Gladstone Land Corp: Q3 Earnings Analysis

Lets review the recent Q3 Earnings of $Gladstone Land(LAND)$ $Gladstone Land Corp(LANDM)$ $Gladstone Land Corp(LANDO)$ and do a company analysis on whether it is a good buy?

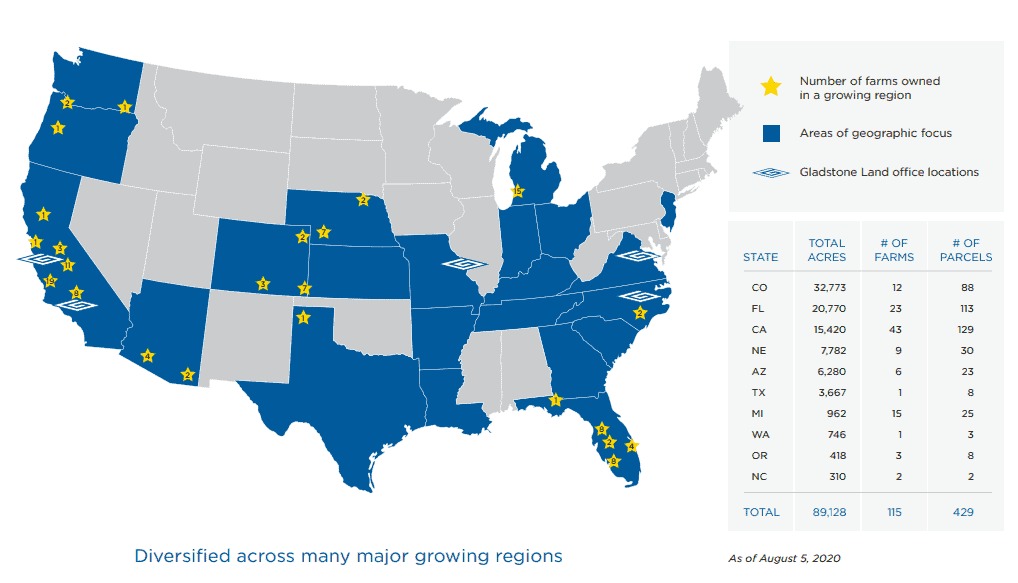

For those who do not know, Gladstone Land Corp is a Farmland REIT. Which means they buy Farmland all over United States, and lease it to farmers and other corporation. Their revenue is mainly from the rental that they obtain, and occasionally the appreciation of farmland price. The company invest in all types of farmland that produces fruits, vegetables, nuts and all forms of crops.

Key Takeaways from Q3 Earnings call:

- "The second half of 2021 is shaping up to be a strong one for us, as we have begun receiving information from some of our tenants on the amount of participation rents for the year," said President and CEO David Gladstone.

- Q3 adjusted FFO of $0.17 tops the consensus estimate of $0.15 and increased from $0.13 in Q2.

- The company also increased the number of shares outstanding by issuances under its at-the-market program, a move that reduces AFFO per share amounts.

- Q3 total operating revenue of $19.6M, beating consensus of $18.0M, rose 16% from $16.9M in Q2.

- Total cash lease revenue increased about 17% Q/Q, primarily driven by participation rents recorded during the current quarter of approximately $1.8M, versus ~$19,000 in the prior quarter.

- Acquired five new farms, consisting of 1,516 total acres, for ~$62.3M and executed six new leas agreements that are expected to result in total increase in annual net operating income of ~$132,000, or 10.3% over that of the prior leases.

- Since the end of Q3, Gladstone Land (LAND) acquired two new farms consisting of 1,503 total acres for $46.3M and executed four lease renewals expected to result in total increase in annual NOI of ~$95,000, or 5.9%, over that of the prior leases.

Now the big Question here is, Is it a good company to invest?

Here are my Analysis:

- This company has beaten earnings by 88% in the past 5 years. Farmland is essential to the world, and Gladstone is the only public farmland REIT besides Farmland Partners. Which means, they have a very strong Moat to their business.

- Earnings have grown 1200% in the past 5 years. I believe The company's earnings will continue to increased and improved. Running a REIT requires very little operating cost as they do not have to do much work besides acquiring and leasing the lands.

- The company has been in an explosive growth mode. The company has been actively acquiring more and more farmlands and they are able to lease 98% of their lands at any given time.

- The CEO is very passionate about the business and has his net worth invested into the company, which shows the company has good management.

- As of currently, the valuation of the company is slightly overvalued. Current price to free cash flow is 65 which is very overvalued. A good price to free cash flow for this company would be below 20. Therefore we will have to wait for the current price to take a dip, and swoop in to buy when the market crash.

- There is one thing I dislike about this company, the constant shareholder dilution. The company has been issuing more and more shares due to the fact they company need to raise money to fund their organic growth. However, I believe in the long run, the growth effect will outweigh the shareholder dilution.

So, I would recommend everyone to add this company into their portfolio. This is truly a company with strong moat, fundamentally good earnings, brilliant management and it will be one of the top company in time to come.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- MurrayBulwer·2021-11-12Agriculture is an important industry. Compared with technology and finance, it has received too little attention. But the company's performance is very bright. I hope it has a better future.点赞举报

- DaisyMoore·2021-11-12The competitive advantage of this company is very obvious. This is one of the biggest reasons why I support it. Gladstone is the only public farmland REIT besides Farmland Partners. good luck!1举报

- PagRobinson·2021-11-12Great analysis. The advantages and disadvantages were introduced in detail. But I don't know much about agriculture. I'm looking forward to your more views on this industry.1举报

- Trevelyan·2021-11-12Thorough analysis in place, thanks for sharing.点赞举报