How To Pick An Investing Tool(Part 3/3)

各位好! 如果你有某种内容想要我写,可以留下留言。多谢支持!😃

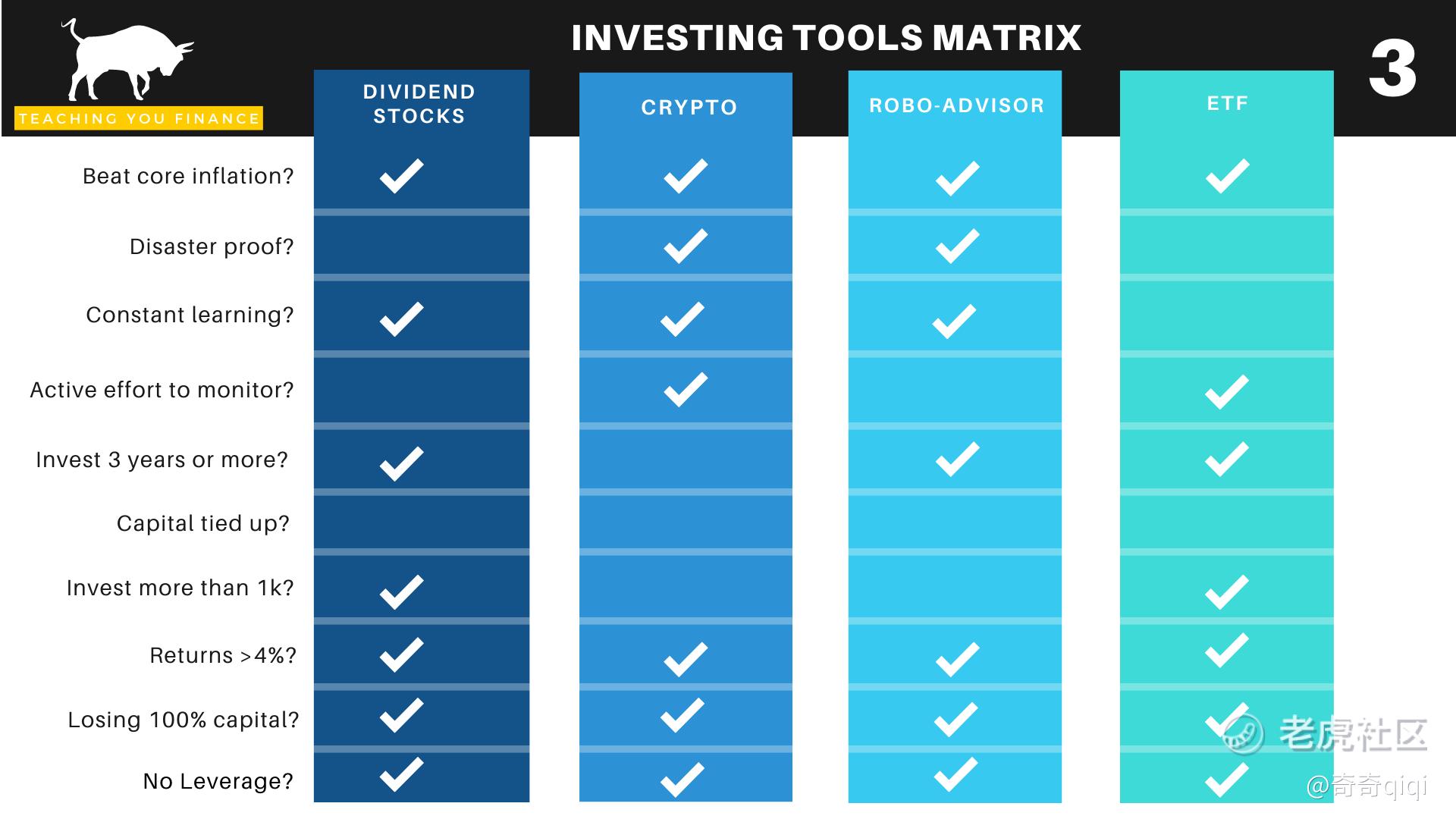

Sharing some of the more prominent asset classes for investment. This is the final part of a three part series for my Investing Tools Matrix😁 In the previous two blog posts I introduced the first 8 types of investing tools in my matrix. If you have not read it yet, click here for part 2. Part 2

If you feel that you are not yet ready to start investing or having some reservations, read my ‘Is One Ready to Invest’ blog post to find out more. Click here Are you ready to invest

Here are the last 4 tools which I will share more below.

9. Dividend Stocks

Dividend stocks are stocks that can come in all forms of industry and companies. REITs share similar characteristics as dividend stocks. I covered this in my Investing Tools Matrix part 2. One big characteristic of these is as a shareholder, you will be rewarded with dividends either every quarter/semi annual/ annually.

Stock price fluctuation is not important in this case and we do not earn from capital appreciation (if prices do grow that is a plus but not a must) and all those buy low and sell high crap that you come across online. One example is OCBC bank (Not a stock recommendation). Its last price was 10.32 SGD as of 29th Jan 2021. $华侨银行(O39.SI)$

If we see the past historical price for OCBC, we noticed that this stock has been hovering over this same exact price somewhere in year 2013, 2015, 2017, 2020 and now at 2021. Prices are usually stable (there are exceptions) and predictable. If you are buying this stock and hoping for its stock price to rise to 30 SGD per share one day then I think you should stop dreaming. The data speaks for itself. You are buying the wrong stock, using the wrong strategy and please re-think your game plan!😢

A good dividend stock company is one that has displayed growing revenues and growing dividend per share trend for the past few years. As dividend yield is make known upfront to us buyers, it is easy to calculate upfront roughly how much you will earn even before you invest in that stock.

Taken from Dividends.sg, dividend yield of OCBC share was 4.25% in 2020. Lets say you plan to purchase 5 lots (1lot = 100 shares) of shares using your CDP account, 10.32 SGD per share * 500 shares = 5,160 SGD has to be first invested to purchase the stock. (exclude transaction fees as I am just showing an example here haha).

4.25/100*5160 = 219.30 SGD per annum of dividends you will receive as a shareholder of OCBC. This means that your gains are in fact fixed and predictable! You know by investing in 500 shares of OCBC you will get back exactly 219.30 SGD if the dividend yield was 4.25% in year 2020 and nothing more or nothing less in this case. 😂

The more shares you owned, the higher the dividend yield you will get to enjoy. Its as simple as that so that’s what I decided not to focus so much on this at the moment. Yes I am earning more than what I got from the bank savings account but you really need a large sum invested (I will say at least 10K SGD) into this for a longer term (about 3 to 5 years) to really reap the benefits of compounded dividend investing.

10. Cryptocurrency

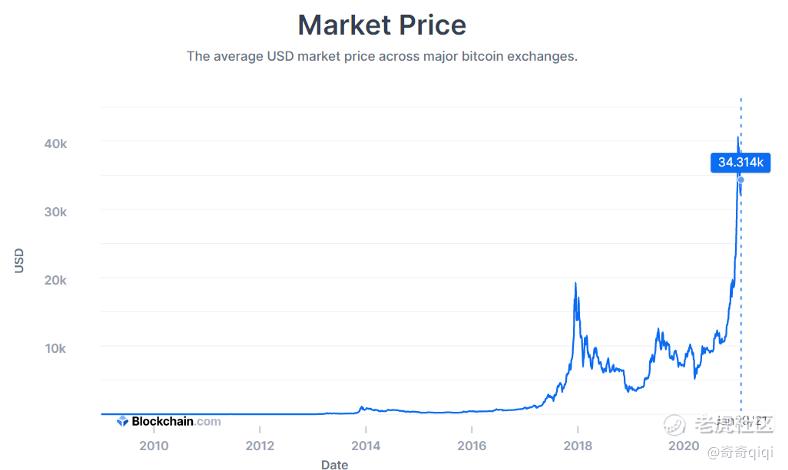

This is not a new kid in the block. They have been with us since 2009 but it first gained worldwide popularity in 2014/2015 when their prices started to surge. In the 4th quarter of 2020, popularity of crypto started to rise again especially for Bitcoins and Ethereum. (*this is not a get rich scheme, don't FOMO).

I have watched some of the gurus online but as of now I have not seen any of them able to perform a clear fundamental or technical analysis on Bitcoins or Ethereum. The Crypto market is still at an infancy stage so please invest only a small sum of your portfolio in this. There will be some people who will YOLO and put 100% of their money inside but please bear your own risk if the prices drop one day which no one will know when acutally.

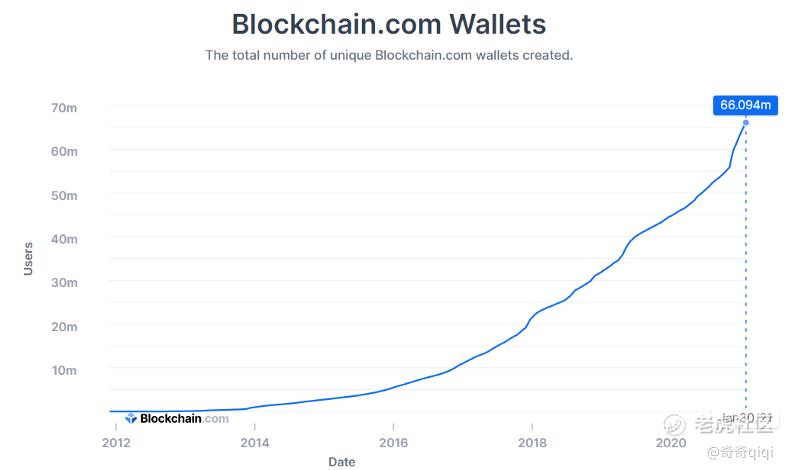

Of course part of the reason why Crypto prices are rising is because more institutional companies are recognizing and accepting the usage of crypto. eg. DBS bank is even launching a digital exchange due to the demand of crypto.

From the charts, the number of people opening a Crypto wallet has been increasing from 2018 to present. The price and market capitalization of Bitcoin has been on a upsurge since the 4th quarter of 2020. Crypto is a form of digital currency and its traded in a decentralized platform called Blockchain. This can be used as a hedge against inflation similar to why people buy gold to preserve their cash as a store of value.

Both Gold and Bitcoin have some similarities in terms of having a limited supply and they have to be mined making them valuable in value. With the Gold market capitalization at 10.6 trillion USD, Bitcoin has potential to grow further in the next decade with a current market capitalization of 642 million USD.

There are many Crypto scams going around online, it is easy to get deceived online so please be careful when you are buying Crypto. There are legitimate websites available such as Gemini and Binance.sg. All of these are online ‘wallets’ to buy and sell crypto.

There are two ways to store your Crypto. First is store them directly with the Crypto exchange and add a second layer of security such as 2FA to make it more secured. The second is to store them offline, away from the exchange directly onto the Blockchain itself and using a hardware wallet key to access to your coins in the Blockchain.

The Crypto market is opened 24 hours everyday unlike the stock market which is closed on weekends. Due to the volatility of Bitcoin and people FOMO-ing to enter, Bitcoin prices can fluctuate alot about +/- 1000 USD or even 2000 USD per hour.

11. Robo-Advisor

A passive way to make money while you sleep as you do not need to actively manage your portfolio. The Robo-advisor will help to do all those hard work so that you can spend more time to do other more productive stuffs in your life 😎 Basically you choose a plan and what level of risk you want and deposit money into it.

This is best for those who are just starting out in investing. You can learn and observe why do they invest your money into certain stocks, ETF etc and try to understand all these small details. When your money grows, you have to keep questioning yourself is the gains enough for you? Is it too little etc, am I depositing too little each month and what or how you can do better to get higher returns. If you keep doing this, I can assure that you will grow and understand how things work faster. 😀

I have done a review for Stashaway which is the first blog article before but have not publish and post it in Tiger Broker. There are tons of Robo-Advisor out in the market. I am currently using Stashaway — 36% risk, Syfe 100% Equity portfolio and UOB AM-Invest most aggressive portfolio. Each company will differ in their methods to invest and manage your funds.

Even if the market crashes etc some of them claimed to have some sort of optimization logic to rebalance your portfolio to minimize your losses. Thus, as I said before, making money while you sleep and let them do the work. 😊

12. Exchanged Traded Funds (ETF)

ETF are just a basket of stocks that represents a particular market index (passive) or an industry.

One local Singapore example is the Straits Time Index (STI) comprising of the top 30 largest performing companies in the Singapore stock exchange. I have written a blog article on this. Click here if you have not read it :) What are the issues with the STI index?

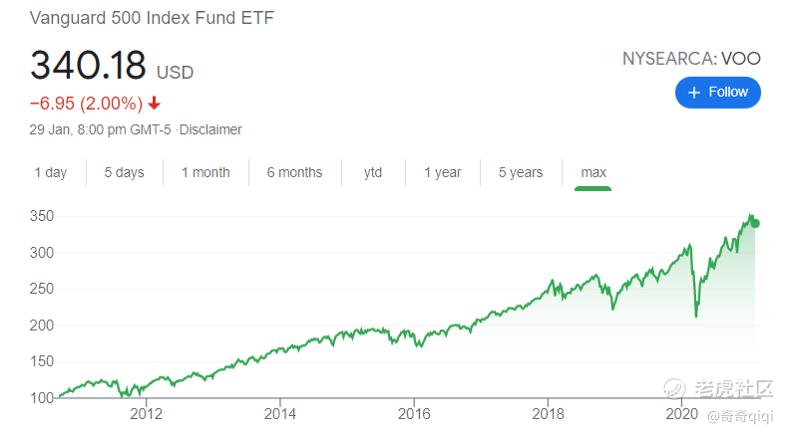

One overseas example is the Vanguard S&P 500 ETF (VOO) $Vanguard S&P 500 ETF(VOO)$ which represents the top 500 companies in the US. One industry active ETF is ARK Innovation ETF (ARKK) where specific stocks that meet its criteria will be included as part of this ETF. $ARK Innovation ETF(ARKK)$

ETF offers diversification as multiple companies are in this same basket. eg. if 300 companies out of the 500 companies in VOO are making losses due to covid, but if the top 200 companies in this ETF are still making money, it can offset the losses of the bottom 300 companies. Hence, its possible for the overall ETF to be positive and its share price will continue to climb and increase in the longer term.

ETF has a self-cleansing effect where weak performing companies will be removed every quarter/semi-annual/annually and gets replaced by higher performance companies in its waiting list. Hence, companies in the ETF are usually the better ones although there are still weak performing blue chip companies out there.😂

Depending on which ETF you purchase, there are some ETF which is dividend based while some ETF is price appreciation based or even both. You have to do your own research to see which one you want.

Summary

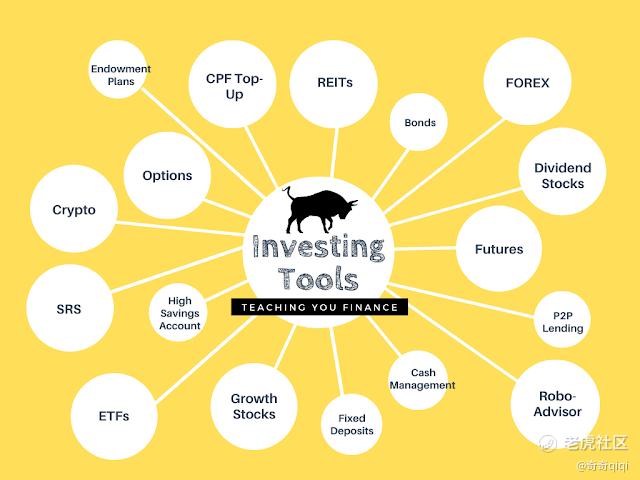

What I have covered are just the breadth of tools available for you to use. There are many higher level strategies involved for each tool to bring greater returns which I will not cover in here. After going through all of these different investing tools. I will like to summaries all that I have covered in my three part series into the following hub-and-spoke diagram. 😀

There are many ways to make money as you can see. There is no one fixed way to work towards financial freedom. Different tools will require different amount of effort, time, risk and money to invest. The smaller size bubbles are those with lower returns while the larger size bubbles are those with unlimited profits and losses.

Good luck in your journey! 😃

Originally published at https://medium.com/the-investors-handbook/investing-tools-matrix-part-3-3-3cedf726da92?sk=b95d5f0a38d538df443fa048b556f547

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- Officer·2021-11-04What other crypto currencies u suggest?2举报