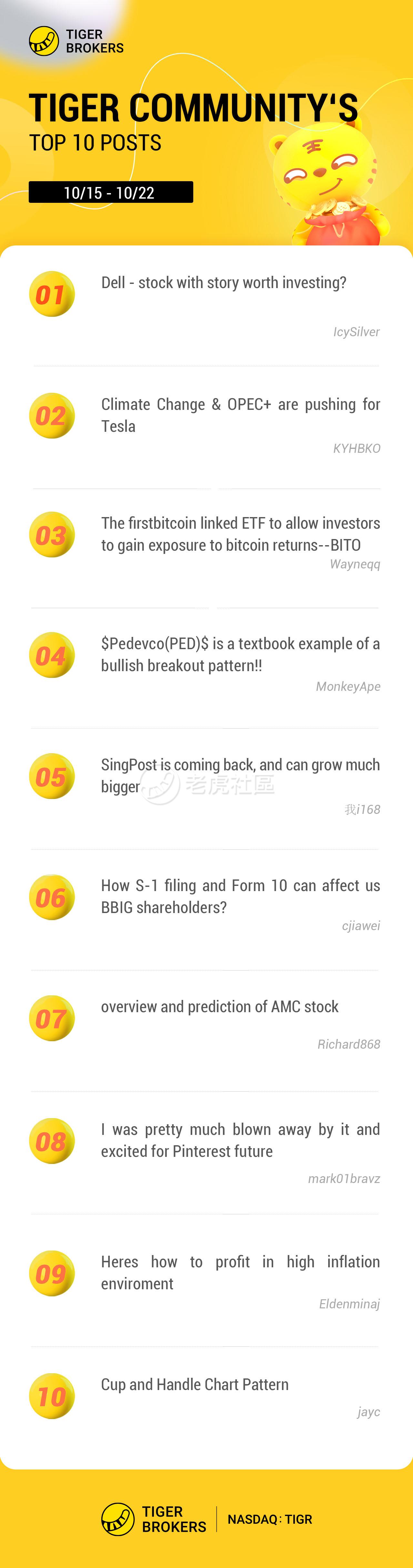

Welcome to our column: Posts of the Week! 🚀🚀🚀🚀🚀🚀🚀🚀

An updated tip :)

We have extended the list with 10 posts and if tigers want their posts to be chosen, you can @Tiger Stars in the article or the comment to earn more exposure because we will evaluate those posts that @Tiger Stars with priority.

A quick wrap-up of this week

For this week,

1.@KYHBKO@Wayneqq@IcySilver have mentioned @Tiger Stars in their articles and all their informative posts have been successfully selected! congratulations!! We welcome and encourage more tigers to @ us!!

2. Congrats to Tigers@IcySilver@MonkeyApe@我i168@cjiawei@Richard868 Their posts are the first time selected in the "🏆 Posts of the Week". Thanks for sharing your insights on stocks and markets with us.

Stock opportunities:

1.The first bitcoin linked ETF to allow investors to gain exposure to bitcoin returns--BITO

Tiger:@Wayneqq

The first bitcoin linked ETF to allow investors to gain exposure to bitcoin returns. But… this fund does not invest in bitcoin directly.. it invest in bitcoin futures contracts..

2.SingPost is coming back, and can grow much bigger

Tiger:@我i168

I think SingPost is coming back, and can grow much bigger.

Here are some key points -

a) Traditional profit contributor, IPP (International Post & Parcel) was hit most (>50%) due to almost double of the conveyance costs which are a function of flights from Changi. With flights recover, the cost will drop fast.

b). SingPost has rapidly grown its e-commerce logistics, with >60% of revenue from this segment. Its domestic e-com logistics now can make up to the loss of Letters & Printed Papers, i.e. SingPost has survived the declining domestic volume.

c). With increased stake in FMH to 51%, SingPost has made significant progress its 2nd "Home Market" strategy. You can consider SingPost now as Sing(+au)Post, particularly in courier and e-com logistics services.

d). SPC property side contributes c.50% of operating profits...a solid and steady profit support/pillar of the group.

All in all, you have a solid foundation part - property, recovery part - IPP, and growth part - e-commerce logistics.

3.overview and prediction of AMC stock

Tiger:@Richard868

Facts:

- famous movies from disney and dc will only be show in theatres. (No pirated haha)

- covid situation in US is improving due to the approval of red pill (which donald trump took)

- not just movies, amc also offers to watch live wwe, sports etc.

- accept bitcoins.

- With the recent market up trend movement, whi ch dun even care about the bad jobs and consumer reports, it still went green like 😂

- Volatility in AMC now is very loancw.

When in doubt zoom out. This is not financial advise, i maybe wrong haha.

4.How S-1 filing and Form 10 can affect us BBIG shareholders?

Tiger:@cjiawei

Essentially, whatever divis and ratios we get from Tyde, it cant be publicly manipulated/ traded for a duration so which means tyde can possibly go up during the time it isnt on the exchange. If TYDE ratios are as good as they say, shorters may want to go long on it, and thus, as supply and demand trends go, TYDE goes up and BBIG goes up as well.

Further, the ex-dividend is still October 22nd. The filing is still happening on Oct 25 where we should know a lot more about the ratios and whatnot.

The Board and MGMT have our backs. We just need to trust them. Shorters are fucked once the Form 10 filing comes out.

5. Pedevco(PED) is a textbook example of a bullish breakout pattern!!

Tiger:@MonkeyApe

The volume seems good and intraday trading has been going well for the past 2 weeks of this stock since it’s first breakout to $2.42, and in my opinion, we’re merely few days away from the next breakout, I predict a $3 target, then the shorties will start to borrow shares as the price inches towards $3 and bring the stock down.

6. I was pretty much blown away by it and excited for Pinterest future

Tiger:@mark01bravz

In my opinion, given that Pinterest have their partnership with not just $Shopify but $target as well, it might be posed for a major run up after or before its q3 earnings. Now it is believed that Pinterest is kind of revamping their platform into whatever you see you can buy.

7.Dell - stock with story worth investing?

Tiger:@IcySilver

On a bigger picture, Dell price structure looks bullish in long term. The up trend has started since Nov 2020.There was a spike in volume on 15 April 2021, and the price then range between 94 and 104 for a few months. Earning results of last 2 quarters were better than estimated, yet the price did not make big moves. However, notice the average volume during this phase was relatively stable and low. Likely a healthy sign of big hands accumulating the stock. In early September, price has completed an accumulation phase and had broken above previous high around 105 on 23 Sept. The price then did a consolidation and a small retracement. It is now all time high above $110.

Long term bullish. Is it a right time to enter long now? Well, that will depends on risk appetite and investing horizon. If looking for a short swing trade, now might be a little late. I might wait for a pull back before entering.

Tigerpedia:

8.Cup and Handle Chart Pattern

Tiger:@jayc

1. There should be a clear difference between the 'cup' and the 'handle'. Not only in time (the handle forms faster than the cup), but also the absolute price bottom of the 'handle' should be higher than the price bottom of the 'cup', otherwise it is simply a double bottom.

Market trends and industry news:

9.Climate Change & OPEC+ are pushing for Tesla

Tiger:@KYHBKO

The world is facing an energy crisis. With energy prices soaring, it leaves all fearful of the coming winter as heating is needful in the households. With OPEC+ not increasing their supply, this has led to oil prices hitting recent highs. those needs are what Tesla is well poised to meet with its sustainable energy systems. Also, in regard to its EV sector, with EV cheaper in maintenance, eligible for rebates, reducing the carbon footprint, these will push the demand towards EV.

10.Heres how to profit in high inflation enviroment

Tiger:@Eldenminaj

Warren Buffets advice?

Invest in companies with low capital investment. He said "the best business to during inflation are the business that you buy once, and then dont have to keep making capital investments subsequently."

Therefore, he ask us to stay away from companies like railroads and utilities which will have higher operating cost during Inflationary Period but instead invest in company with low capital need such as$Apple(AAPL)$$Microsoft(MSFT)$

Congratulations to all these tigers! 👏👏👏

How can I get selected?

1、Write in-depth posts as many as you can, sharing insights on stocks and markets with others.

2. The posts should be ORIGINAL.

3. Posts with more than 500 characters are to be given priority.

4. Posts with any content that undermine the community experience will NOT be selected, like misinformation, rumors, Insults, harassment, threats, derogatory languages, etc.

NOTES:

1. Tiger coins will be sent within 5 working days after the results are announced.

2. This column will be upgraded in the future with more rewards.

精彩评论

Cheers to all fellow Tiger-s