Huya Inc. – Q2 FY2021 Earnings & Live Conference

The last time I wrote about Huya was back in June when I took a position at approximately below $15.

You can view the article here if you are interested.

Since then, the company has plunged due to the fear over regulation on gaming which has also impacted other gaming companies such as Douyu and Tencent.

This article will be focusing mainly on the Q2 earnings which they’ve just announced and the highlights that investors should look upon.

Q2 FY2021 Earnings Takeaway:

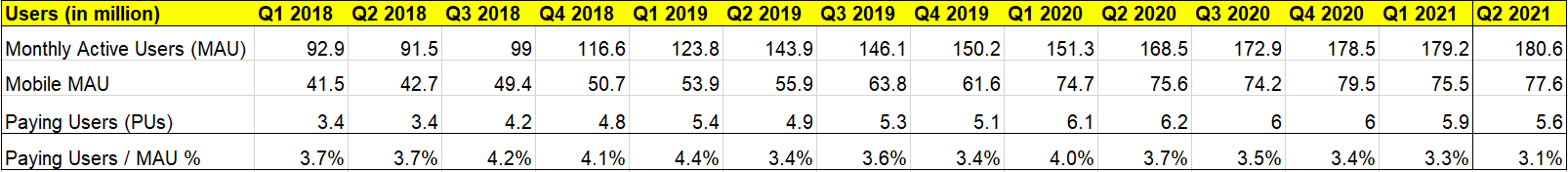

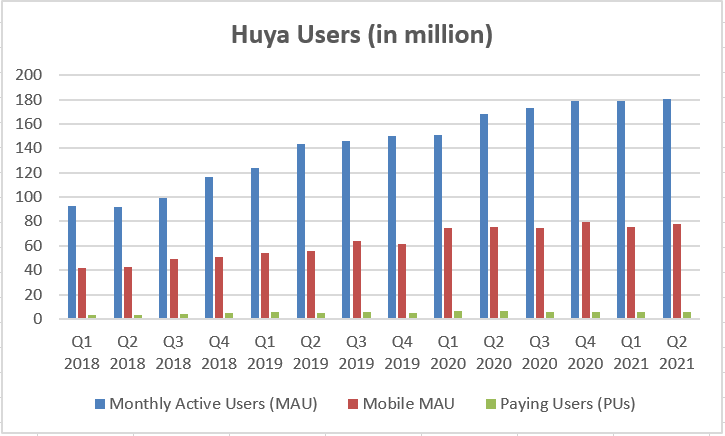

Let’s first update our spreadsheet on the key metrics that everyone is interested about.

Total MAU and Mobile MAU increased slightly from the previous quarter and YoY comparison.

Average mobile MAU is now at 77.6m users while paying users have declined to 5.6m, which is the lowest since Q1 2020. This is not a good sign and in my last article, I highlighted the importance of the company shifting away from the current monetization model to something which is more tangible.

Net revenues for the second quarter increased by 9.8% to Rmb 2,962m (US$459m) YoY and 14% QoQ.

While the proportion of the live streaming revenues still dominate the earnings, the one particular thing to highlight from this earnings is the amount of advertising revenues that have grown significantly this quarter.

In Q1 last quarter, the company registered a 54.6% increase YoY on advertising revenue to Rmb 212.5m (US$32.4m) while this quarter, the company has a strong performance by growing 189.9% YoY in this segment to Rmb 383.2m (US$59.4m).

This now represents 13% of the overall net revenues and likely will be expected to increase over time.

If we look at the model which Twitch and the other big players are now adopting, the majority portion of their revenues come from advertising.

We can expect the monetization model to slowly shift and become dominant over time and this will reflect in the bottomline a few quarters after.

The company is making profits and generates an operating cashflow of Rmb173.6m (US$26.9m) in the quarter, which brings its cash equivalent to Rmb 10,738.2m (US$1,663m).

At today’s market price of around $9.3, this brings the enterprise value of the company to only about less than $600m, which looks extremely cheap across any key metrics that you are measuring.

If we annualized the earnings, this would value the company at a Price to Enterprise value of only 3.7x and a Price to Earnings at 18x.

If we exclude the net cash, then this would be valued at Price to Earnings at roughly 5x.

While it is cheap, the implications of what is happening in most Chinese stocks today bring most companies value to be considered cheap so there is not much relative comparison in terms of value perspective.

Conference Call Takeaway:

The conference does provide a bit more insights than the announced results. Let me try to cover the highlights which I managed to take note.

- Main reason for live paying users which dropped to 5.6m this quarter is due to the higher base last year due to pandemic.

- Further deeper cooperation with Tencent (elaborated more below).

- Deepening quality content for users in terms of technology and platform features.

- Abide by the cooperation of the regulation.

- Segmental breakdown

- Broadcast 122 Esports tournaments in 2nd quarter – 626m viewership.

- Self-developed 14 popular mobile games

- Huya game room – provides game analysis for interested fans

- Overseas MAU – increased this quarter by 20m users – focus on monetization revenue, overseas revenue increased by 200% YoY growth.

Question 1 – Content Strategy 2H spend and key operating metrics in terms of MAU, Paying Users and ARPU for 2H.

Answer 1 – The management made two versions of scenario for this year on the merger – one which is the successful merge and another which is the unsuccessful scenario. Now that the outcome is out, there won’t be major changes to the content strategy from before.

Management is also expecting MAU to continue to grow in 2H and main focus is to grow mobile MAUs which is more of key metrics than overall MAU.

Question 2 – What is business strategy in the future after the post failed merger with Douyu? Also, can management share some insights on further integration with Tencent.

Answer 2 – Focus on overseas investment as the management sees more growth opportunity traction and content user acquisition overseas.

Collaboration with Tencent, continue to strengthen cooperation with Tencent and will update investors from time to time on major updates.

Question 3 – Can management share more insights from overseas user acquisition, content build-up, monetization strategy.

Answer 3 – Seen significant results in overseas as can seen from the 200% year on year revenue growth and operating loss shrinking significantly which will help the overall bottomline over time.

Video content users have been increasing. Average MAU who watched video content increased by 30m in Q2. In the near future, will also launch video content on Huya’s platform based in Q3 onwards – which will be segregated in terms of traditional video and live streaming.

Question 4 – Video content and its potential monetization model advertising?

Answer 4 – Still in the midst of contemplating monetization model between video content to integrate with live streaming. Still in the early stage about monetization but advertising would likely be more appropriate.

Question 5 – How will education regulation due to children holiday period impact the active users? OPEX objective?

Answer 5 – Growth in users due to school holiday but education regulation haven’t seen much impact.

OPEX objective – is to reduce bandwidth costs per user and growing users with lower user acquisition costs per user.

Question 6 – Now merger has failed, does management consider other M&A considering the huge cash balances?

Answer 6 – The huge cash balance is used for broadcast and content user acquisition, and will consider M&A from time to time but have not found a suitable one at the moment.

Conclusion:

The overall key takeaway I get from both the earnings and the conference is that management has put key focus on increasing its mobile active users and overseas investment acquisition strategy.

With the video content up and coming integrating with their live streaming, we should see the advertising revenue segment continues to climb strongly, albeit this at the expense of their live streaming revenue which likely will continue to struggle due to decreasing paying user.

While the company remains cheap on valuation, sentiments on Chinese companies remain poor and there seems to be not much catalyst from the gaming segment which might push its share price closer to what it should be properly valued at.

www.3foreverfinancialfreedom.com

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 中國大白·2021-08-19现在国家大力度整治小视频,教育和娱乐圈,不知道能走多远2举报

- Fabi·2021-08-20中概最近还是别碰比较好3举报

- 咪咕蜡·2021-08-17游戏有虎牙,体育有虎扑哈哈哈哈还挺像的2举报

- 山头的小猪·2021-08-17虎牙不就游戏发家的嘛,他收到的冲击肯定大1举报

- 霎风雨·2021-08-17虎牙在回升了,应该已经过了调整期1举报

- 王无所不知·2021-08-17虎牙除了游戏跟直播,基本上没有其他业务了吧?点赞举报

- 老师我·2021-08-27游戏人生啊点赞举报

- 潇湘yeyu·2021-08-27好2举报

- 我一大地飞歌·2021-08-27阅1举报

- 骑士20200504·2021-08-27虎牙2举报

- Lydia758·2021-08-27阅2举报

- 马dr高勝利·2021-08-27又秀了1举报

- fsfvghxxbgn·2021-08-27噗楼日1举报

- 黄本聪·2021-08-27好点赞举报

- 从股到金·2021-08-27👍🌹2举报

- 从股到金·2021-08-27👍🌹1举报

- 不亏先生·2021-08-27...点赞举报

- 30b92ab4·2021-08-27阅点赞举报

- 富甲1方·2021-08-20漂亮2举报

- 吴琼琼·2021-08-19很不错2举报