Unit Trust vs ETFs: Which should you choose?

Exchange Traded Funds (“ETFs”) have gained popularity over the years amongst investors who seek to broaden the diversity of their portfolio without having to spend more time and effort to manage and allocate their portfolio.

Since then, we often hear investors debating which product, Unit Trust or ETFs, is a better investment vehicle. In today’s article, we will dive deep into each product and help our investors make a better decision if they should include a Unit Trust or ETFs in their portfolio.

What is Exchange Traded Funds?

ETFs are designed to track or ‘replicate’ an index, sector, commodity, or other assets, allowing its investors to gain exposure and benefit from returns similar to that of the index or sector. A well-known example is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index.

An important point we think market participants should note is that there are two main methods managers can adopt when replicating the respective index. The first method is known as direct replication whereby an ETF manager fully replicates an index via a representative method (cash based). The second method is to utilise financial derivatives such as swaps or access products (participatory notes) to track indices on restricted markets that cannot be directly mimicked. Such ETFs are known as synthetic ETFs.

Read: What is a Fund?

Key differences between Unit Trust and ETFs

The similarity between Unit Trust and ETFs is the idea of bundling many individual investments - such as stocks or bonds - into a single investment to bring about diversification to one’s portfolio. Nonetheless, there are a few fundamental distinctions between them.

A. Trading methods

A key difference between Unit Trust and ETFs is the way they are traded. Most Unit Trust adopts a forward pricing which means that prices are only calculated when the day ends. An investor who subscribes to the Unit Trust before the subscription cut off time will have their units priced on the same day but notified of their transaction price on following business day.

In Contrast, the price of an ETF is live and depends on a multitude of factors such as bid-ask spread, akin to that of a stock.

B. Active versus Passive investing

Another difference between Unit Trust and ETFs is the strategy that managers use. Unit Trust managers deploy an active investing strategy which focuses on which securities to buy and sell at any given time based on factors such as earnings growth of a company or perhaps the prevailing macroenvironment. This is commonly referred to as ‘stock picking’.

On the flip side, ETFs typically adopt a passive investing strategy whereby the investment strategy is clearly laid out to track a particular sector, asset class or index.

Why invest using Unit Trust?

Since ETFs only track the benchmark, it will not have the ability to outperform the market. Hence, investors who are willing to pay a higher management fee to invest in active funds, managed by portfolio fund managers will be able to enjoy an additional alpha.

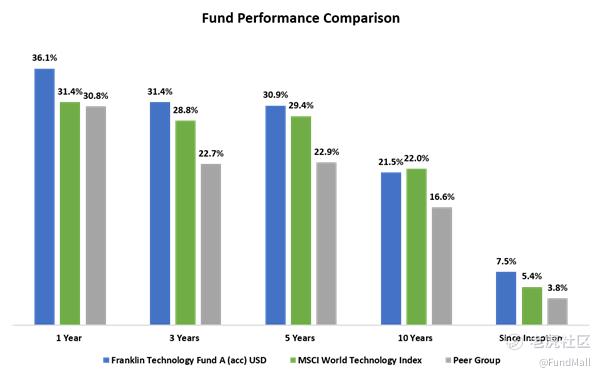

Take for example $FTIF - Franklin Technology A (acc) USD(LU0109392836)$ which invests in high quality, undervalued, emerging leaders in line with the most attractive, multi-year technology themes around digital transformation ( Artificial intelligence, Cloud Computing, Computing services, Internet of Things and E-commerce). The fund has outperformed its peers on a 1-year, 3-years, 5-years and 10-year duration and since inception time period. Such strong performance and additional alpha created is attributed to the active approach taken by the team to identify megatrends and select winners from the industry.

Do you prefer Unit Trust or ETFs? Leave a comment below.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- CornellRudolph·2021-10-31这不是选择哪一个,我认为ETF/基金投资什么很重要。就我个人而言,只有在他们投资正确的债券的情况下,我才会选择他们两个1举报

- AdairHoratio·2021-10-29我会选择etf,市场流动性较高,风险也不是那么高,所以我不需要太担心,也不需要做买/卖的决定点赞举报

- PageDickens·2021-10-29I prefer ETF. I will also buy ETF in my usual investment, because its risk will be relatively low and its eggs can not be put in the same basket.点赞举报