What happens when the Fed tapers?

Federal Reserve Decision:

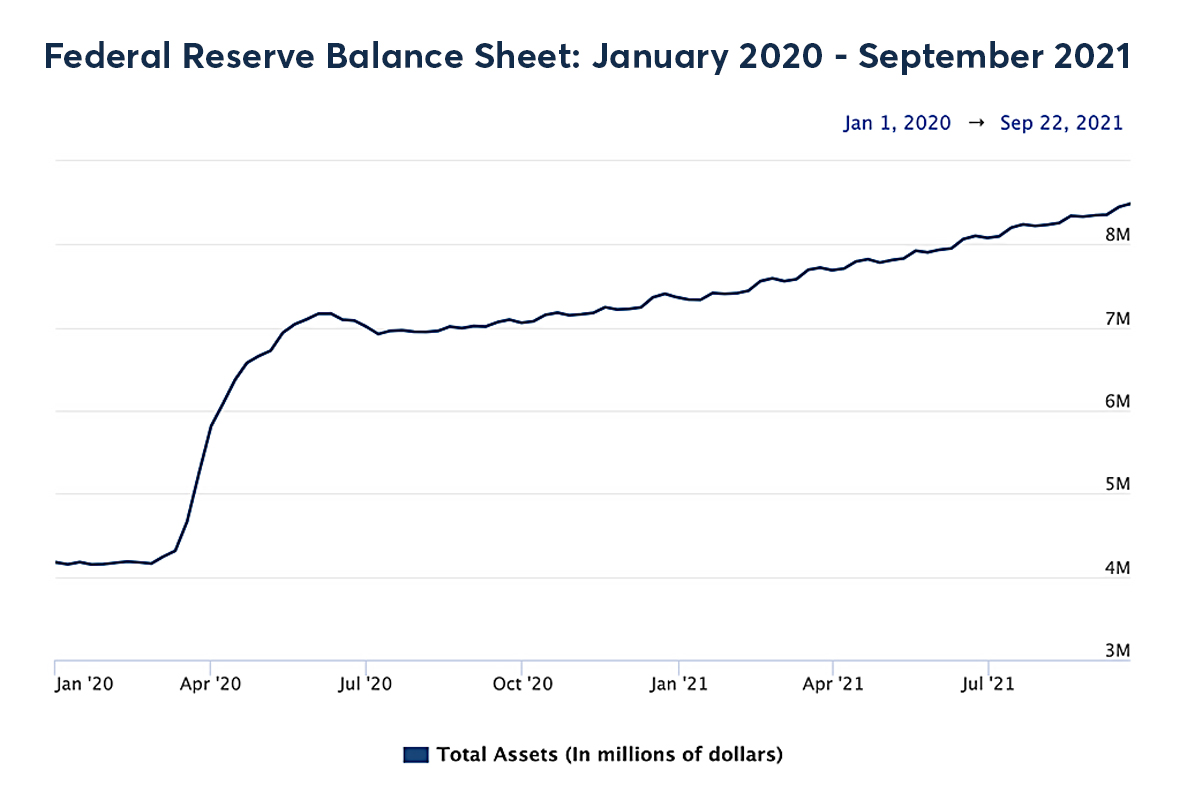

According to Yahoo Finance, the Federal Open Market Committee's (FOMC) November meeting will take place from Tuesday to Wednesday, with the policy statement and press conference from the meeting serving as the central bank's penultimate opportunity this year to announce formal plans to begin rolling back its crisis-era quantitative easing program. For the past year-and-a-half, the central bank has been purchasing $120 billion per month in agency mortgage-backed securities and Treasuries, as one major tool to support the economy during the pandemic.

In late September, the FOMC's latest monetary policy statement and press conference from Federal Reserve Chair Jerome Powell suggested the central bank was apt to announce the start of tapering before year-end, and continue the tapering process until"around the middle of next year."

What Happens When the Fed Tapers?

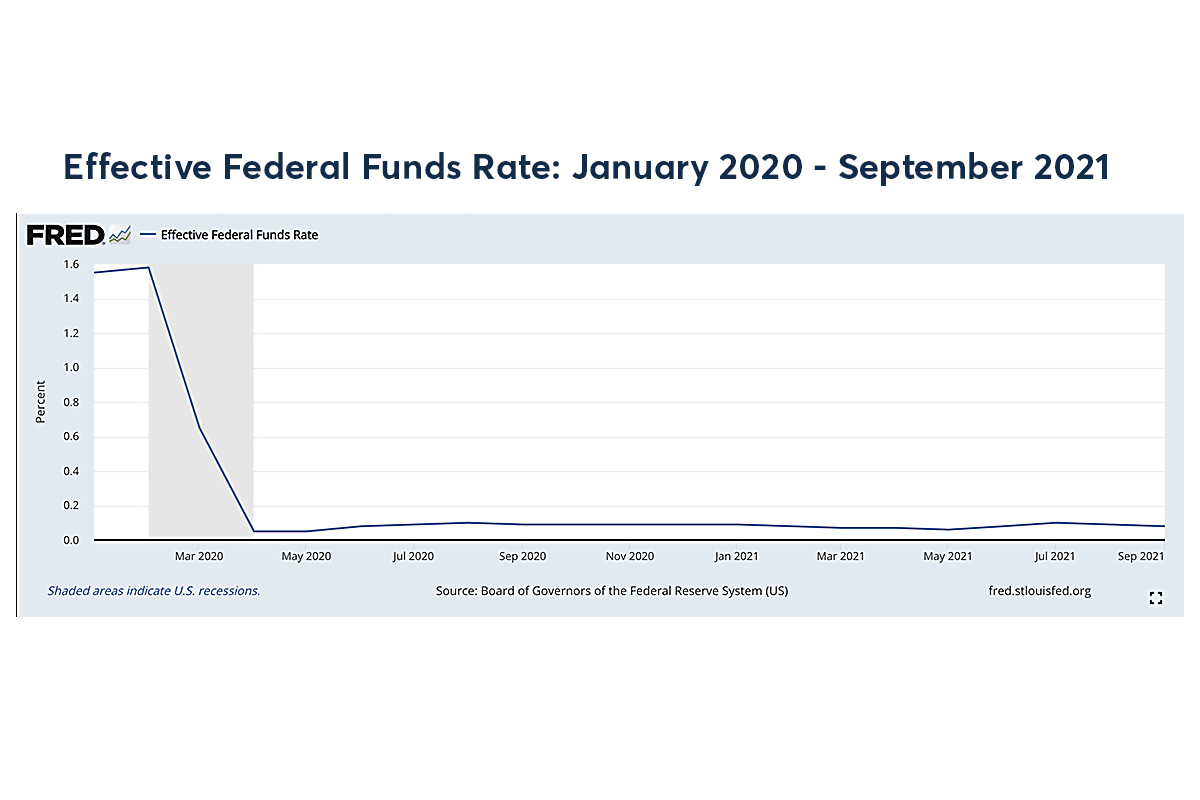

"In response to the coronavirus pandemic, the Federal Reserve slashed interest rates to zero in March 2020to help bolster growth. It also began its $120 billion in monthly asset purchases, a program known as quantitative easing (QE) that has roughly doubled the Fed’s balance sheet to about $8.5 trillion since the start of the pandemic." Scott Bauer says.

Aside from interest rates, tapering could have an impact on the U.S. dollar. The trajectory of the U.S. dollar is important for investors as it impacts everything from commodity prices to corporate earnings. Higher yields make dollar-denominated assets more attractive to income seeking investors. Tapering is typically bullish for the dollar as it means a move toward tighter monetary policy. Since currencies normally appreciate when their domestic short-term rates rise, as the Fed continues to signal imminent tightening, markets are pricing in higher rates. This offers support to the dollar amid an already choppy risk environment that is a positive for the safe haven dollar. As mentioned above, if the Fed will be buying fewer debt assets, there would be fewer dollars in circulation.

你认为美联储缩债利好股市吗?(单选)

你认为美联储缩债利好股市吗?(单选)免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。