Option Strategy – Straddle or Short-Straddle?

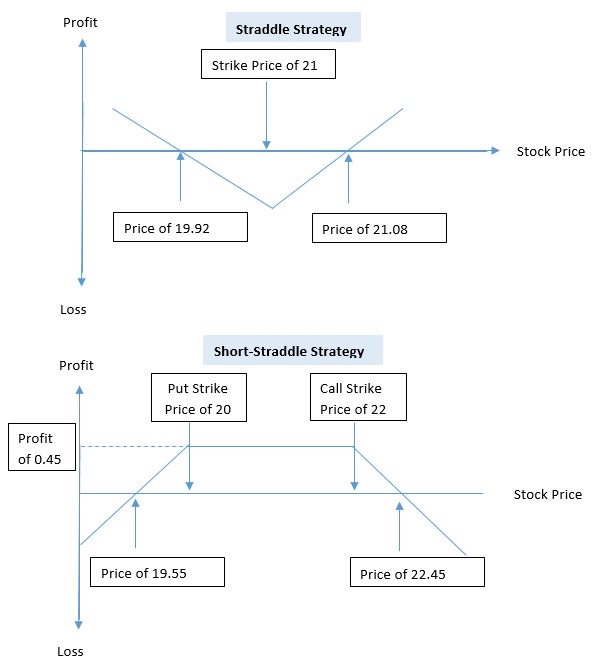

1. Straddle – buy a Call Option and buy a Put Option at the same strike price and with the same expiry date.

2. Short-Straddle – sell a Call Option at a higher price and sell a Put Option at a lower price, with the same expiry date.

In the Straddle Strategy, you will at least be able to exercise one of the 2 options, and whether you profit from it depends on how far the actual price is, from the strike price.

In the Short-Straddle Strategy, you will at least gain from 1 of the option, since either the call or the put option will go expire, with the other option being exercised. In a fortunate situation in which the final stock price falls in between the Call and Put Option strike price, both options will expire and you gain from the fees from selling them.

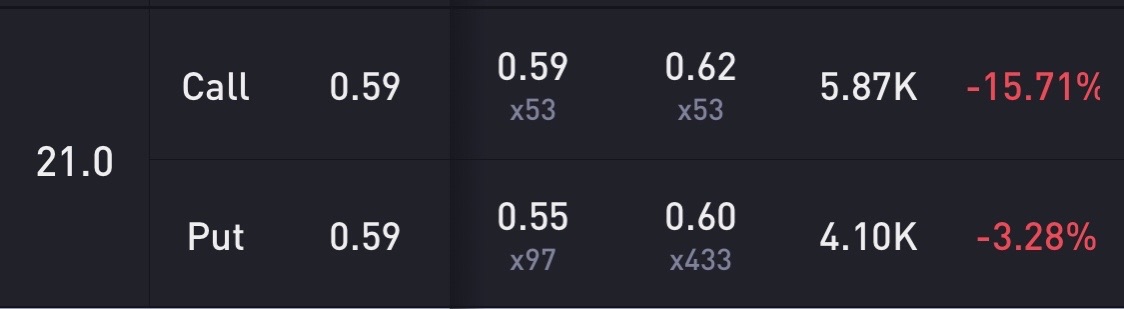

Using Straddle Strategy, PLTR as a example, buy 1 lot of Call (0.59) and 1 lot of Put (0.59) at strike price of 21 will cost 1.08 x 100 = $108, and to profit from it, the price of PLTR has to either fall below price of 19.92 or rise above price of 22.08.

Using Short-Straddle Strategy, sell 1 lot of Call (0.21) at strike price of 22 and 1 lot of Put (0.24) at strike price of 20 will gain 0.45 x 100 = $45, you will always profit of $45 if the price of PLTR stays within 20 to 22. However, if the price falls below 20, you will only start to make a loss if the price of PLTR falls below 19.55. On the other fall, if the price increases above 22, you will only start to make a loss if the price of PLTR rises above 22.45.

My personal thought, I prefer Short-Straddle Strategy, and it is especially ideal if you already own shares of PLTR with average cost below 22. This is to protect yourself from unlimited losses from an extremely bullish situation, where the call you sold is actually ‘covered’. In such as event, you are technically not losing either, as long as the average cost of PLTR you owned is below 22.

Invest safe.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- EricVaughan·2021-11-30谢谢大家的分享,这对我购买期权很有帮助。但我认为购买期权的风险高于投资股票。你觉得呢?1举报

- AgathaHume·2021-11-30I don't want to invest right now, even in options. future news is uncertain. there is too much mixed news in the markets right now.点赞举报

- MamieBenson·2021-11-30I think an important point of buying options is to judge the trend of price changes. For now, I think prices will continue to fall.1举报

- DaisyMoore·2021-11-30I also like straddle because it is safer than short straddle.1举报

- LesleyNewman·2021-11-30stock + options = money🤣🤣 thank you for giving me new ideas点赞举报

- JackPowell·2021-11-30your idea is great. It's just a matter of choosing the stock点赞举报

- BonnieHoyle·2021-11-30the butterfly spread option is interesting, but I prefer to own the put option right now点赞举报

- BlancheElsie·2021-11-30wow your options strategy is very good, it does guarantee a low risk点赞举报

- BartonBecky·2021-11-30Im more bullish on bearish options right now, hhh because of the new virus点赞举报