Dell - stock with story worth investing?

Had always been fascinated by Dell. From the principles of the company, the marketing strategy and its love-hate relationship by listing publicly.

Story of $戴尔(DELL)$

Dell as a brand, has some very legendary story behind. The story started in 1984 by Michael Dell who wanted to sell computers (specifically PCs) at the lowest price possible by getting rid of the middle men, and use low-cost direct marketing method.

It was first listed in 1988 with an IPO price of $8.50 and raised $30 million.

It was pioneer in selling computers directly on its website. This is 1996, the early internet wild wild west era. Before e-commerce was even common.

The company was doing successfully and expanded into various other consumer products. Then there is a change in leadership. Michael Dell stepped aside as CEO in 2004.

SEC started some informal enquiries into the company's financials late 2005. Then the smartphone era started. Dell was fighting a losing battle (revenue wise) against the uprising smartphones, tablets. Long story short, Dell was losing its market share in the competitive industry of PCs.

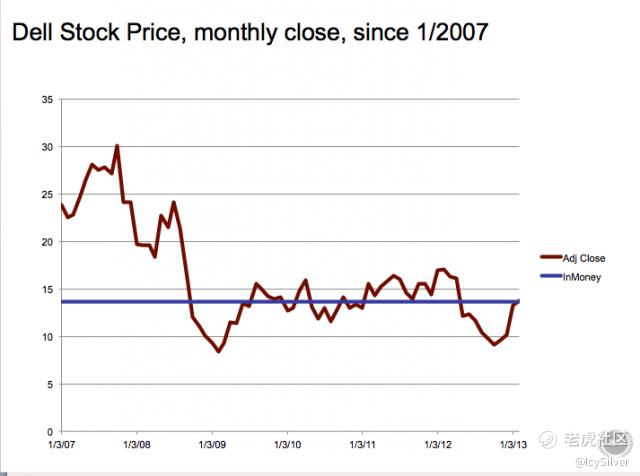

Michael Dell returned as CEO in 2007 to revamp the company. He partnered with Silver Lake Partner in 2013 to privatise DELL at cost of $24.9 billion, which was the largest privatisation exercise at that time.

The story continues. After some transformations done, $戴尔(DELL)$ was re-listed in NYSE in late 2018 via some complex corporate actions. The saga of delisting and re-listing might have left some investors unhappy over it. One might question, if the maneuvour was necessary to fix the company, or just a usual business deals.

2021

According to a report by Gartner in June 2021, Dell is third in market share of PC, claiming around 17% of 71.6 million units of PC world wide. Desktop PCs are showed a 40% increase compared to 2020. Due to the pandemic, demand of PC increased but on-going shortage of components are affecting delivery of the PCs.

It's hard to know for sure the impact of component shortages, and the possible supply chain crisis on Dell. But demand for PCs may wind down as people are starting to return to physical offices around the world. We might get a better understanding in the upcoming earning meeting.

Technical Analysis Chart

Regardless, Dell price has been doing really great since re-listed. Let's check out the chart.

On a bigger picture, Dell price structure looks bullish in long term. The up trend has started since Nov 2020.

There was a spike in volume on 15 April 2021, and the price then range between 94 and 104 for a few months. Earning results of last 2 quarters were better than estimated, yet the price did not make big moves. However, notice the average volume during this phase was relatively stable and low. Likely a healthy sign of big hands accumulating the stock.

In early September, price has completed an accumulation phase and had broken above previous high around 105 on 23 Sept. The price then did a consolidation and a small retracement. It is now all time high above $110.

Conclusion

Long term bullish. Is it a right time to enter long now? Well, that will depends on risk appetite and investing horizon. If looking for a short swing trade, now might be a little late. I might wait for a pull back before entering.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- WYCKOFFPRO·2021-10-20$Dell Technologies Inc.(DELL)$ just completed the accumulation and is at the mark up phase. Definitely worth paying attention for a low risk entry.1举报

- jeffry09·2021-10-20Indeed, I am still waiting for the price to fall before preparing to buy2举报