Black Friday did not end well with the global market. Omicron (a Covid19 variant) has crashed the markets, leaving Dow Jones down by 900 points. This has created few considerations - will the market continue to fall because of the omicron. Personally, once the vaccine makers bring assurance about the effectiveness of their "current" vaccines, the market concerns should be brushed away. However, let us remain cautious as we approach the week.

Despite this, I have done my research for few companies and these are my technical setup to take (LONG) positions. Note that I have done my checks on these companies and thus, do not forget your due diligence as we have different investment strategies, risk-reward tolerance and investment timeline.

Some of my favourites include:

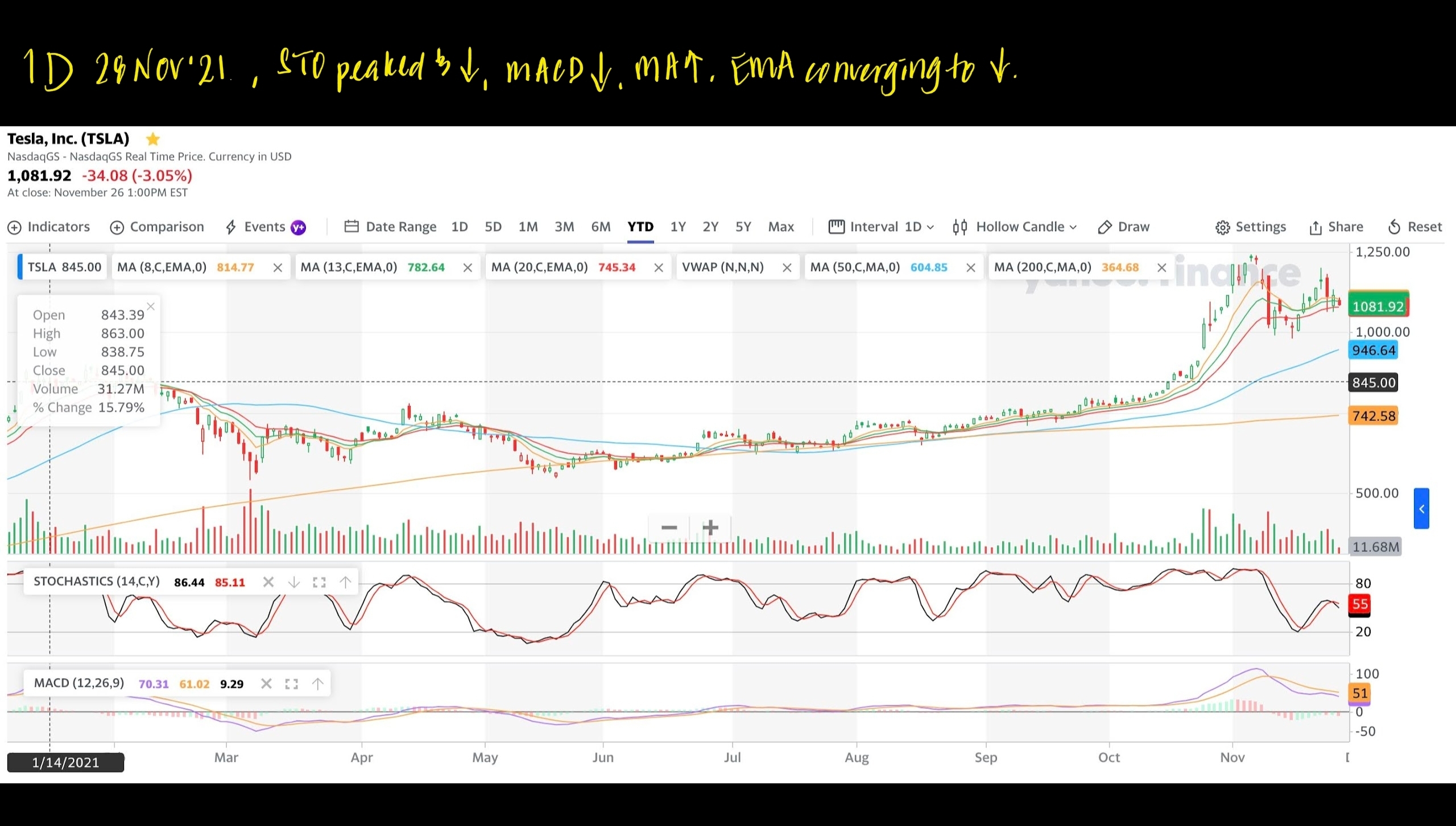

$Tesla Motors(TSLA)$remains an exciting stock. there are several who sees this being over-valued. If the metrics are based solely as a auto maker, it is but I see Tesla as a sustainable energy company changing the world with their innovations in solar energy, energy storage, transportation, battery innovations, insurance, AI, robotaxi, Tesla bot, and more. Looking at the technical chart, a down trend is expected but there are also good news about the increase in their China manufacturing capability, FSD and their new Gigafactories starting production by the end of 2021. I hope to catch Tesla around $1000 and plan to DCA for this company.

$TENCENT(00700)$is one of my favourite Chinese companies who has a great market reach, investing heavily into the future. They are also one of the leading investors out of China with shares in JD.com, PDD.com, Tesla, NIO, Sea Ltd and more. I believe that the company is undervalued and will hope to take a position when the price has bottomed up.

$Naspers Ltd.(NPSNY)$is a global internet group titan and one of the biggest global investors whose investments are reaching 2 billion users all over the world. They have a strong stake in Tencent under their international holding company $Prosus NV(PROSY)$that was worth about $200 billion few months back. Through their international portfolio, they are invested in food delivery, tech startups, telecommunications, classified, Education technology, payment & fintech and more. Hopefully, I can take a position after the price has bottomed up.

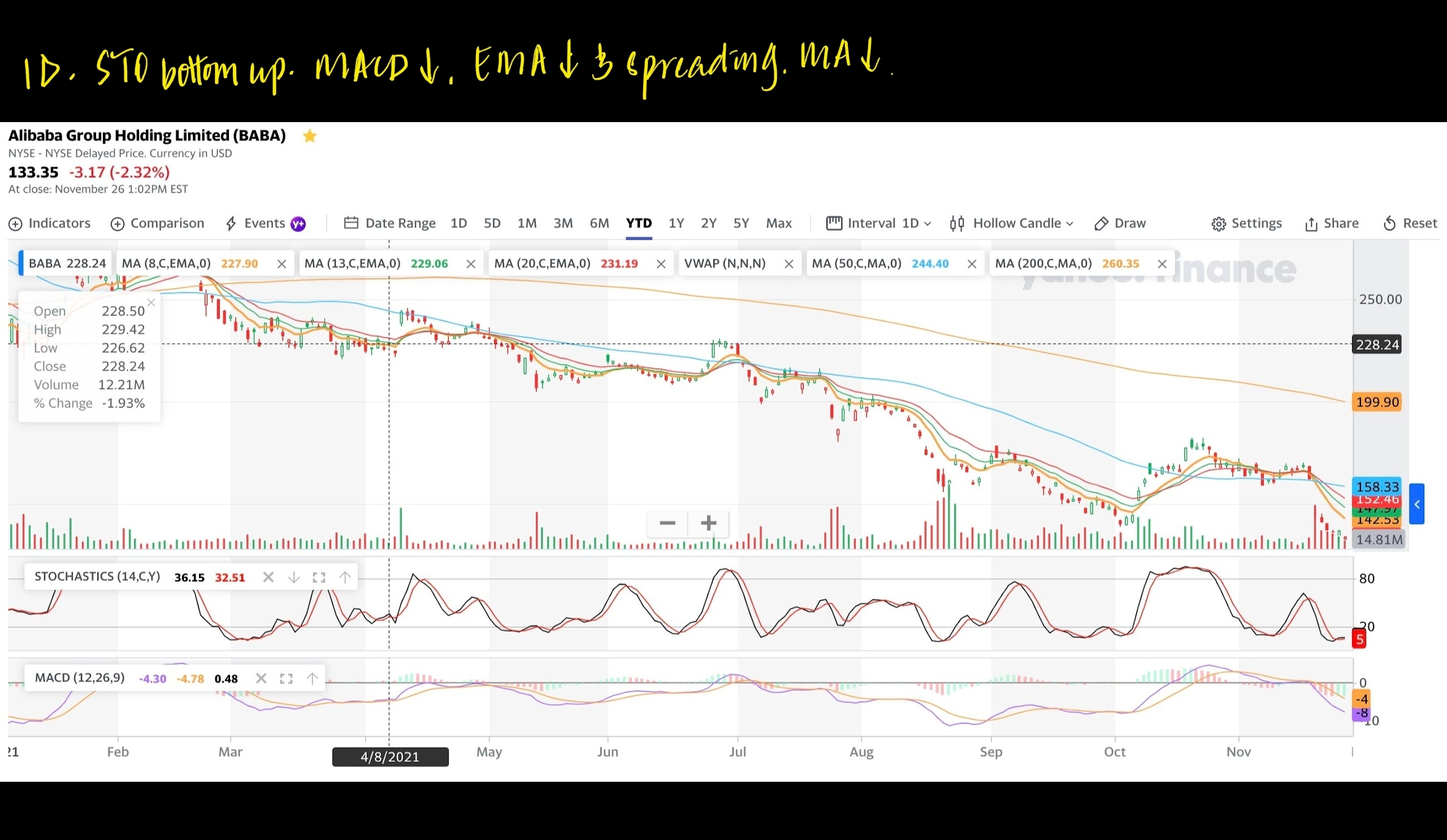

$Alibaba(BABA)$remains a controversial stock. It is a painful relationship as the recent decline has affected my portfolio significantly. Despite the disappointing results from recent earnings, the company is poised to be one of the market leaders of e-commerce in the world. while both EPS & revenue disappoint, the fundamental of the company remains sound. Their efforts to invest into the business, cost cutting, and a growing cloud business should help them in their recovery. this can still take a while but I plan to buy and "forget" till I have funds for the next round.

As per always, this should not be construed as financial advice. Being a hopeful realist, I am hopeful of their long term growth but prepared to bear some pain in the weeks ahead. Time will tell if I am brave or foolish but these will become part of my "school fees" to be a better investor. We need to do our due diligence to qualify the companies, scrutinise their earnings & projections and try to take advantage of the various market situations. Invest safe.

精彩评论