Demystifying Options Part 6

If you are not familiar with options, I would suggest reading my first 5 posts:

Part 1 - Introduction to options

Part 2 - Selling Put options

Part 3 - Buying Put options

Part 4 - Selling Call options

Part 5 - Buying Call options

If you have tried selling or buying options, you might encounter some common issues:

Issue 1: Unable to find any buyer or seller willing to take up your option contract, so your transaction is pending for a long time.

Issue 2: As a seller, your option mostly ended up ITM and getting exercised.

Issue 3: As a buyer, your option mostly ended up OTM or ATM, and expiring worthless.

I will try my best to provide some tips and rule of thumb based on my limited experience. I am not always right or have the best solution. Please feel free to correct me if I made a mistake or to propose better solutions in the comments section and we can all learn together.

If you open the options window in Tiger, you might be overwhelmed with the many rows and columns of numbers. I will describe the important ones briefly. There are some difference between the mobile version and the desktop version.

1) Expiry Date - Date at which the option expires.

2) Strike Price - Price that you are willing to pay (SELL PUT and BUY CALL) or be paid (BUY PUT and SELL CALL) for the underlying stock.

3) Bid Price - Premium that the sellers on the market are requesting from the buyers for each share. If you are selling options, this is the column to pay attention to.

4) Ask Price - Premium that buyers on the market will be willing to pay for each share. If you are buying options, this is the column to pay attention to.

5) xOrder - The number below the Bid price and Ask price. It refers to the number of contracts who have that bid or ask price waiting to be transacted.

6) Last - Last transacted price for the option where a buyer successfully found a seller.

7) Volume / Vol - Number of successful transactions for the day.

8) Imp Vol / IV - Implied volatility (IV). It is a prediction of how volatile the stock is, or how big the fluctuation the stock price will be. A high percentage means the stock price will move up or down a lot whereas a low percentage means the stock price will not move much.

9) Unclosed / Open Int - Number of pending contracts, meaning number of buyers who have not found a seller + number of sellers who have not found a buyer.

The rest of the columns are for advanced traders who use them as a guide to predict likely price movements, entry and exit prices for day trading, which i will not be covering in this post. The greek characters (Delta, Gamma, Vega, Theta, Rho) are interesting parameters that describe the relationship between the option and underlying variable such as stock price, time, etc. I will briefly describe them when there is a need to use them.

Issue 1: Unable to find any buyer or seller willing to take up your option contract, so your transaction is pending for a long time.

Solution: The ability to find a buyer or seller is generally dependent on 2 factors, the Volume (point 7) and the Bid(seller) or Ask(buyer) price.

Point 7 (Volume) records the number of transactions since the start of the trading day. If 1 hour after market open, the number is 50 or below, I would consider it low volume and it will be difficult to get your trade in or out. If it is above 500, your trade would most likely be successfully transacted. Anything in between and it will be average, so it might take a while for the transaction to be successful.

Even if you transact in a high volume option, your bid and ask price must be realistic. For example, if you are selling option, and the market Bid price(premium) is 1 dollar per share. You request for a premium of 2 dollars per share. You will not be successful until the market changes. Similarly, for buying option, if the market Ask price(premium) is 1 dollar per share and you request to only pay a premium of 50 cents per share, you will not be successful until the market changes.

In summary, to solve issue 1, select a high volume option and set your bid/ask price as close to the market rate as possible to increase the chance of a successful transaction quickly.

Issue 2: As a seller, your option mostly ended up ITM and getting exercised.

Solution: You will want to pay attention to Implied Volatility [IV] (point 8), Volume (point 7), Unclosed (point 9), strike price (point 2), expiry date (point 1), and to a lesser extent, the 2 greek characters (Delta and Gamma).

As a seller, if you are just selling to get cash flow and do not plan to get the underlying stock, you will want to trade a stock with a low IV (point 8). Anything above 50% means the stock price tends to go up and down more, so a higher chance of being ITM.

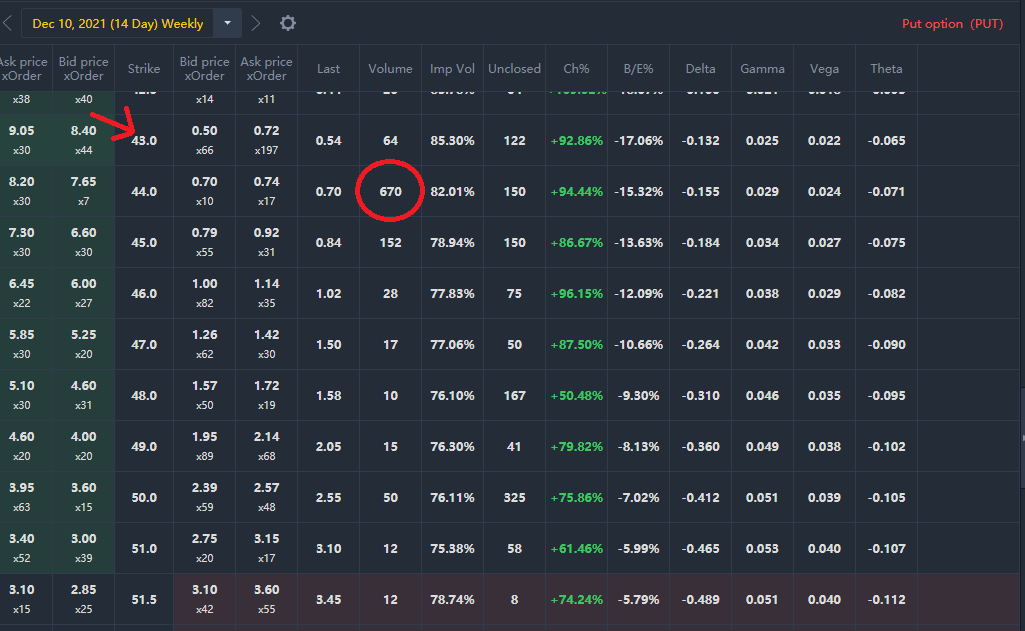

Volume (point 7) and unclosed (point 9) will give you an idea where most of the trades are occurring. If you want to decrease the probability of ending up ITM, you want to SELL PUT at a strike price that is lower than the one with a very high volume or unclosed and for SELL CALL, higher than the strike price with high volume or unclosed. An example for SELL PUT where for a particular strike price, the volume circled in red is very high for OTM option. Selecting a strike price one step lower (Red arrow) will increase the chance that the option will end up OTM on expiry. Note that this is not a guarantee, it just increase the probability.

Strike price will also play a part in being ITM or not. If you sell close to or ATM, it is likely that your option will be ITM on expiry. The further away your strike price is to the current share price, the less likely it is to be ITM.

Expiry date is another factor. The longer the expiry date, there is a higher probability that will end up ITM.

The 2 greek characters (Delta and Gamma) provide some additional information. Delta will tell you the probability of the option being ITM or not on expiry. Ignoring the sign, a 0.2 delta means that there is 20% chance it will be ITM on expiry. Gamma determines how stable Delta is, meaning high gamma is high volatility, similar to IV, so to be OTM, you want gamma to be low.

However, following the above solutions for selling options generally means the premium you will get is low. There is a trade-off between playing safe and the premium you will get. If you play very safe, you will get very low premium. The more risk you take, the higher premium you get.

Issue 3: As a buyer, your option mostly ended up OTM or ATM, and expiring worthless.

Solution: If you are buying options, you would want the complete opposite of a seller in issue 2. You would want the IV to be as high as possible. A high IV means a higher chance of ITM as the stock price fluctuates a lot.

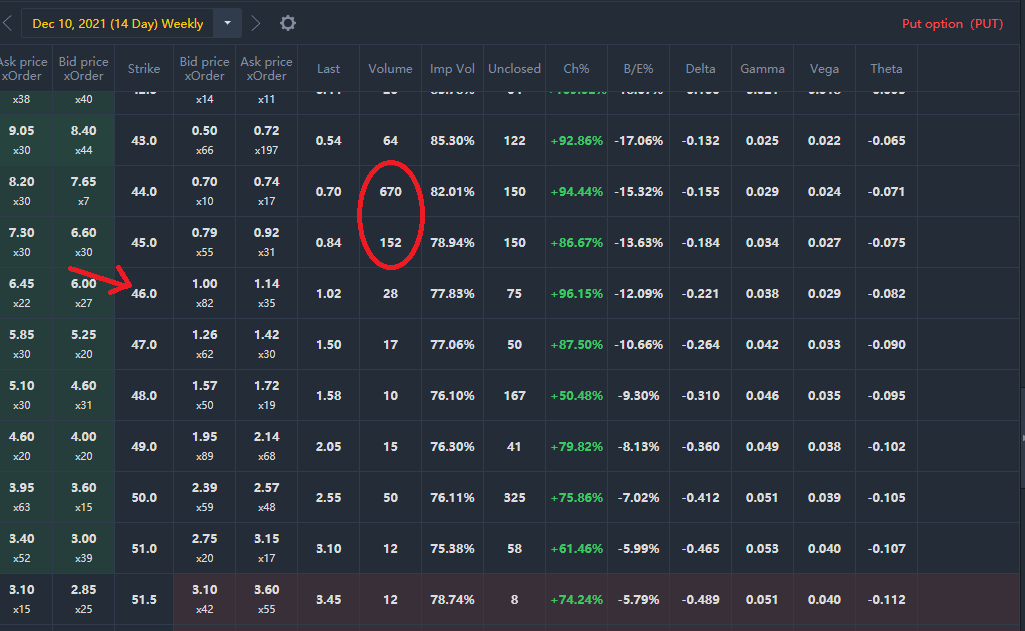

You would also want to avoid the place where most trades are occuring to increase the possibility of ending up ITM, so you want to BUY PUT at a strike price higher than the one with a very high volume or unclosed and vice versa for BUY CALL. An example for BUY PUT where for a particular strike price, the volume circled in red is very high for OTM option. Selecting a strike price one step higher (Red arrow) will increase the chance that the option will end up ITM on expiry. Note that this is not a guarantee, it just increase the probability.

For strike price, it is better to buy near the actual market price. For expiry date, you want to buy an option with a long expiry date. For the 2 greek characters (Delta and Gamma), you want both to be high.

However, following the above solutions for buying options generally means the premium you need to pay will be high. There is a trade-off between the premium you pay and winning the trade. Higher winning chance = higher premium to pay.

In Demystifying Options part 7, I will explain LEAPS.

Always remember.. If you do not understand what is happening, do not blindly follow and execute the trade!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

Thanks for your effort, WayneeQQ ❤