JAPFA Got Milk

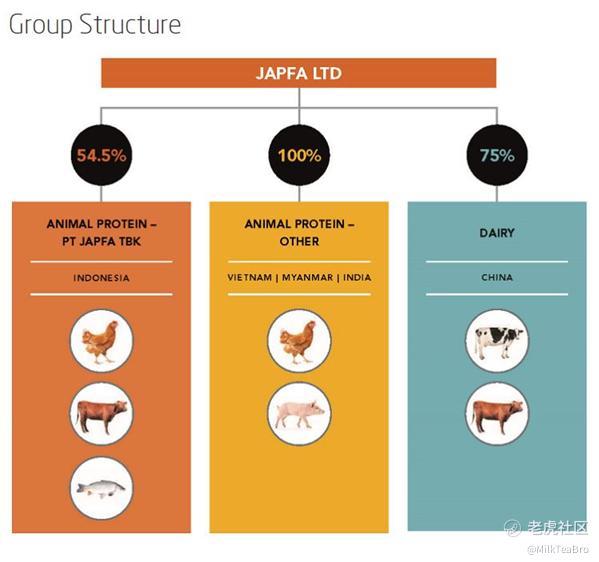

Headquartered in Singapore; JAPFA employ over 40,000 people across an integrated network of modern farming, processing and distribution facilities in Indonesia, China, Vietnam, India and Myanmar. JAPFA specialize in producing quality dairy, protein staples (poultry, beef, swine & aquaculture) and packaged food that nourish millions of people.

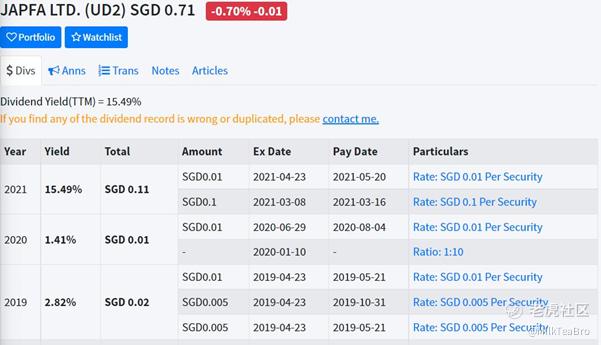

Stock price closed at SGD 0.71 on 10/09/2021.

P/E ttm=2.97; P/B=0.8; Dividend yield=15.49% for year 2021

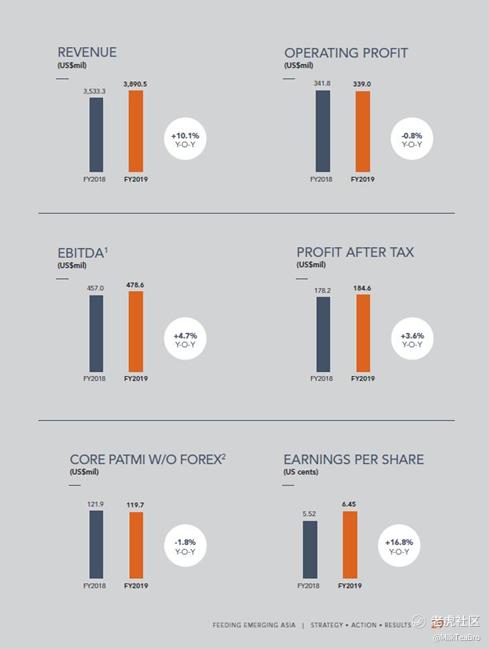

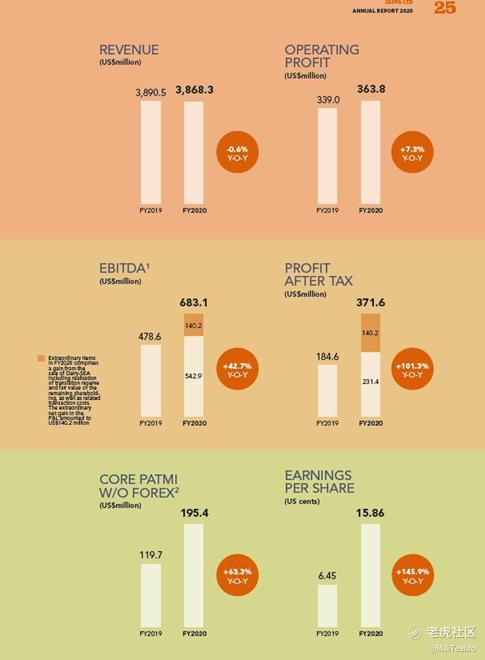

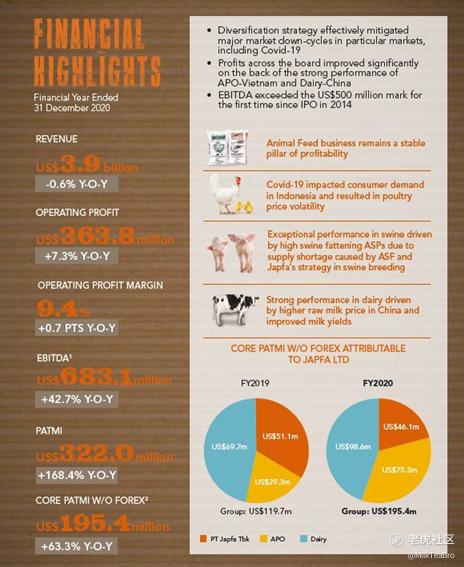

Company earning/share is in growing trend for recent years, even hit by Covid-19, US Cents 5.52, 6.45 and 15.86 for year 2018, 2019 and 2020, last year on year growth is 145.9%.

Currently JAPFA is bearish technically, it could slip a little further. But its valve is higher than his price.

JAPFA got milk business in China. Dairy farm was demanded in China. A few news has reported that JAPFA sold a little China dairy farm share to others which built partnership to secure the sales contract. Chinese are improving their living standard quickly and are thirsty in milk. And China Government tightened food security and standard. All these are favour to big dairy farm player.

Some more, JAPFA is leading in animal feed, she can well control dairy farm cost.

Profits After Tax & Minority Interests (PATMI) from dairy farm grow from USD 69.7 million to USD 98.6 million, year on year grown 41.4%.

$丰益国际(F34.SI)$ is popular stock in Singapore Agriculture and consumer products industry because it is in STI list.

Wilmar International current P/E=11.8; P/B=1.03; Dividend yield=3.43%. This stock looks building bottom now. You can compare JAPFA with Wilmar International, they are in similar industry.

@Tiger Stars @小虎投资狮城 You are welcome to leave your comment.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- TigerStars·2021-09-14我们当然同意你的观点,中国优质乳制品和蛋白质主食有巨大的潜在市场,我们希望看到更多的新加坡公司来这里!!2举报

- MilkTeaBro·2021-10-11$贾普法有限公司(UD2.Si)$开始翱翔1举报

- 我i168·2021-09-20买!点赞举报