$Lendlease Global Commercial REIT(JYEU.SI)$ 313@Somerset located in Singapore's famous Orchard Road is an icon and a very popular destination for the millennials. It is owned and managed by Lendlease. The current occupancy is 98.9%.

Lendlease Reit is also redeveloping the Grange Road Car park next to 313@Somerset which is very attractive to retailers. As a result, there have been positive rental reversion and new leases signed especially for Food and Beverage outlets in 313@Somerset.

The other important development is Lendlease is expanding into the suburbs by its acquisition of JEM which is next to the MRT.

Lendlease is also now included in FTSE EPRA Nareit Developed Asian Index. This puts Lendlease in the spotlight of many funds and will improve trading liquidity.

LReit distribution per unit has improved 32.8% on 2H2021 to 2.34 cents per share compared to 1.76 cents the previous year.

LReit DPU current yield is 5.3% which is very attractive compared to putting money in the bank.

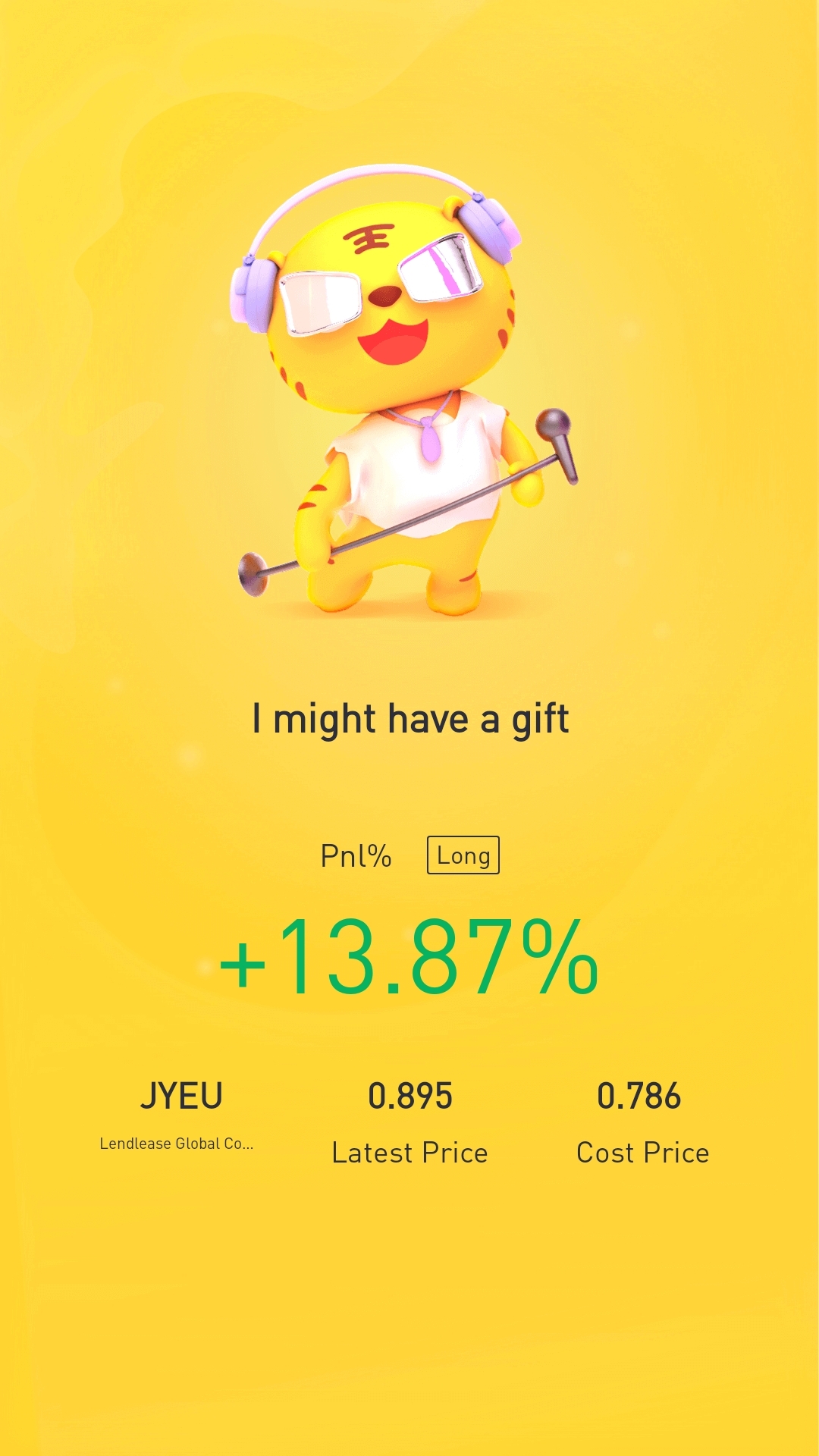

With the reopening of Singapore to international borders, $Lendlease Global Commercial REIT(JYEU.SI)$ will continue to grow exponentially and ultimately improve its net profits long term. This will certainly lead to improved DPU and provides a great source of passive dividend income for me.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

Good reminder! @koolgal