What is PPI? How does it relate to CPI?

Last time we talked about what CPI is, today we'll talk about its perfect partner — PPI.

1. What is PPI? The Producer Price Index (PPI) is used to measure commodity prices, which represents the average price of goods purchased by manufacturers.

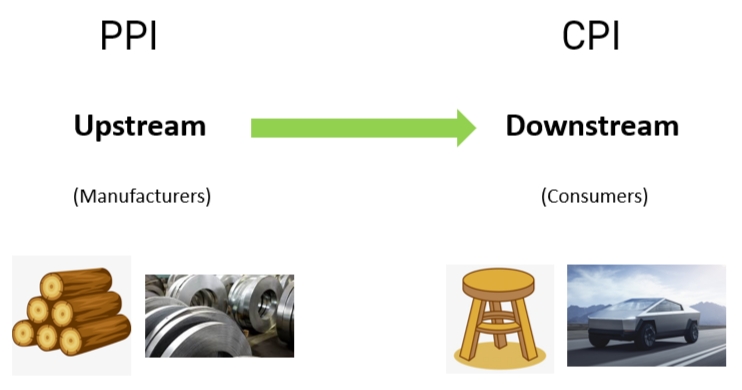

2. Why PPI is CPI's perfect partner? In general, PPI measures the average price of upstream market, and CPI represents average price of downstream markets.

When the upstream price increases, the downstream market will receive increased signs, and the price gap between the two markets can be filled with cost-shifting. For example, if lumber's price increases, the price of wooden stools will increase. Therefore, investors can use PPI to predict CPI. This is why they are perfect partners.

3. What is the PPI for? PPI can measure the inflation rate experienced by manufacturers. If PPI is higher than expected, this means the inflation risk is rising from manufacturers. The Fed may increase the interest rates based on an increasing PPI, which results in bullish on the U.S. dollar.

KEY TAKEAWAYS

1. The Consumer Price Index (CPI) and the Producer Price Index (PPI) are economic indicators that measure inflation in the United States.

2. The CPI evaluates expenditures of domestic and internationally imported consumer-related services for residents of urban or metropolitan areas, including professionals, the self-employed, the poor, the unemployed, and the retired, as well as urban wage earners and clerical workers.

3. The PPI looks instead at the prices that producers pay and measures changes in the sale prices for the entire domestic market of raw goods and services.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。