Review of Singapore O&G Ltd

Singapore O&G Ltd got my attention because it had no volume yesterday morning trading hours except my placed order filed.

So, I looked deeper for this company.

Established in 2011, Singapore O&G Ltd. (SOG) is a leading healthcare service provider dedicated towards delivering premier medical services to women’s and children’s health and wellness at affordable prices.

This stock P/E was 12.15 and dividend yield was 7.12%, these numbers were top in the health care industry.

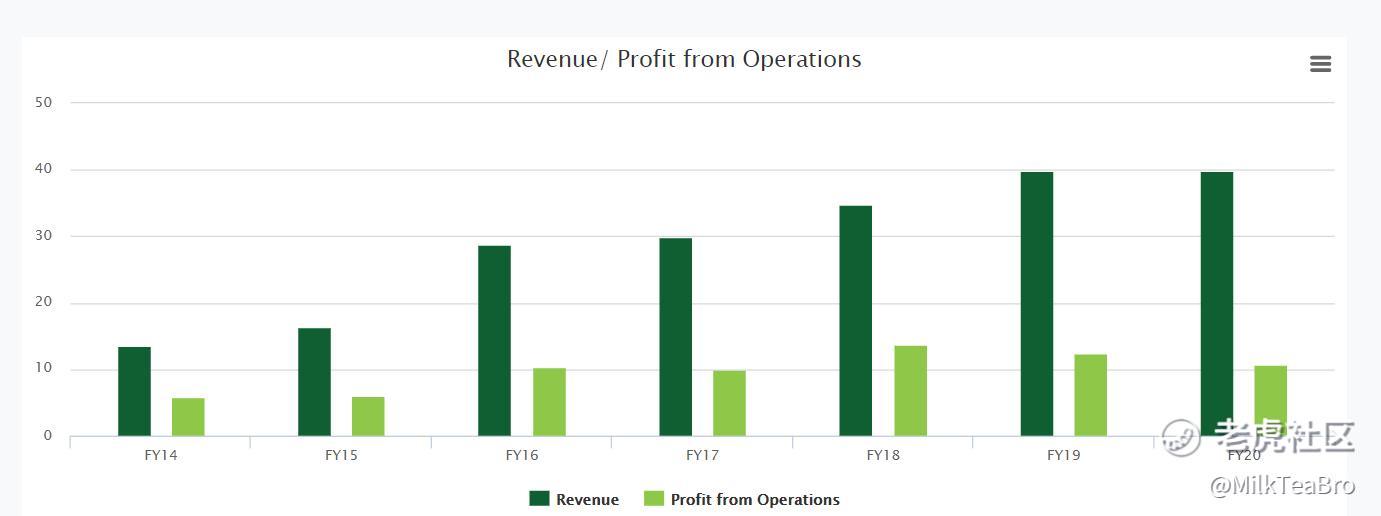

The company operation revenue was stable.

Net profit was stable expect last year loss 1.1 million.

I continued to look for reason for 2019 loss in the 2019 annual report. ‘an impairment of goodwill of S$11.9 million due to the declining earnings of the Dermatology segment which impacted the recoverable amount of this cash-generating unit, the Group posted a net loss after income tax of S$1.1 million for FY 2019’

So, the year 2019 loss was one time action and not cash related, goodwill reduces for Dermatology Segment. If put back 11.9 million to the account, year 2019 profit was totally normal.

Let’s look at interesting part, top holder of Singapore O&G updated on 01/09/2021.

Five people hold more than 70% shares. And all these five people are doctor who work in Singapore O&G.

Tung Lan Heng, Doctor, Executive Director;

Kee Whye Lee, Doctor, Executive Director;

Suan Tiong Beh, Doctor, Executive Chairman;

Teng Ee Lim, Doctor;

Wan Ling Choo, Doctor.

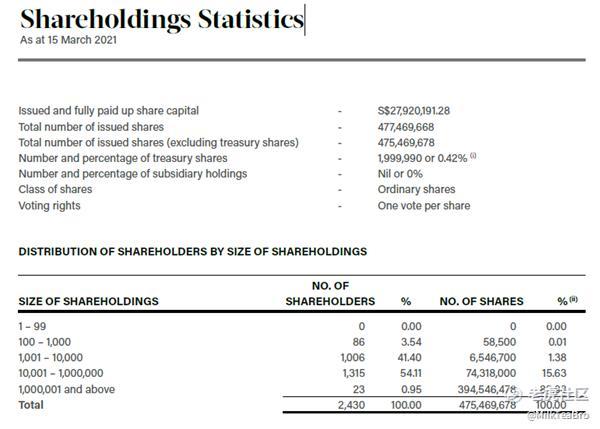

Shareholdings Statistics in 2020 annual report.

Total 2430 share holder only, it was funny. My company employee number is more than it.

Doctors were highly respected in Singapore. I believed these five Doctors, the owner of Singapore O&G, would not manipulate stocks.

In another side, liquidity of stock was very low, very little share holders and very litter shares in the public, the big institution investor can’t buy it.

My wife gave second childbirth in Singapore University Hospital. But all my company colleague’s family choose private hospital to give birth except me. Singaporeans are rich. My wife visited women private clinic one time because government hospital appointment would be 2-3 Month later, we can’t wait for it. In my personal experience and opinion, Singapore O&G revenue will maintain steady.

The company doesn’t have dividend policy. However, the Company has declared and paid dividends each year since IPO. For FY 2020, 1.70 Singapore cents per share, represented 85.2% of the Group’s net profit after tax for the year.

Health care industry, Leading in Women and Children clinic, good dividend, and P/E value, but very low stock liquidity, how will stock price go?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 老夫的少女心_·2021-09-08我们现在在老虎上可以买这个股票吗?是不是有兑换货币?2举报

- 揭人不揭短·2021-09-08第一次看新加坡公司的评述,谢谢你,给我打开了新世界的大门。2举报

- 哎呀呀小伙子·2021-09-08短线看着好像是在调整中呀,能不能买?2举报

- 小时候可帅了00·2021-09-08一眼就相中了你这个股票,谢谢诚意的分享,好人一生平安。3举报

- 宝宝金水_·2021-09-08要是中国有自IPO以来每年都宣布和支付股息的公司就好了。公司敢于于2020财年,每股1.70新加坡仙,占本集团年内税后纯利的85.2%支付姑息,说明人家很有底气,很好的公司,谢谢分享。3举报

- 七色祥云6·2021-09-08这只股票的市盈率为12.15,股息率为7.12%,在医疗保健行业中名列前茅。会继续关注! 2举报

- 布莱登森林·2021-09-08感谢博主分享了这只票子,很不错,继续关注!1举报

- 孙立冉·2021-09-08这种股票可以参考港股的仙股,没有流动性,死水一滩啊1举报

- 一池咸鱼·2021-09-08没有成交量为啥关注这票呢?不担心买了卖不出啊?1举报

- 栋哥·2021-09-08感觉很不错,现在可以进场吗?1举报