Demystifying Options Part 4

This is part 4 of Demystifying Options... If you are not familiar with options, I would suggest reading my first three post:

Demystifying Options Part 1 - Introduction to options

Demystifying Options Part 2 - Selling Put options

Demystifying Options Part 3 - Buying Put options

A short recap on the types of options available...

There are 2 types of options - Put option and Call option. You can buy and sell both of them.

This post will be discussing about SELLING call options.

There is 1 IMPORTANT rule when SELLING CALL Options. Violating this rule means you have a very high chance of losing money.

Rule: You have at least 100 shares of the company to sell should the option be exercised. Each option contract is 100 shares, so the more option contracts you sell, the more shares you need to hold. If you do not have the shares and the share price goes up, you will be forced to buy the shares at market price and fulfil your sell call obligation at a loss.

There is another thing to be aware of when selling call options. You limit the maximum profit you can make if the share price goes up beyond your sell call strike price. I will explain this in detail below.

Some terms you might have heard before but not sure what it means...

Covered Call: If you have 100 shares of the company in your account before you SELL 1 CALL option, this is called covered call. This is ok.

Naked Call: If you DO NOT have 100 shares of the company in your account before you SELL 1 CALL option, this is called naked call. You are violating the rule. This is NOT RECOMMENDED!!

Lets use Alibaba as an example company for all descriptions below.

Let's say you owned 100 shares of Alibaba at $150 per share. You feel that the share price will not rise a lot in the short term, but you are ok to sell your shares if it hits $180 dollars. In addition, you might want to have a steady cash flow from dividends. Unfortunately, Alibaba does not give dividends, so there is no cashflow when you are holding onto its shares. You can only get capital gain when you sell off the shares.

Choice 1: You can set a sell limit at $180 dollars for 100 shares and if the price hits $180, your trade will be executed and you will sell your 100 shares to get $18,000. This is capital gain only.

Choice 2: You can sell 1 call option contract with a strike price of $180 with an expiry of your choosing and get paid a premium while you wait for the share price to go up above $180. This is similar to dividends cash flow.

Lets go through the process of selling call option:

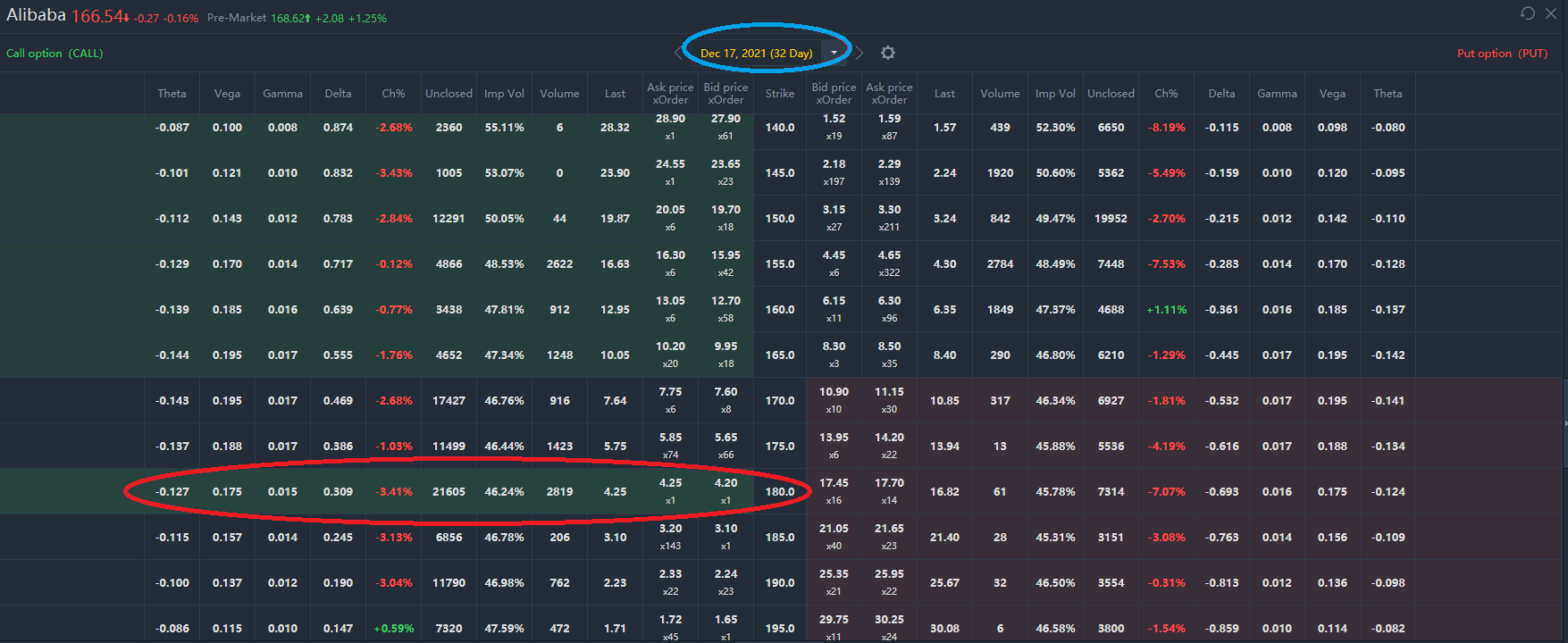

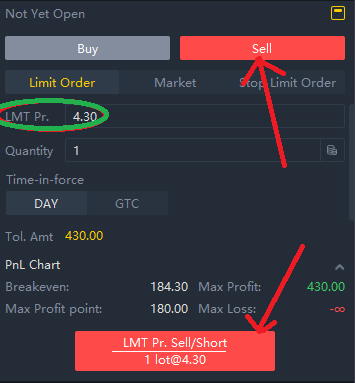

Step 1: Select an expiry date from the list (circled in blue), the strike price you decide (circled in red), and enter the premium you want to collect (circled in green). This premium is for 1 share. The total premium will be multiplied by 100. Remember that you are SELLING CALL option, so click on SELL shown with the red arrow.

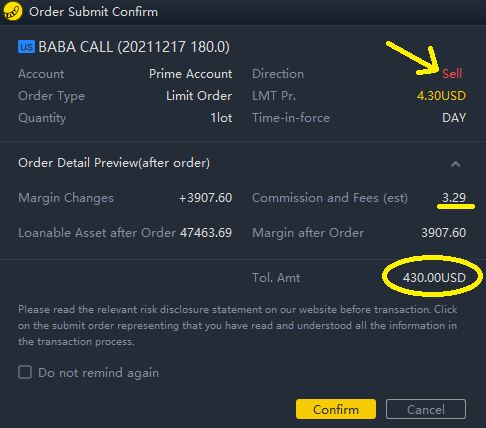

Step 2: The next screen is the confirmation screen of your sell call option. You can expand the order detail to see how much the commission and fees (Yellow underline) and the total premium you will collect. Note that the amount you collect will be the total amount subtract the commission and fees. In this example, the total premium you will collect is $430 (circled in yellow). Note the yellow arrow indication of the direction of the option (SELL)

Step 3: If a buyer decides that the premium you ask for is acceptable for the duration of the contract, he/she will pay you the premium and the contract becomes valid. You will get the premium immediately. This will be reflected in your tiger account USD cash position.

Step 4: You wait until the expiry date of the option. The share price can go up and down during this period of time. The buyer can choose to exercise the option at any time until the expiry date, but typically, unless it is deep in the money, it will usually not be exercised.

Step 5: On the day of expiry at market closing, 2 things can happen.

1) If the share price on the day of expiry at market closing is the same or below the strike price ($180 or lower), the contract expires worthless. This means that you keep the premium you collected and you can repeat Step 1 again.

2) If the share price on the day of expiry at market close is the above the strike price (more than $180), the contract gets exercised. Tiger will sell your 100 shares of Alibaba and you get $18,000. Even if the share price is $300 per share, you will still pay $180 per share because you promise to sell the shares at $180 per share as per the option contract. You will still keep the premium you collected. So, effectively, your overall profit is $18,000 (your selling price) + $430 (sell call premium) - $15,000 (your original purchase price) = $3430. Notice that this is much less than if you were to sell it on the market at $300 per share if you did not have the sell call contract. This is what I meant earlier when I say that SELLING CALL option limits the maximum profit you can make.

You may also notice that there is a max profit of $430 and max loss of -infinity. This is a very IMPORTANT WARNING

Max profit is the premium that you are paid.

Max loss is the amount that you will lose if you DO NOT have 100 shares in your account when you SELL CALL (Naked CALL). If you do not have the 100 shares , you will buy the 100 shares at whatever is the market value when the SELL CALL expires. If the share of Alibaba shoot up to $1000 dollars per share on expiry, you will pay $100,000 to buy 100 shares of Alibaba and so you can fulfil your obligation to the buyer to sell at $180 dollars a share. So your total loss is $100,000(buy from the market) - $18,000(sell to buyer at 180 dollars a share) = $82,000! In theory, if the share prices goes to the moon (infinity), your loss also goes to the moon (infinite). This is similar to short sellers shorting a stock and they are forced to cover their position when the share price goes to the moon.

In Demystifying Options part 5, I will discuss about buying call options...

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- Venus_M·2021-11-17哦哦~谢谢🙆❤5举报

- PSG2010·2021-11-18Then no one should be willing to sell options. They may gain less and lose a lot.2举报

- koolgal·2021-11-17Thanks for another well written Options course. I look forward to practising it.3举报