eBay a stock to keep for value, or a sinking stock to ditch?

The Beginning

In 1995, Pierre Omidyar decided to launch a website that would serve as a transparent auctioning platform between passionate buyers and sellers of collectables. He named the site, AuctionWeb.

Thanks to the Internet, the site took off. In fact, it was first of its kind to allow customer-to-customer auction in the virtual world. The site was officially renamed as $eBay(EBAY)$ (which stood for "electronic Bay Area") in 1996.

The company went public with IPO in September 1998 on NASDAQ. eBAY the stock was born.

How successful was eBay? Well, eBay revenues top $1 billion mark in 2002.

Business model

eBay earns its revenue mainly through listing and transaction fees. So buyers would pay eBay to list their goods on the site. The sellers could also pay extra to promote their goods in the listing results. eBay would expose the goods to its millions of users. It would then take a transaction fees from successful transactions.

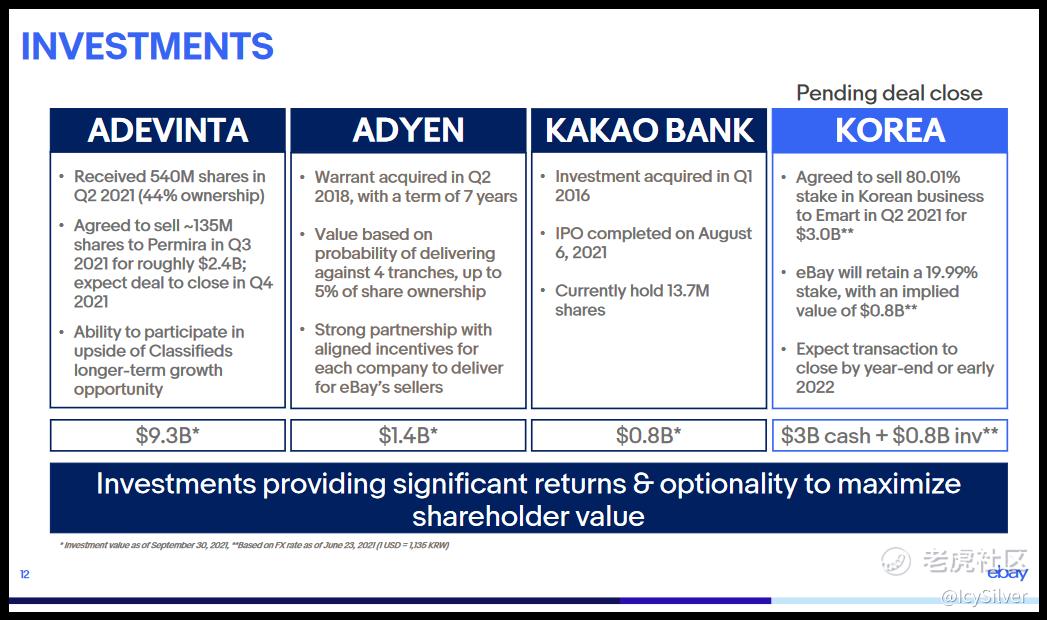

Flushed with investment funds from the earlier days, the company also grew a lot from business acquisitions, including Skype, Gumtree and most notably, Paypal. In 2002, eBay bought Paypal (who just IPO) for $1.5 billion that brought synergy to both platforms. $PayPal(PYPL)$ was contributing 40% of its revenue. However, eBay decided to spin off Paypal (valued at $50 billion) in July 2015. Was it a good business decision? It's hard to tell, because it might have been a good investment decision for eBay, but there are ripple effects to eBay's own payment system. Skype was eventually sold to $微软(MSFT)$.

Strengths

Depends on how you look at the business, eBay's root is still deeply rooted in the technology sector.

eBay has been early adopter of new technology and embraces change along the way. To encourage protect buyers, feedback forum was introduced in 1997. There were also many initiatives to help sellers, including the eBay University. eBay mobile app was pioneer on Apple App Store in 2008. eBay also started early to expand to other parts of the world, having access in more than 200 countries by early 2000. It was one of the first companies to do auto translation in Machine Translation Tools help drive cross-border commerce in 2014.

Competition/Challenges

Being one of the pioneers in the space of e-commerce also means it's hard to defend its lead. Amazon, Craiglist, even the more recent Facebook Marketplace are all giving a hard time for eBay.

Majority of eBay users are still based in US (40%), followed by UK (16%), South Korea (13.5%) and Germany (11%). These are very mature e-commerce markets, and there are many other similar platforms locally.

The marriage-then-divorce with PayPal also posed some challenges. Before acquiring PayPal, eBay used a payment system by Billpoint. But with PayPal spun off, eBay decided to build internal payment system with help from Adyen (listed in Amsterdam) and had moved sellers over to the new system. Not an easy technical challenge, given that payment is crucial in the eBay platform. The internal payment system is expected to make payment more convenient for buyers, and eBay stands to get a small fee from sellers to use. PayPal may stand to lose business from eBay too. Sounds like a bad divorce?

Some newer programmes were introduced including Certified Refurbished products and Authenticity Guarantee program for luxury goods.

Financials

In the latest 2021Q3 earning report released on 27 Oct,

- Revenue was $2.5 billion, up 11% on an as-reported basis and up 10% on a foreign exchange (FX) neutral basis.

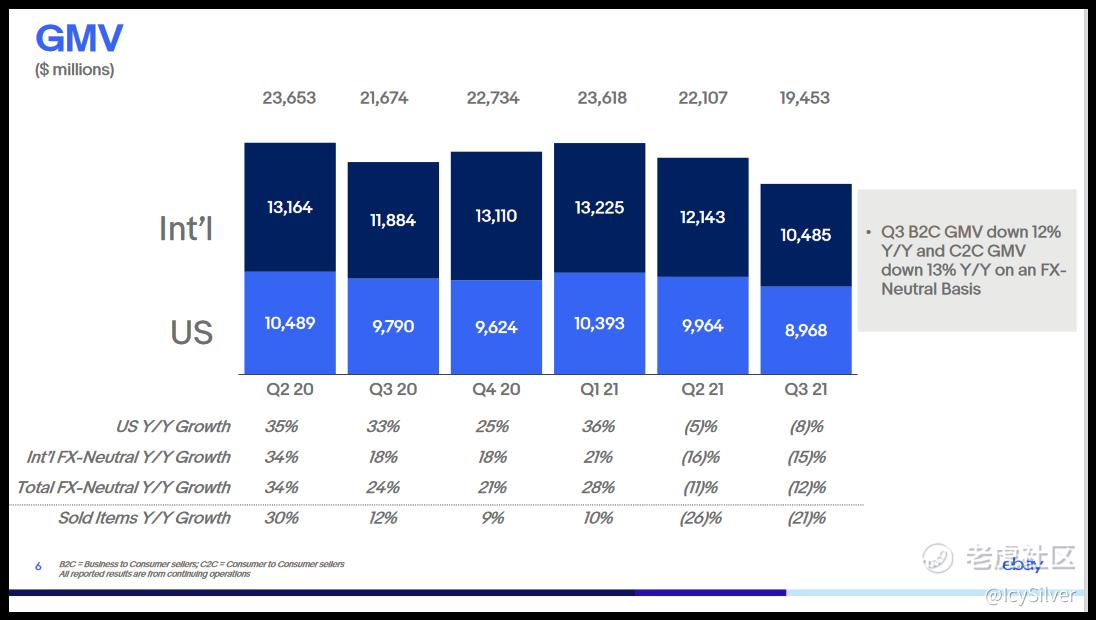

- Gross merchandise volume (GMV) was $19.5 billion, down 10% on an as-reported basis and down 12% on an FX-Neutral basis.

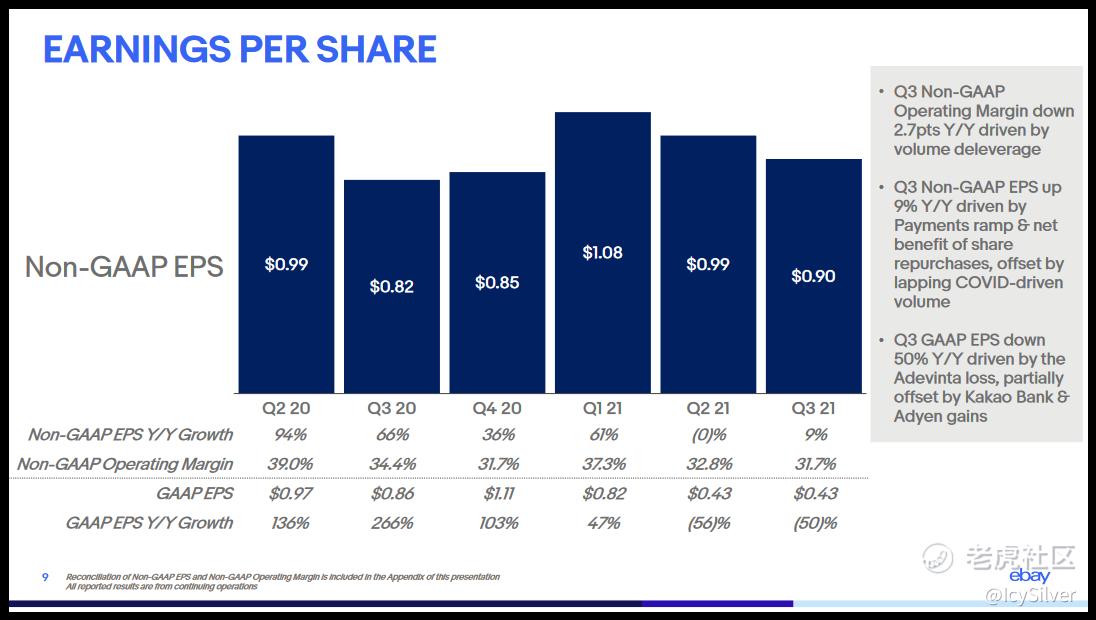

- GAAP net income from continuing operations was $283 million, or $0.43 per diluted share.

- Non-GAAP net income from continuing operations was $591 million, or $0.90 per diluted share.

- Generated $661 million of operating cash flow and $502 million of free cash flow from continuing operations.

- Returned $2.4 billion to shareholders in Q3, including $2.3 billion of share repurchases and $116 million paid in cash dividends.

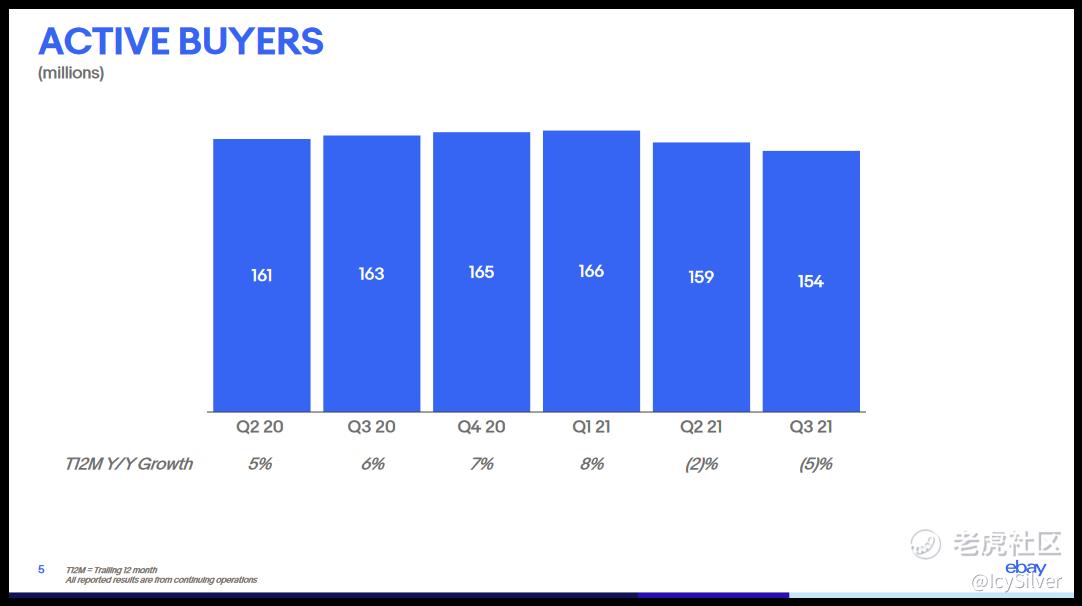

- Annual active buyers declined by 5%, for a total of 154 million global active buyers.

- Annual active sellers were flat at 19 million global active sellers.

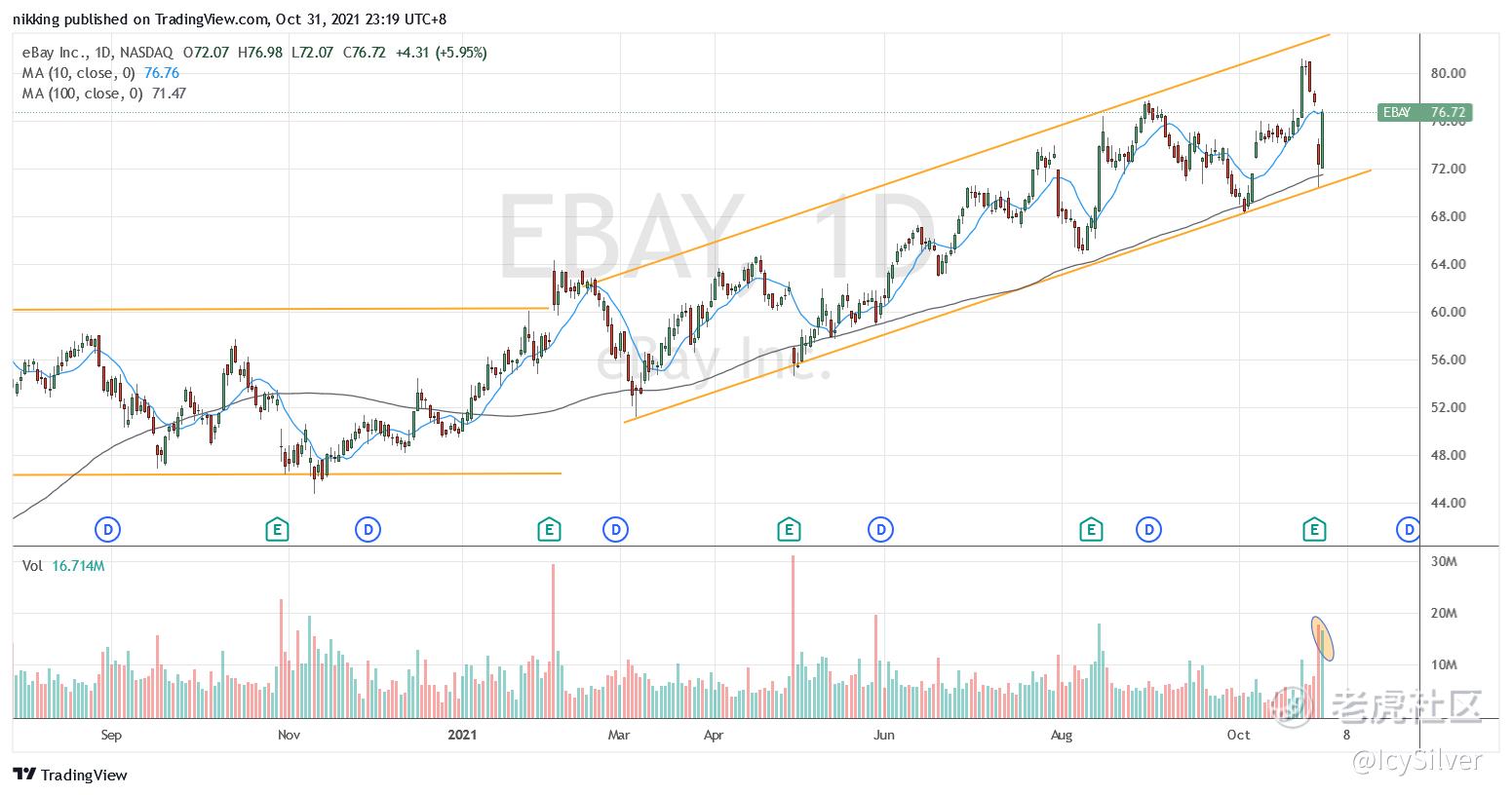

Charts

Since 2021, eBay chart has been trending up beautifully, staying above MA100 consistently.

Q32021 earning report on 28 Oct resulted in 7% drop accompanied by high volume. However, the following day, similar amount of volume had pushed the price back to above $76. This suggests demand is still relatively healthy.

For trading, eBay is now near all time high. Once the price break $80, there could be more up side.

Future

So, is eBay a fossil stock to keep for value, or a sinking stock to ditch? That's the question we should ask ourselves as investors.

Pandemic or not, the e-commerce sphere is getting saturated and filled with competition. For a pioneer like eBay, either it should return to its root to dominate the auctioning days, or venture into revamping the business with new ventures. Perhaps it would be a bit of both.

Will eBay able to acquire more active users? Is eBay able to continue entice existing users to stay active?

Business challenges aside, the price chart of eBay still up trending. If the overall market condition is still bullish, eBay may remain a buy. However, until more clarity on how eBay manage to maneuver the challenging landscape, it would be premature to know if eBay is a value stock worth holding on.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- MurrayBulwer·2021-11-02EBay has done a good job in cross-border business, which is also what I think her core competitiveness is. Many peer companies can learn its technology and business, but the mode and influence are difficult to be replaced in the short term. Well done!2举报

- JONESTea·2021-11-02I dont consider to buy eBay... compared to it, apparently growth stocks are much charming2举报

- WinifredAnn·2021-11-02This is a very comprehensive analysis I have read, before investing we do have to recognize the future value of the stock itself2举报

- yansuji·2021-11-02🧐Mobile payment is very good and convenient for people's lives, but stocks will be affected by various factors. Long-term investments can be held, but in the short term, don't.3举报

- BartonBecky·2021-11-02If you want to invest in the long term, please hold on and don't be intimidated by the short-term sinking.👨💻3举报

- AgathaHume·2021-11-02I very much agree with your point of view, their financial results are very good, so dare to hold it.👏3举报

- DaisyMoore·2021-11-02The analysis is very in place, and the figures and charts clearly show us eBay. I'd like to know where the good buying point is. 😃2举报

- JackPowell·2021-11-02😝Really a good article, I agree with your analysis, so I am ready to buy, come on.3举报

- PhilipJones·2021-11-02cant agree too much but I would continue keeping eyes on it not a good time to buy in2举报

- AlanBright·2021-11-02ebay is left behind by the "time", the business operation style is just too old. look at the stock price, it shows no chance to get higher.😂1举报

- StevenHarris·2021-11-02Can you produce a little of this analysis for OCGN as well?1举报