How to profit from selling PUT with Tiger Broker?

Selling Cash Secured PUT has been my regular realizing profit strategy over the years. Don’t get tricked to think that selling a PUT is a big risk. Let me explain why then show you how to do it with Tiger Broker.

Why Sell PUT?

Using PLTR at $24 for example. If you like to buy 100 shares of PLTR at $20, you can only set a buy order at $20. However, if the stocks continue to trade at the range of $22-$24, you can never get it. So the cash you hold is losing out on opportunity cost.

But if you sell 1 contract of PLTR PUT with a strike price of $20, you can actually collect the premium. 1 contract equals 100 shares when it gets assigned. The premium you earn will be determined by the contract value you sold the PUT at.

So, if you have the intention to buy 100 shares of PLTR at $20, this is a WIN-WIN Situation. If it doesn’t drop below $20 after the expiry date, you earn the premium. If it drops, you get 100 shares of PLTR at $20 per share AND also minus-ing the premium you get. So you actually get 100 shares of PLTR at a value below $20 per share.

So what’s the RISK?

Well, the risk is that if it drops way below $20, you still have to purchase the 100 shares at $20 when you get assigned. But there are ways to get around it like rolling your PUT by selling another one. You can also close it before it drops taking either a small profit or some realized loss but you don’t get the 100 shares of PLTR anymore.

So, I only recommend doing this when you are happy to get it at the strike price. This also means that you must have the available cash to own the 100 shares at the strike price. This strategy is called Cash Secured Put.

How to Sell PUT on Tiger?

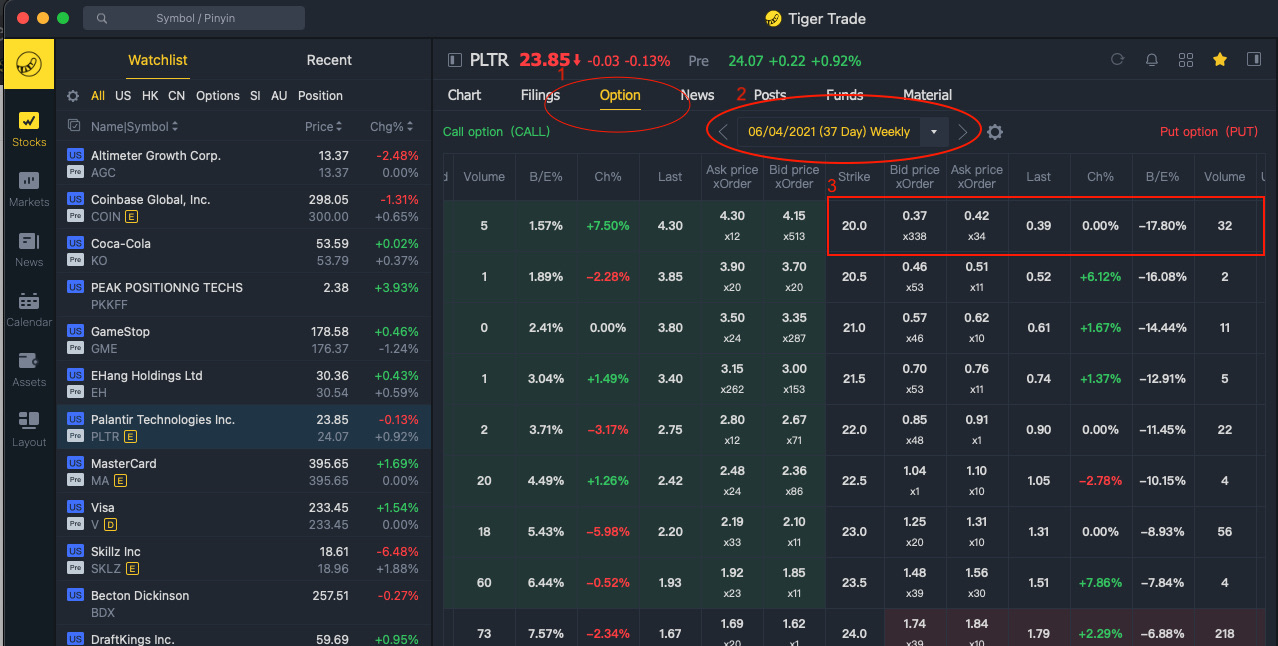

1. Clicking into each stock, there is an OPTION Tab.

2. Filter by the Expiry Date that you prefer.

3. Look at the Stike Price and its Premium.

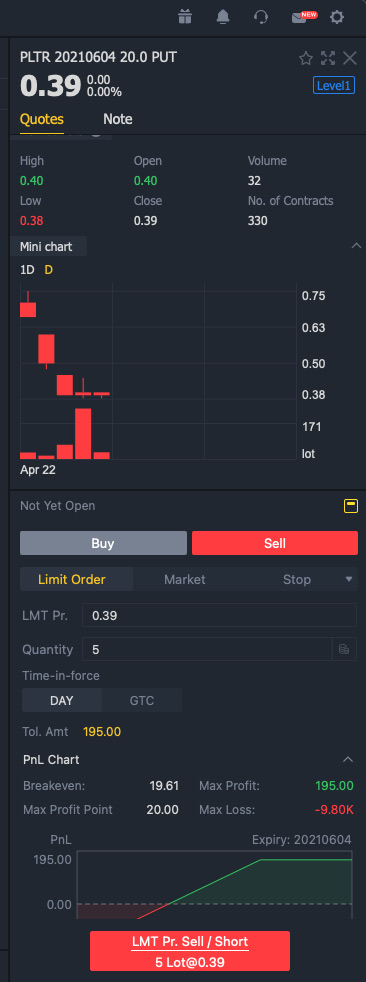

Click on the row of your preferred Strike Price, then the bar on the Right Side will Change.

So in this case, I am willing to buy 500 Shares of PLTR at $20 - $0.39. Essentially on Assignment, I am getting each share at $19.61.

If I don’t get assigned, I will realize the $195 profit at expiration.

When best to sell PUT?

I often look for a 21 - 60 days expiry PUT Option and prefer to Sell the PUT on a day when the market/stock is having a red day. This usually results in a higher premium.

For strike price, I often look at the support level. It will be best if the moving average acts as support too.

I been doing this way to earn regular realise profit. I find that as don’t I stick to the strategy for cash secured put, I continue to either generate income or get the stocks I want at my preferred price. Don’t fall into the temptation of attractive premium but not the price you willing to own the shares.

I hope this help you. Good luck!

PS: This is not financial advice, Please do your own DD before investing.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 哈V·2021-04-30well explained. after you get the 100 shares one day then apply covered call点赞举报

- 美股数据张老师·2021-05-01Why English in Chinese Broker ?点赞举报

- sjskd·2021-04-30卖put是盈亏比太低点赞举报