Not All Tech Stocks Are Equal So Be Selective + Market Update

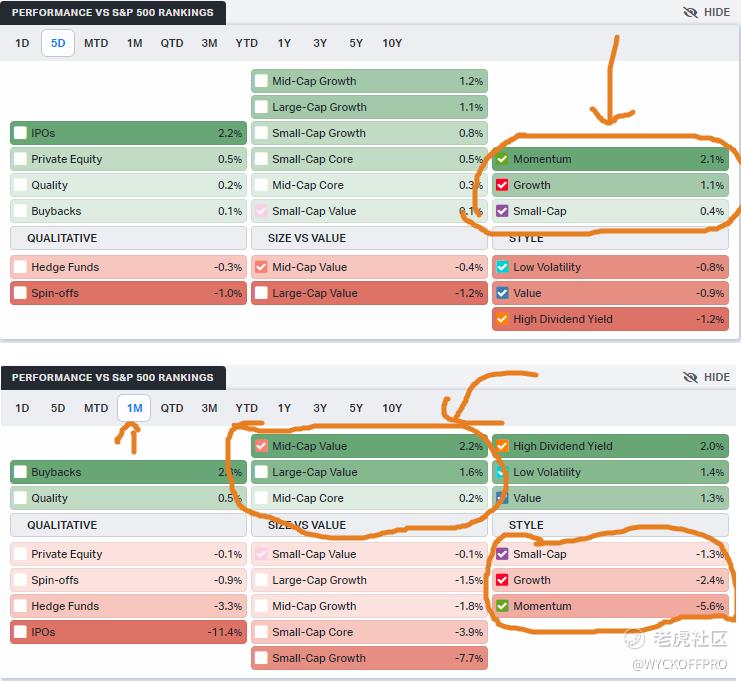

What sectors or groups outperform in last week and last month?

Last week Nasdaq led the rebound and rally up as it outperformed the rest of the indices. However, not all tech, momentum or growth stocks are equal. In fact, majority of the previous momentum stocks (check out Cathie Wood's portfolio) are still not recovered to even 50% of the sharp drop.

Refer to the chart below and you will see that despite momentum and growth outperform last week (upper pane), on a monthly timeframe (bottom pane), they are still the worst performers (-2.4% and -5.6%) compared to the benchmark index S&P 500. On the other hand, mid and large cap value are the top performers (beat S&P 500 by 2.2% & 1.6%).

During sector rotation, it is essential to pick the outperforming stocks else you will only see the index keep going higher while your stocks are not moving up.

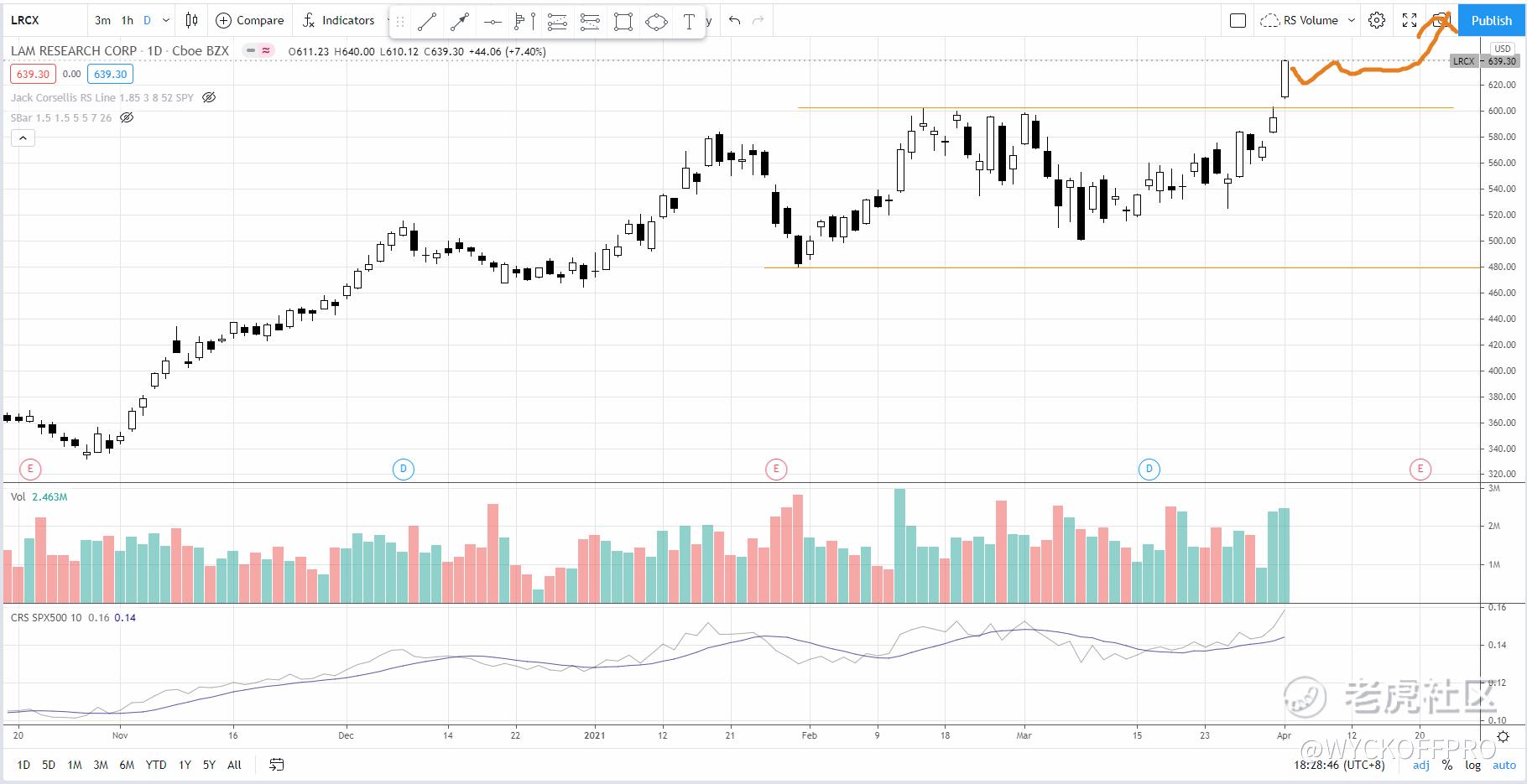

Strong stocks in focus in the Semiconductor Sector

In my last Sunday's post, I mentioned strong sectors like Homebuilders (ETF Ticker: ITB) and Semiconductors (ETF Ticker: $半导体指数ETF-HOLDRs(SMH)$ ) which are still the case. Refer to the charts below where these 5 strong stocks in the semiconductor sector - $应用材料(AMAT)$ , $阿斯麦(ASML)$ ,MU, LRCS, ON are likely to outperform the sector ETF - SMH.

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。