What is taper and its importance?

On Wednesday, the Fed said taper may come soon if the economy continues to progress, but didn't announce the specific dates.

This should be the biggest news for the financial market. But wait... what is taper and why is it so important?

What is taper?

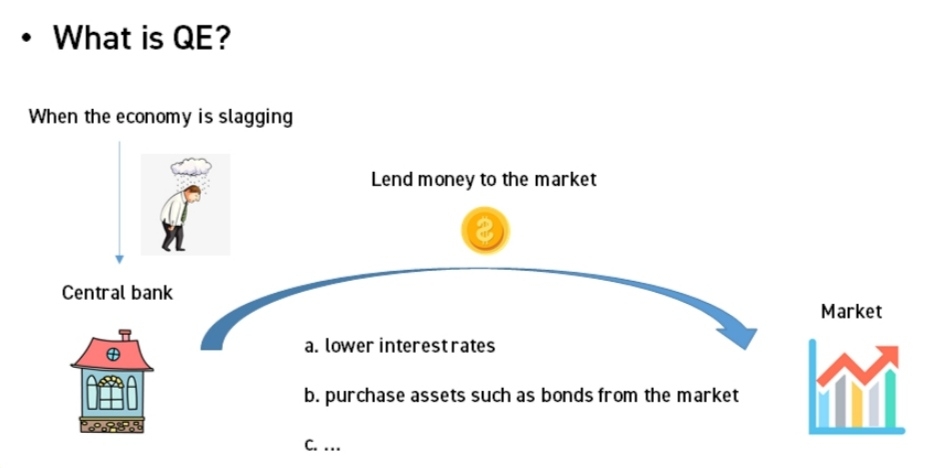

Before talking about taper, we should know what QE is — the opposite of taper.

When the economy is slagging, the central bank tends to lend more money to the market. This aims to increase consumption and investment, which is a good way to take the sluggish market back to normal.

To lend money out, the central bank can lower interest rates or purchase assets such as bonds from the market. These measures are summarized as QE (Quantitative Easing).

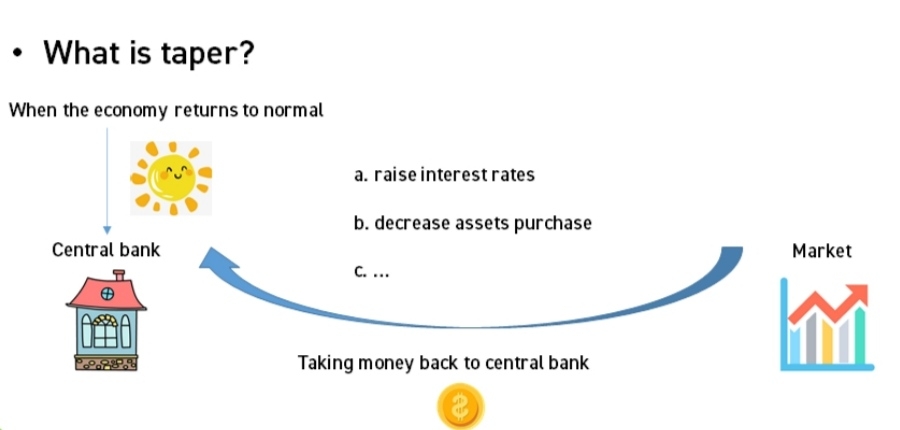

Therefore, the opposite of QE — taper, is taking money back to the central bank, by raising interest rates or decreasing assets purchases.

With rising interest rates, people who are using leverage may choose to sell their stocks because they can't afford the high cost of borrowing. As more people sell, the stock price will fall. As a result, the stock market may react negatively to taper.

How about this time?

On Wednesday, the Fed said the U.S. central bank could begin scaling back asset purchases in November and complete the process by mid-2022. However, after the Fed's announcement, US stocks staged a comeback from their September rout, which is a proof of strong market confidence.

Key Takeaways

1. Tapering is the theoretical reversal of quantitative easing (QE) policies, which are implemented by a central bank and intended to stimulate economic growth.

2. Tapering refers specifically to the initial reduction in the purchasing of and accumulation of central bank assets.

3. As a result of their dependence on sustained monetary stimulus under QE, the financial markets may experience a downturn in response to tapering; this is known as a "taper tantrum."

4. Taper tantrums may lead central banks to promptly re-accelerate asset purchases (and essentially reverse the process of tapering).

5. Central banks, for the most part, have not been able to sustainably unwind their expanded balance sheets.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 1078527f·2021-09-26oh wow thanks, how can we profit from this?1举报

- 灯塔国02·2021-09-26美联储也害怕股市会跌啊,因为他们也炒股呀。2举报

- 低买高卖谁不会·2021-09-26目前的大盘还是一篇歌舞升平,没有什么大的问题,不用慌。2举报

- 福斯特09·2021-09-26缩表其实并不怎么害怕,就害怕伴随而来的加息,那才是股市头上的利剑。1举报

- 老夫追涨杀跌·2021-09-26各国央行本来就不想清理其扩张后的资产负债表,都想着耍流氓的。1举报

- 搞钱树·2021-09-26都在想着提高债务上限了,怎么会控制水龙头?1举报

- 德迈metro·2021-09-26美联储现在就是一个牵线木偶,没有什么主观能动性。1举报

- 豆腐王中王·2021-09-26美国的通胀很快就会爆发,其实已经爆发了,早就应该控制水龙头了。1举报

- 尔维斯肌肤·2021-09-26我一直有个信念,是疫情造就了这轮牛市。1举报

- 刀哥拉丝·2021-09-26很棒的文章,有宏观有微观有数据有分析。1举报

- 迪士尼迪斯尼·2021-09-26缩减可能很快就会到来,不用宣布日起,我们都能猜到。点赞举报

- 波king·2021-09-26现在的通胀又有上升的趋势,只是不知道美联储说的暂时是多久点赞举报

- 纯天然绿色学渣·2021-09-26美联储一直在喊,都快听麻了,这个靴子在不落地,都块成“狼来了”点赞举报

- 46e6f3e7·2021-09-26Good technical term information!1举报