$SoFi Technologies Inc.(SOFI)$Given that sofi is preparing for it's q3 earnings call. I feel that it may be time to revisit what sofi had shared during its q2 earnings and caused the share price to tumble.

“My passion for SoFi grows every day. We are committed to running faster, reaching higher and achieving more.” — CEO Anthony Noto

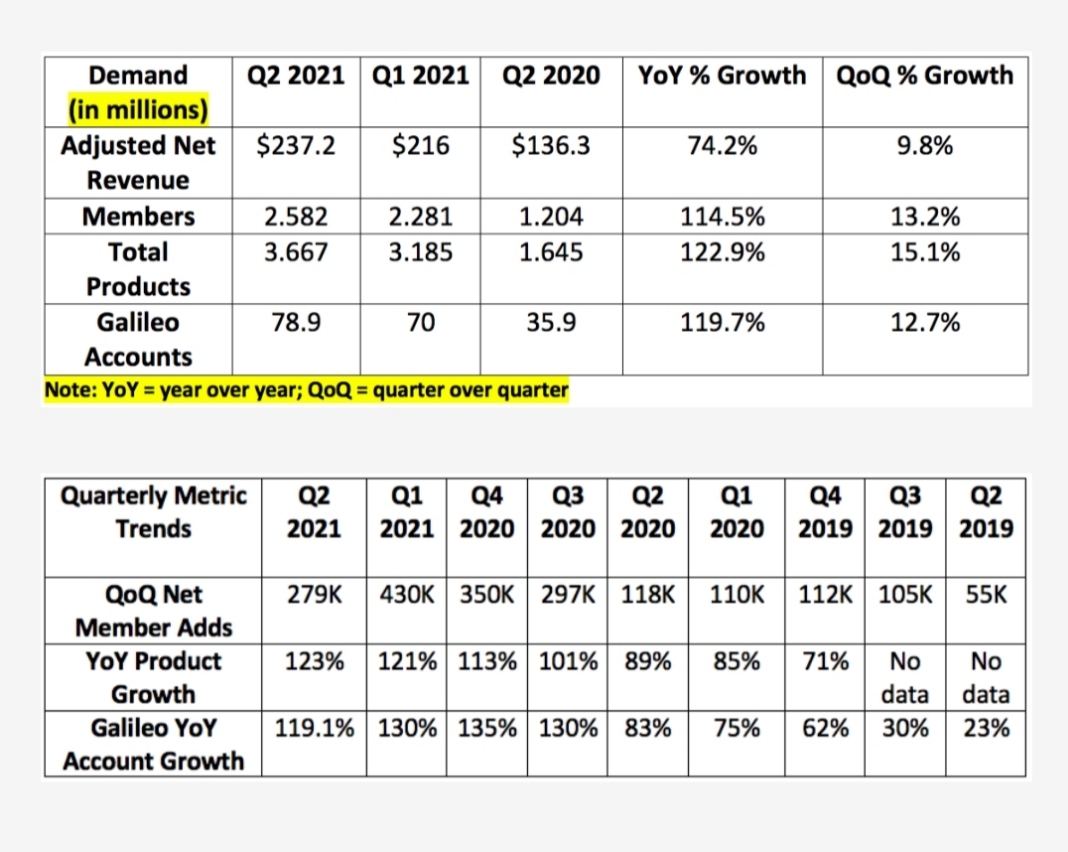

a. Demand

SoFi's internal guidance called for $215-$220 million in adjusted net revenue. Analysts expected $231 million. The company posted $237.2 million in adjusted net revenue topping the highpoint of internal guidance by 7.8% and analyst forecasts by 2.7%.

This quarter represents the 8th straight period of accelerating membership growth. Similarly, total product growth has accelerated for 7 straight quarters. Brisk expansion is one thing, but rising sequential growth rates point to strong momentum going forward.

The company’s most mature product — student loans — saw 11% year over year growth despite the moratorium and pandemic headwinds cutting industry volume for this segment by 50%.

SoFi’s financial services segment saw 602% year over year growth to reach $17 million and roughly doubled sequentially. This newer part of the organization still does not feature a positive contribution profit margin but that is quickly moving in the right direction. Every financial services product grew triple digits year over year.

The company continues to intentionally go slowly with monetizing its financial services segment to fuel early growth. It will launch new revenue streams here (options and margin accounts) in the future. With very little incremental cost to launch new products, this will directly boost profit margins.

Galileo — SoFi’s application programming interface (API) developer — saw revenue rise 138% year over year to reach $45.3 million. This was despite a delay in revenue recognition from a key client and fading stimulus check benefits.

“We are expecting to see stronger sequential growth for Galileo into the third quarter.” — CFO Chris Lapointe

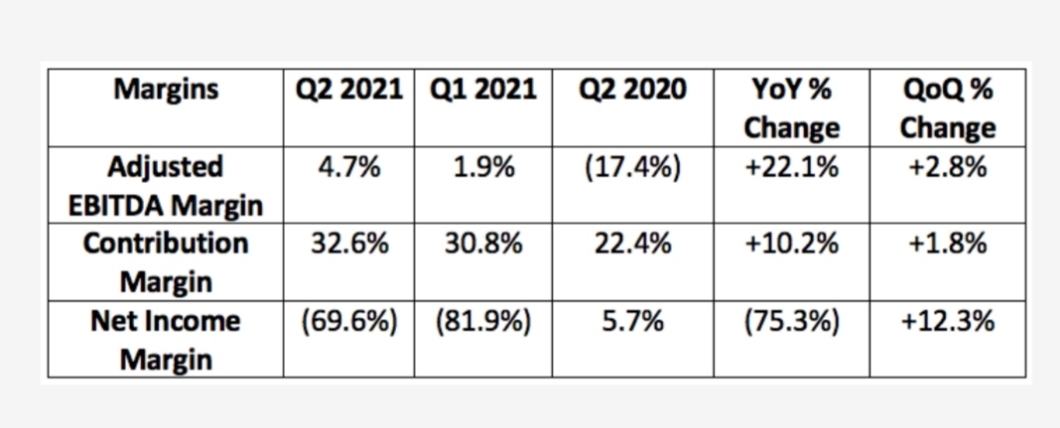

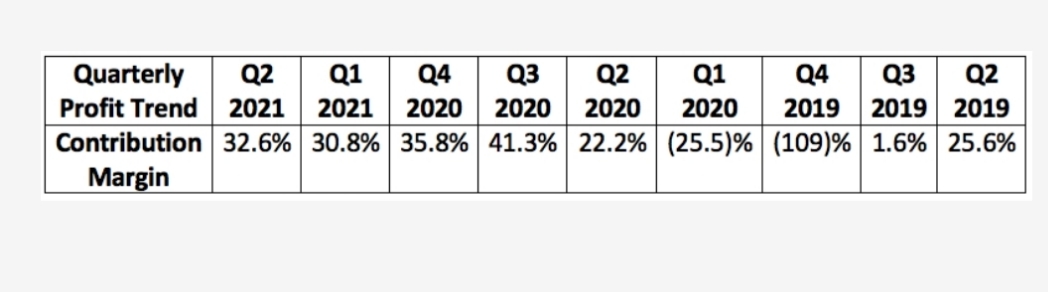

b. Profitability

SoFi’s internal guide called for $(8)-$2 million in Adjusted EBITDA. It posted $11.2 million thus beating the high point of its outlook by $9.2 million.

$144 million of the company’s $163 million net loss came from non-recurring charges related to going public and a change in the fair value of warrant liabilities. Without these charges, net income margin would have been (8.8)%.

c. Guidance Updates

SoFi is reiterating its 2021 revenue and EBITDA guidance despite a $40 million annual revenue hit from the CARES Act moratorium extension on federal student loan payments. This hit should not repeat in 2022 as it’s set to expire at the beginning of next year. It also does not include the $12 million in revenue from its APEX acquisition which was originally included in its 2021 guidance.

Third Quarter 2021 Guidance is as follows:

$245-$255 million in adjusted net revenue

Analysts were expecting $260 million. This was lowered primarily due to the CARES Act extension.

$(7)-$3 million in adjusted EBITDA

d. Operational Highlights

Product upgrade highlights so far in 2021:

Rate match guarantee on student loans

Snooze feature to lock in current rates on new student loans

Home loan rates calculator tool

Two-day early paycheck feature within SoFi Money as well as overdraft protection

Weekly dividend ETF as well as crypto and fractional shares on SoFi Invest

SoFi's Credit Card rewards program saw a meaningful ramp in accounts, balances and spend following its debut this year. SoFi Relay — the company’s free credit score monitoring — is also leading to “a surge in new membership.”

“There is much more innovation in the pipeline, stay tuned.” — Noto

SoFi introduced a loan/money bundle that gives users lower rates on personal loans that are paid off via direct deposits. This is its “products are better together” in action.

50% of personal loans were fully automated in the quarter vs. 30% year over year.

The company has reduced time to loan funding by 50% so far this year.

e. Notes on Galileo

The company expects run rate contribution margin from Galileo of 30% but it is lower for now as SoFi invests in its future growth. SoFi has been heavily investing in the Galileo segment to finish moving its operations to the cloud & to roughly double its head count to position the entity for growth.

Galileo has signed 22 new partners since the beginning of the year. 12 out of 22 of these new client wins came in the second quarter. With Galileo collecting revenue per transaction this is quite the positive development. For context, Galileo added 41 total clients in 2020.

No major partners have left the Galileo platform.

f. Conference Call Highlights

1. Anthony Noto

SoFi’s user lifetime value (LTV) continues to rise with consumer acquisition cost (CAC) continuing to fall thanks to cross-selling new products. We were not given a specific LTV/CAC metric.

“Product NPS is improving.” — Noto

Quarterly milestones:

SoFi has now sold 3x more financial services products than lending products. These two metrics were roughly equal 12 months ago. This drove a 70% increase in cross-selling activity year over year.

Galileo crossed 100B in annualized payment volume in July.

“We couldn't be more encouraged with our acquisition of Galileo. We’ve made significant investments to build out its cloud environment over the last 15 months. It’s now built and will lead to significant cost savings via integrating with SoFi Money and Credit Card. We have a very robust Galileo product pipeline.” — Noto

Noto compared the importance of the Galileo purchase to eBay buying PayPal and Google buying YouTube — quite ambitious. He further added that any major m&a activity for the company will likely involve small, international entities.

“Our superior LTV generated by our users thanks to cross-selling is higher than our competitors. This allows us to more aggressively reinvest in lowering rates and improving services. Nobody else has built a one-stop shop.” — Noto

Noto told investors that he is committed to delivering long term profit margins in the 30% range.

SoFi re-engineered its lending process and risk quantification leading to:

A 30% approval rate spike

A 60% funnel conversion spike

0 negative impact on its credit quality

Noto was asked about SoFi potentially debuting a buy now pay later (BNPL) product in the future. Noto called the opportunity “exciting” and referenced the possibility on launching a BNPL product in Latin American markets in the future.

SoFi plans to expand Galileo’s product offerings well beyond ACH and debit.

Noto continues to expect the bank charter process to be wrapped up in the coming quarters. This will boost net interest margin across the board for the company. There was no specific date given to investors on the call.

2. Chris Lapointe

Adjusted EBITDA margin on incremental revenue was roughly 30% in the period pointing to strong margin momentum going forward.

g. My Take

The CARES ACT student loan moratorium extension hurt the company this quarter. It was likely gearing up for a large raise to guidance until this news surfaced. Still, growth rates in its key operational metrics continue to accelerate and its EBITDA margin turned positive. In my view, SoFi admirably endured temporary headwinds and can now look to even further accelerate growth going forward.

I'd be a buyer on any significant share price weakness. I have kept buying on the 14-15 dollars range so my returns so far is at around 20% on SoFi.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- AprilBridges·2021-10-30UPP for this stock. I'm holding 3000 shares for it and 60 calls for Jan 2023...Next cap will be the start of the reversal...3举报

- TBanger·2021-11-03Im Looking forward to this next earnings report, and all the future SoFi Will enjoy there after.1举报

- YanYanYanYan·2021-11-03[惊讶]点赞举报

- 赵鲜生·2021-11-03👍2举报

- Frog1012·2021-11-03好2举报

- 喵爸1·2021-11-03好2举报

- Muller·2021-11-03牛1举报