Market Overview

Wall Street ended lower at the beginning of a holiday-shortened week on Tuesday (Dec. 27), as rising U.S. Treasury yields pressured interest rate sensitive megacap shares. The Dow Jones Industrial Average rose 0.11%, the S&P 500 lost 0.40%, and the Nasdaq Composite dropped 1.38%.

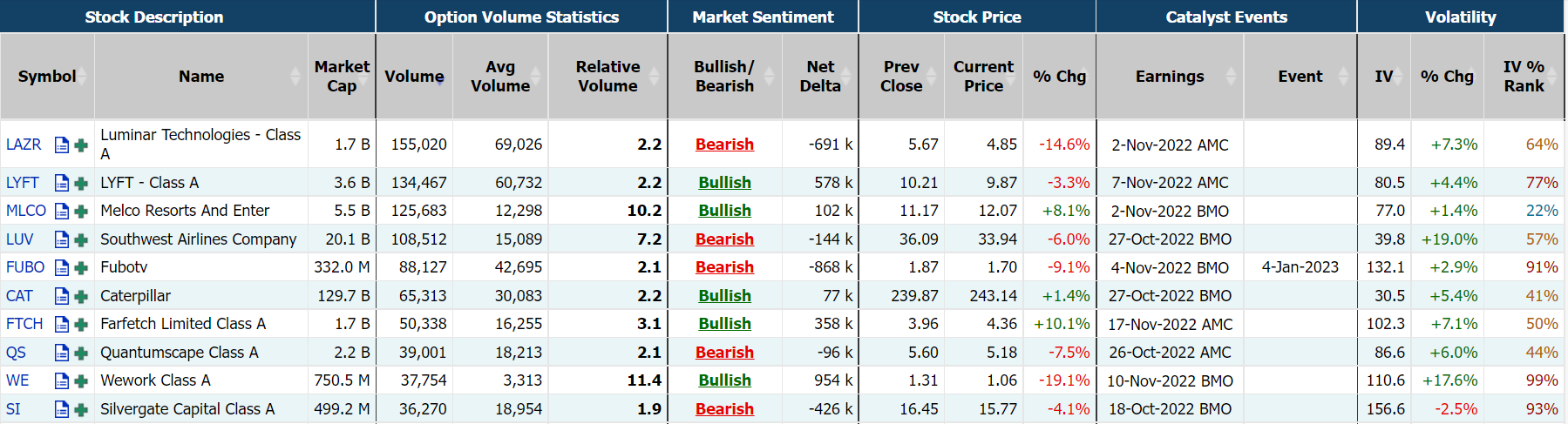

Regarding the options market, a total volume of 27,519,504 contracts was traded on Tuesday, down 7% from the previous trading day. Options trading of Tesla and iShares China Large-Cap ETF was active. Luminar Technologies, Lyft and Southwest Airlines saw unusual activity in options trading.

Top 10 Option Volumes

Top 10: SPY, TSLA, QQQ, AAPL, NVDA, AMZN, FXI, TQQQ, TLT

Options related to equity index ETFs are popular with investors, with 6.16 million SPDR S&P500 ETF Trust (SPY) and 2.12 million Invest QQQ Trust ETF (QQQ) options contracts trading on Tuesday.

Total trading volume for SPY decreased by 9% while QQQ grew by 3%, from the previous day. 56% of SPY trades bet on bearish options.

Tesla shares closed down 11% at $109.10 on Tuesday, for the seventh straight decline and its steepest one-day drop since April. The electric-vehicle maker’s market valuation has shrunk to roughly $345 billion, below that of Walmart Inc., JPMorgan Chase & Co. and Nvidia Corp. This latest selloff also cost Tesla its position among the 10-highest valued companies in the S&P 500 Index, a distinction it had held since joining the benchmark in December 2020.

There are 3.59 million Tesla option contracts traded on Tuesday. Put options account for 53% of overall option trades. Particularly high volume was seen for the $110 strike put option expiring December 30, with 158,378 contracts trading. Secondly, Tesla also saw a high put options volume for $100 strike put option expiring December 30, reaching 123,457 contracts trading.

The options trading volume of iShares China Large-Cap ETF (FXI) also surged on Tuesday, reaching 335.1 million. Hot chinese ADRs jumped on Tuesday with Alibaba, JD.com and Baidu up more than 4%,

China will stop requiring inbound travellers to go into quarantine starting from Jan. 8, the National Health Commission said on Monday in a major step towards easing curbs on its borders, which have been largely shut since 2020. China's management of COVID-19 will also be downgraded to the less strict Category B from the current top-level Category A, the health authority said in a statement, as the disease has become less virulent and will gradually evolve into a common respiratory infection.

Unusual Options Activity

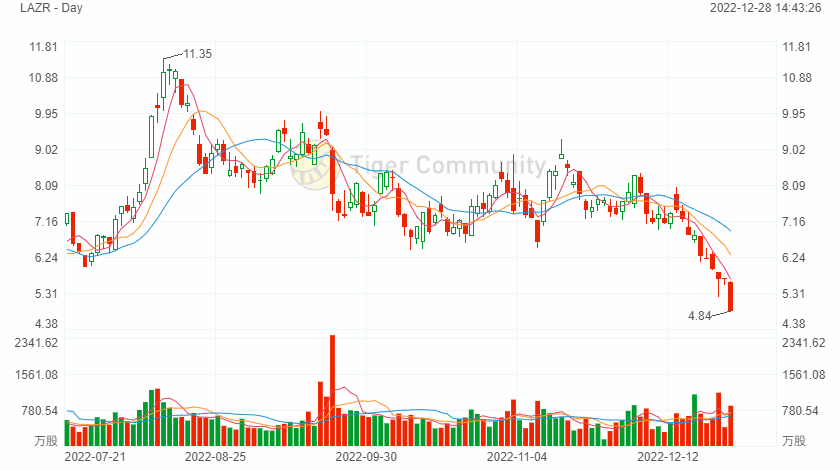

The autonomous vehicle tech firm Luminar Technologies shares tumbled 14.6% on Tuesday and The stock has fallen 36.8% this month. JPMorgan Chase and Citigroup both lowered the target price of the stock in December. Luminar price target lowered to $16 from $30 at JPMorgan while Luminar price target lowered to $20 from $21 at Citi.

There are 155.1K Luminar option contracts traded on Tuesday. Put options account for 86% of overall option trades. Particularly high volume was seen for the $5 strike put option expiring January 20, 2023, with 61,630 contracts trading.

The ride-hailing company Lyft stock closed lower than $10 for the first time on Tuesday (fell 3.3% to $9.87) as they continue a decline that has cost the company roughly $11.18 billion in market capitalization. Shares have declined nearly 77% so far this year, leaving Lyft with a market cap of roughly $3.56 billion.

Cowen & Co. recently downgraded Lyft’s stock to market perform from outperform, with analyst John Blackledge writing about his concern over rising auto-insurance costs — which he called an “industry issue” — plus inflationary and recessionary pressures. He also cut his price target for the stock to $14 from $36.

There are 134.5K Lyft option contracts traded on Tuesday. Call options account for 93% of overall option trades. Particularly high volume was seen for the $11 strike call option expiring January 20, 2023, with 50,950 contracts trading.

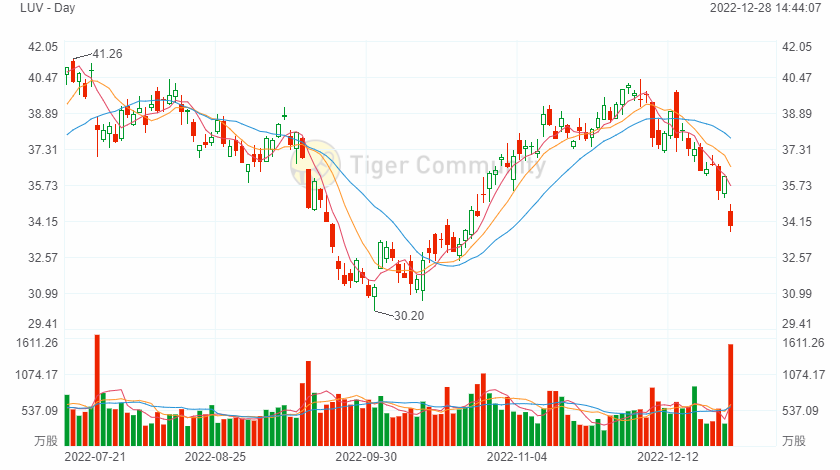

Southwest Airlines came under fire from the U.S. government on Tuesday after it canceled thousands of flights, and its boss, Bob Jordan, said the low-cost carrier needed to upgrade its legacy airline systems. The shares dropped almot 6% on Tuesday.

U.S. airlines have canceled thousands of flights as a massive winter storm swept over much of the country before the Christmas holiday weekend, but Southwest's woes have deepened while other airlines have largely recovered.

There are 108.9K Southwest Airlines option contracts traded on Tuesday. Put options account for 79% of overall option trades. Particularly high volume was seen for the $34 strike put option expiring December 30, with 8,314 contracts trading.

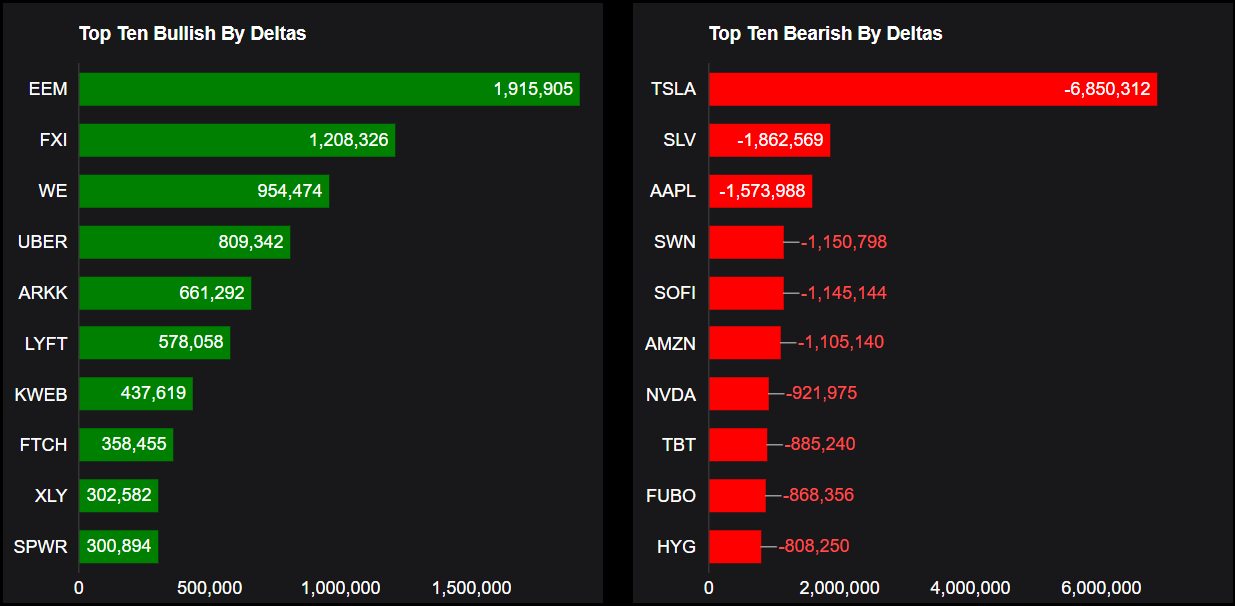

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: EEW, FXI, WE, UBER, ARKK, LYFT, KWEB, FTCH, XLY, SPWR

Top 10 bearish stocks: TSLA, SLV, AAPL, SWN, SOFI, AMZN, NVDA, TBT, FUBO, HYG

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

精彩评论