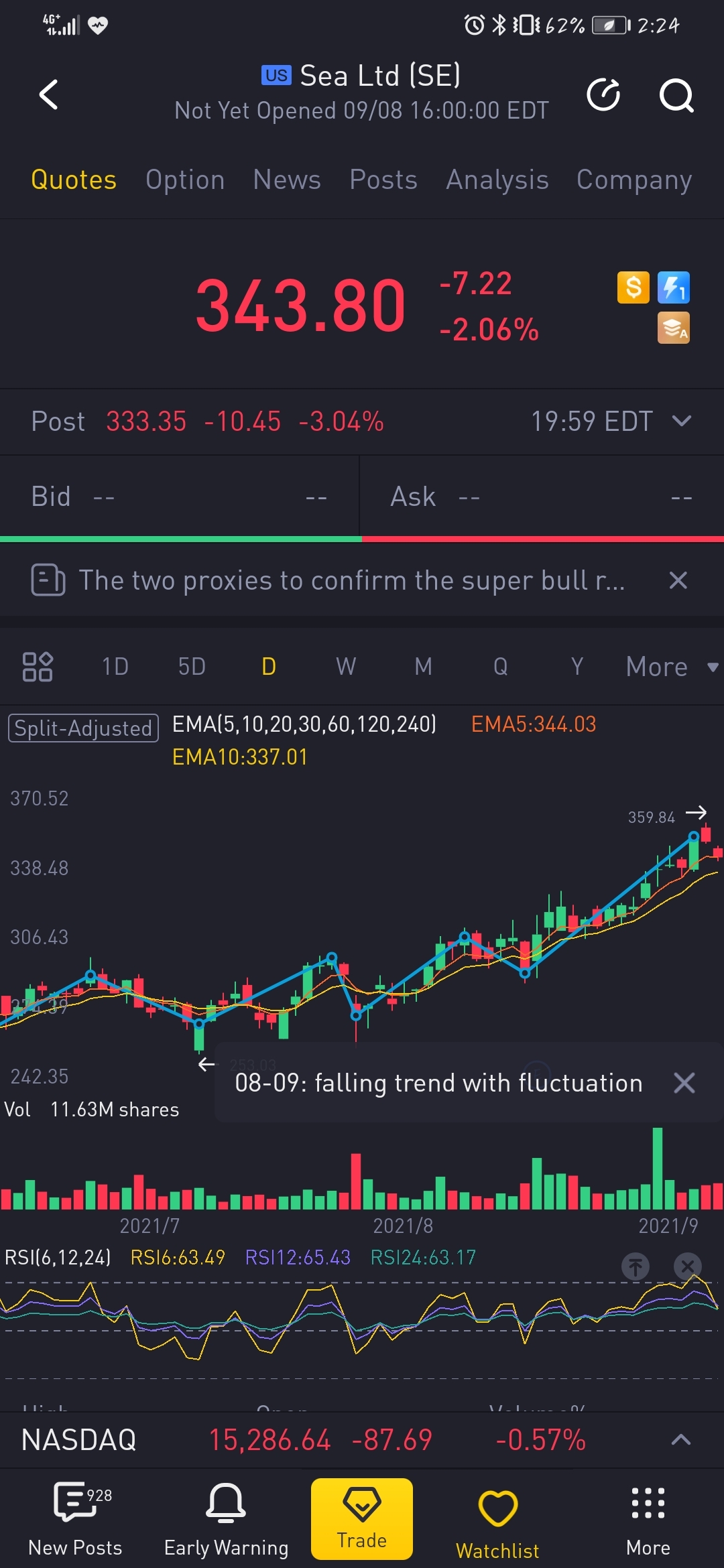

$SeaLimited (SE) Buy now?

Summary

Sea Limited is a very high-quality growth stock that surprisingly receives less attention than Alibaba, MercadoLibre, and Amazon, even though it has outperformed all of them, hands down.

We help investors understand the key metrics in a useful analytical framework to evaluate Sea Limited's growth opportunities and whether it is worthy of a long-term position.

Lastly, we present our valuation argument to help our readers to decide whether they should add Sea Limited stock right now.

Shopee Express and Logistics Mini Container Motorcycle

nuttapong/iStock Editorial via Getty Images

Investment Thesis

Sea Limited (NYSE:SE) is one of our core holdings in our growth portfolio and one that we have taken the opportunity to add on major dips in the uptrend over the last year as the stock's incredible momentum saw it easily outperforming its e-commerce peers and mobile gaming peers.

For growth investors, Sea's incredible growth trajectory has been truly phenomenal, coupled with it being free of Beijing's oversights that saw its Chinese peers fall like dominoes, stunning even institutional investors with the pace of the government's "rectification" adjustments.

Sea's ascent has also been somewhat of a conundrum for value investors, as they don't get how an unprofitable company can be trading at such sky-high valuations without consequences.

Therefore, to answer whether Sea Limited stock is a good long-term buy for investors, we will show our readers how to apply the appropriate analytical framework and valuation treatment to the company, based on its performance and its projections moving forward, so that investors can make meaningful decisions on whether they think Sea Limited is a worthy long-term addition to their portfolio now.

For investors who are new to Sea Limited, we have recently written several articles on the company, which you can refer to them as a preamble (links to the articles are appended here, here and here).

Sea Stock's YTD Performance

Sea & Peers' stock YTD performance (as of 3 Sep 21)

This year, Sea has been one of our portfolio's leading performers as the stock raced to an 83% YTD lead that easily outperformed all its peers and SPDR S&P 500 ETF (NYSEARCA:SPY). This performance is even more incredible because it came off an outstanding 2020, where it also outperformed with a 392% return.

While the rest of its American and Chinese peers often received more coverage than this Singapore-headquartered company, it has been Sea which has been quietly delivering. It has been executing, expanding its Garena gaming ecosystem, and reaching new milestones. It's been scaling its e-commerce footprint to LatAm and demonstrating to Amazon (NASDAQ:AMZN) that they are not experiencing any reopening headwinds. This is in contrast to what Amazon indicated in its recent earnings. The company is also growing its Sea Money footprint, especially through the Shopee/Shopee Pay flywheel, as the company stakes its FinTech leadership ambitions against Southeast Asia's FinTech leader Grab (NASDAQ:AGC).

As a result of Sea Limited's incredible success, the group's China-born CEO Forrest Li is also now Singapore's richest man with a net worth of $20.3B.

SE quant rating (momentum). Source: Seeking Alpha Premium

We have always reminded investors that Sea stock is one that you should never bet against even if you are bearish on its long-term prognosis. The stock has made one of the strongest upside moves we have seen for stocks in our growth portfolio. This is also corroborated by Seeking Alpha's proprietary quant momentum rating, giving it the best possible A+ grade on its most recent performance.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 布莱登森林·2021-09-09Sea Limited can easily exceed e-commerce counterparts and mobile game counterparts of the high-quality bid, it is worth our continued attention!10举报

- 宝宝金水_·2021-09-09股票是很好,涨势也非常棒,但是跟国际一流相比,还需要很长的路走。3举报

- 七色祥云6·2021-09-09Sea Limited是一只非常优质的成长型股票,准备中长线钓大鱼!2举报

- 栋哥·2021-09-09Sea Limited是一只大牛股啊,感谢博主分享,已经加自选池了!2举报

- 哎呀呀小伙子·2021-09-09能轻松超过电子商务同行和移动游戏同行的优质标的,你让我如何能不过多的关注呀?2举报

- 揭人不揭短·2021-09-09Forrest Li净资产为20.3亿美元,这么多钱就能坐上新加坡首富啊?2举报

- 老夫追涨杀跌·2021-09-09就目前 的状况而言,Sea Limited很难超过亚马逊吧?1举报

- 小时候可帅了00·2021-09-09之前听说过这个公司,好像跟阿里收购的那家公司正在拼刺刀,看样子是打赢了。1举报

- 马丁靴子·2021-09-09那它得到的关注确实少,相信很多人都没有听说过1举报

- 未来可期8·2021-09-15阅1举报

- 丁心·2021-09-15涨很多了呢!2举报

- 重庆GEL·2021-09-09这个评级和股票有什么关系?1举报

- Eldenminaj·2021-10-04strong growth company!点赞举报

- 泰格儿沫·2021-09-13不错的分析1举报

- 陆家嘴八废特·2021-09-13[看涨][看涨]2举报

- plaispool·2021-09-13野1举报