Gems in the volatility of Chinese markets

In order to understand how to profit from the volatility in the Chinese market due to Government regulations, we must first understand the reason why US investors shy away from the heavily regulated Chinese market.

The primary reason is fear that in order to protect the government sovereignty of the country, government regulations might hinder the growth and profit of Chinese companies such as DIDI and BABA . Usually in environments where there are less scrutiny and less regulations, companies are able to experiment and grow at a much faster rate. The regulations are never seen in a fantastic light for companies and start ups that are looking for massive growth and profit.

As a result, investors are often spooked when news of tighter regulations imposed on companies that are expanding too fast (Especially when listing on the US stock exchange, due to trade tensions between US and China) breaks out. There have been previous cases that showcased how the government's regulatory stance can significantly impact the stock price of Chinese companies .

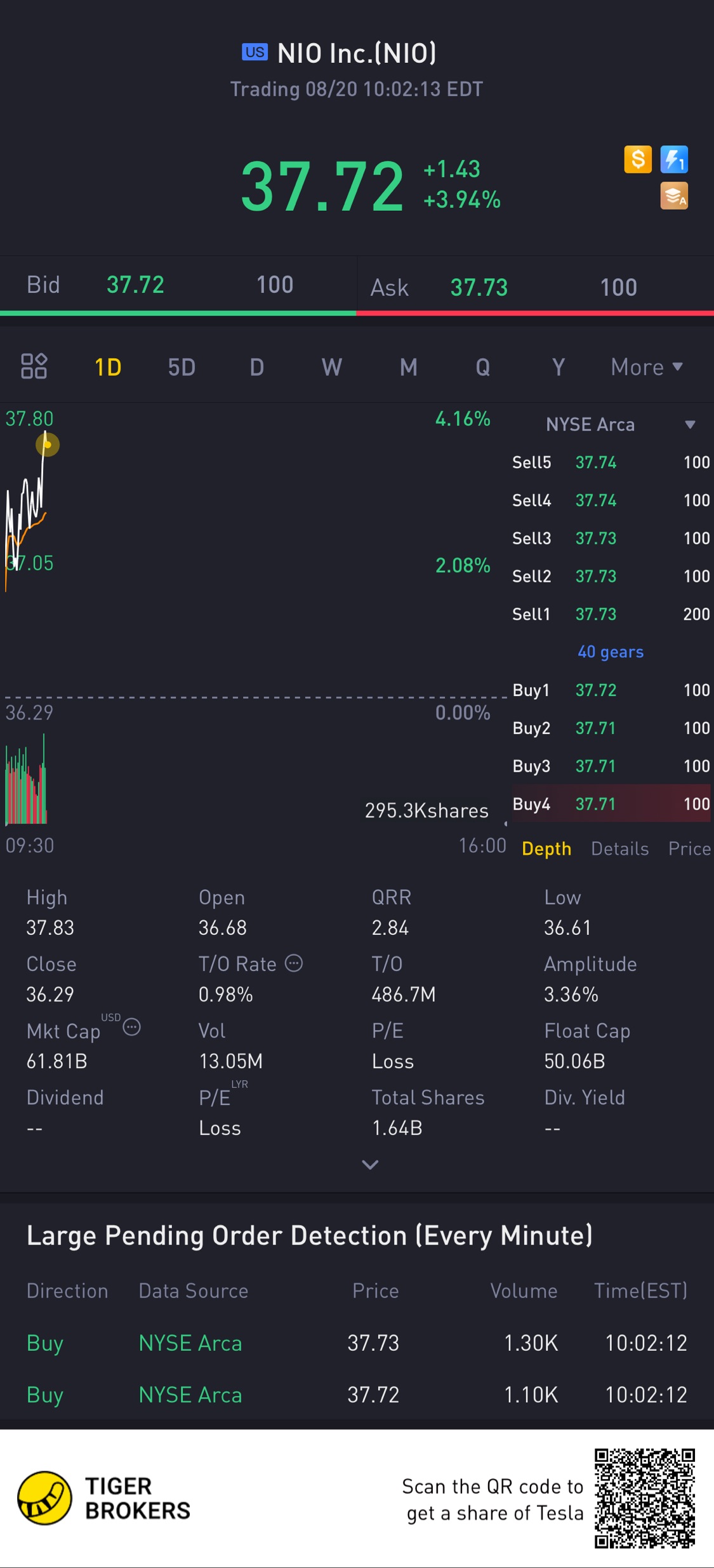

However, let us try to look from the other perspective. Regulations from the Chinese government might not be all that negative. The perspective to consider here, is whether the tight control that the Chinese government have would be able to positively impact a company. I believe that many of us know about NIO which is heavily backed by the Chinese government. Without a doubt they will be regulated as well. However, the involvement of the Chinese government in this case gives us an additional assurance that the company will do well in the long run.

We can be confident that such companies that have intrinsic and great value to the survival and prosperity of China will be favoured by the Chinese government. In this regard, we can be certain that fundamentally-sound and value-adding companies that prioritise China's development can be a gold mine in this atmosphere of fear and volatility caused by tighter regulations.

I believe that even with tight regulations there will be companies that are unfettered and still emerge stronger despite the challenges. This gives us a good indicator of which companies we can really invest in during times like these. 所谓, 疾风知劲草。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 小时候可帅了00·2021-08-21我从来都不觉得监管是一件坏事情,任何变革都需要代价,阵痛的同时也能赋予新的生机。2举报

- 老夫的少女心_·2021-08-21我们很多人都知道NIO,它得到了中国政府的大力支持,它们也会受到监管。然而,中国政府参与此案给了我们一个额外的保证,即该公司将长期表现良好。2举报

- 哎呀呀小伙子·2021-08-21We can be sure that in this atmosphere of fear and turmoil caused by stricter regulation, a well-established and value-added company that gives priority to China's development may be a gold mine.2举报

- 宝宝金水_·2021-08-21即使有严格的监管,也会有不受约束的公司,尽管面临挑战,它们仍然会变得更强大。这给了我们一个很好的指标,在这种时候,我们可以真正投资哪些公司。所谓,疾风知劲草。 1举报

- 揭人不揭短·2021-08-21监管这件事短线来说对中概股确实是巨大的考验,但是这个考验过后,我相信很多企业会迎来新生命。2举报

- 河东荷西·2021-08-21我们要自己思考,任何保证都不是有用的1举报

- 东营天地人和·2021-08-21资本的游戏越来越明显了1举报

- 化他自在·2021-08-21waiting for a result1举报

- 悠远欣然·2021-08-21心平气和2举报