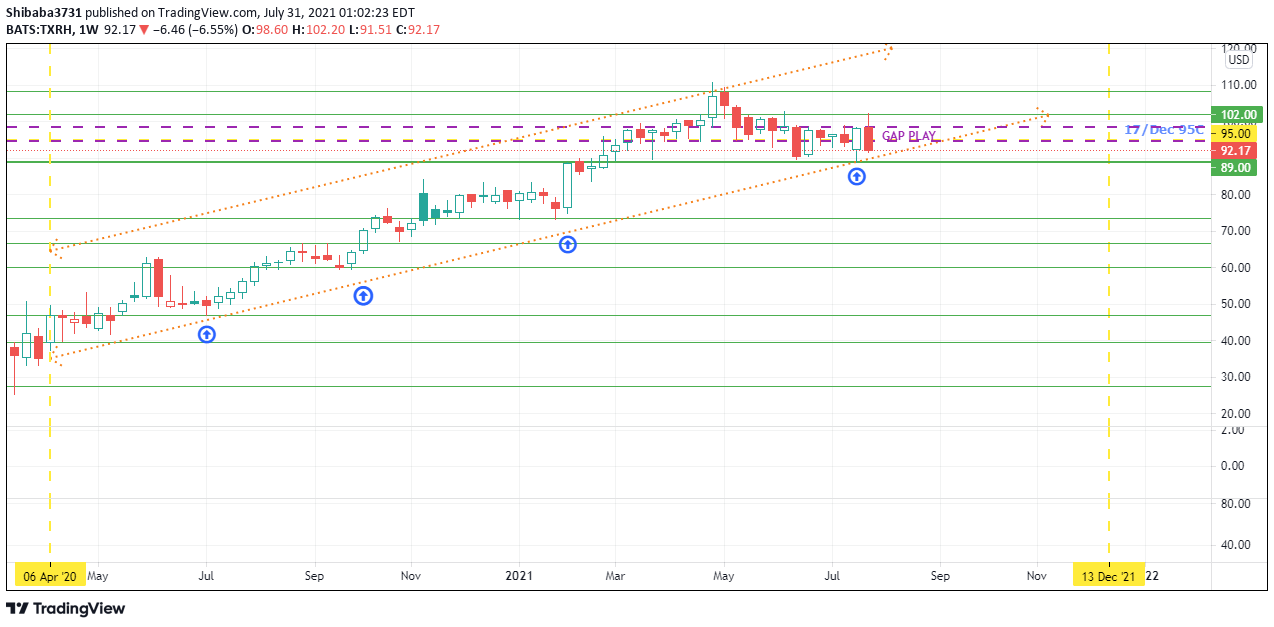

$Texas Roadhouse(TXRH)$ Gap play for $TXRH.

Since Apr 2020, $TXRH has been on a long term uptrend as you can see on the weekly chart. However on 30/July, it dropped 7% as they forecast earnings could be affected due to inflation which will increase food cost. This has created a "bear gap" which I suspect could be market movers trying to short the market and kill all the stop losses first before they buy up the market again.

Next week, watch out for the $89 level which has been a support line for this uptrend. If it is broken, it could be the start of a down trend for $TXRH. If it held this support line, then 17/Dec $95C will be an attractive risk/reward play. Good luck!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。