Lam Research Corp - Semiconductor growth stock to buy?

I have shared on quite a few semiconductor manufacturer and equipment supplier stock. Realize I have not done anything on Lam Research till date.

ASML and KLA are dominant in Photolithography and Inspection segment respectively. Now for Lam, their strength is in Etching process. Similar space as AMAT and TEL. But LAM has its own competitive edge over the other 2 suppliers in the 3D Nand product. And that advantage is yet to be bridge by other competitor, and will not at least for the next 3-5 years. Also taking into the account of the cost of changing supplier, we can say LAM almost cemented their place in 3D Nand for deep etch capability. And potentially expanding market share to other product if deep etch capability is require.

Some background,

semiconductor-equipment companies provide the tools needed to boost supply and could end up being great long-term holdings over the next few years. Their profit has soared in recent quarters as a result of record demand, seen in many equipment supplier share price.

Keep in mind: The process for building intricately designed chips is becoming increasingly complex, which means that the expertise and advanced equipment that these companies have developed are massive competitive advantages over competitors.

As long as the global chip shortage persists, new Fab being build, new design rule requirement, the demand for equipment will continue to grow.

Lam Research specializes in dry etch, an essential part of the manufacturing process in which material is removed using plasma-based technologies.

Every type of semiconductor device goes through the etch process, and demand for these types of tools will certainly remain strong as chipmakers continue to develop more advanced chips.

Since Lam Research is a leader in the dry etch markets, it has plenty of room to continue capturing global market share. That's thanks to trends like cloud computing, 5G networks, the internet of things, and artificial intelligence, which all require advanced semiconductors.

Lam’s customers include international chipmakers like Micron, Taiwan Semiconductor and Samsung

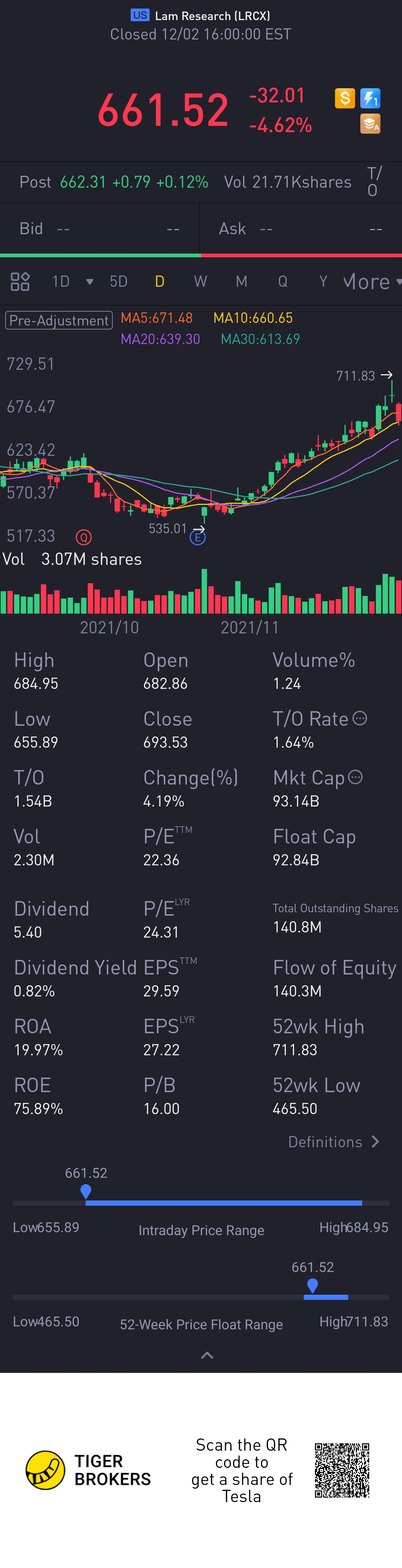

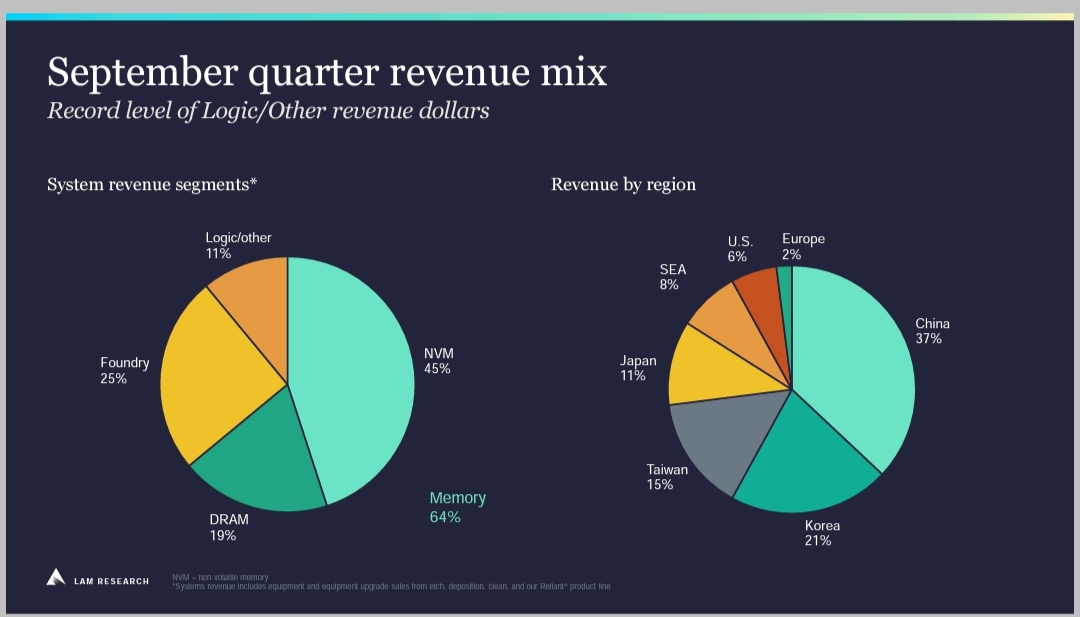

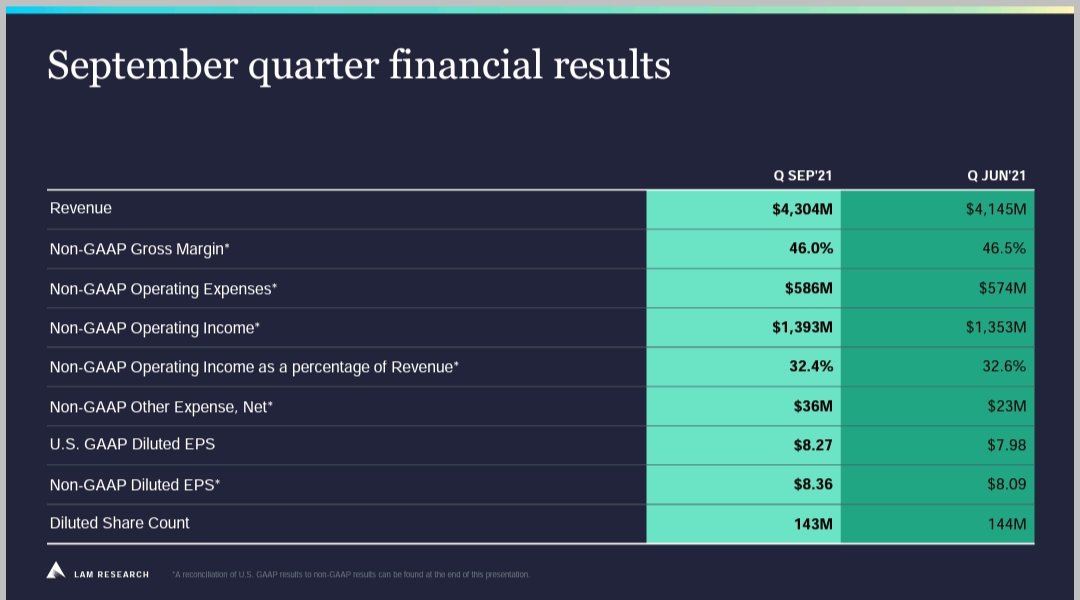

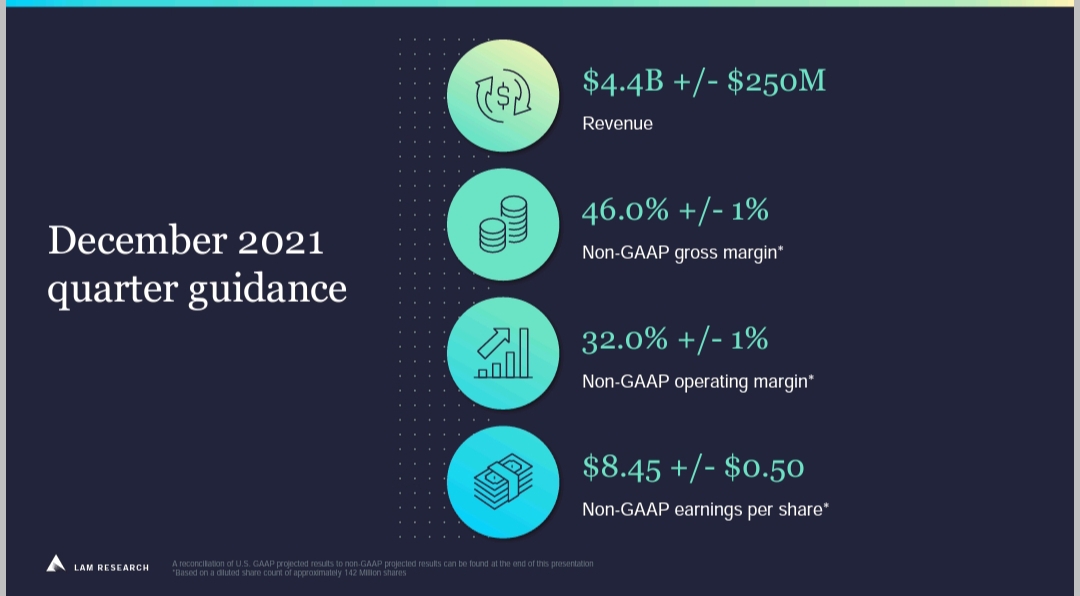

The company report topped consensus adjusted earnings estimates for Q3 as revenue advanced 35% to $4.3 billion.

Lam Research stock has been raise for months hitting the $710 range. But of late, due to overall market sediment, its has retrace back to $660.

Personally I am vested and will continue to hold onto my position. If price soften further to $610 range, will consider to add more to my position.@Tiger Stars@小虎活动

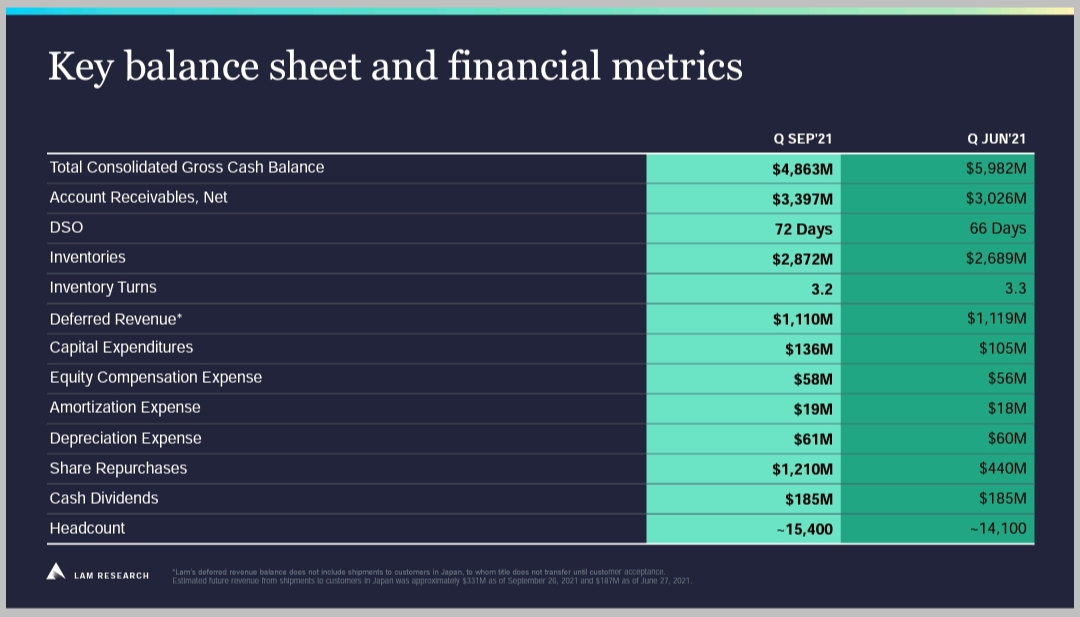

I have attached information of their Q3 result and outlook for Q4.

Thanks for reading and hope you achieve your investment objective.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- EvelynHoover·2021-12-03I'm very optimistic about Lam. For the semiconductor industry, it must be an industry that will develop for a long time. Second, the company has its own technological advantages. It will develop well in the future.2举报

- PageDickens·2021-12-03拉姆研究专门从事干蚀刻。这是它的巨大优势。 对于科技公司来说,拥有伟大的技术研发;能力远比公司规模重要。3举报

- PagRobinson·2021-12-03I don't know what dry etch is, but it sounds great. I am very optimistic about the future of this company!2举报

- MamieBenson·2021-12-03Lam's share price has been rising recently. Have I missed the time of purchase?1举报