General Motors (GM)

The next automotive stock on our list needs no introduction. GM is one of the major legacy automakers, and one of Detroit’s most storied names. The company is the largest of the Big Three automakers, and its product portfolio includes some famous nameplates: Buick, Cadillac, and GMC, to give just a few.

The company has seen its stock gain by an impressive 37% year-to-date even as revenues have slipped over the course of the year. For Q3, the top line came in at $26.7 billion, down from $34.1 billion reported in Q2, and down 24% from the year-ago quarter. Earnings have also slipped; the $1.52 reported was the lowest since the pandemic-induced loss of 50 cents per share in 2Q20.

While revenues and earnings showed declines, GM’s market share showed a more complicated picture. The company’s sales data show it commands a 13.3% market share in the US automotive sector, compared to just 6.9% in the year-ago quarter. But – market share in Q2 was higher, at 15.6%. The volatility here was driven by a decline in auto sales; GM reported moving 446,997 vehicles of all types in Q3, down 33% yoy.

Company management pointed to supply chain disruptions and semiconductor shortages – factors affecting the industry as a whole – as root causes of the rough quarterly sales and results. They are not, however, sitting on their duffs.

GM is actively preparing for the auto industry’s shift to EVs. The company already produces the Chevy Bolt, an all-electric compact car, and its BrightDrop division is in production of all-electric light commercial vehicles for both the first- and last-mile delivery niches. BrightDrop this month delivered its first 5 EV600 delivery vans to FedEx (FDX). These vehicles are the first of a 500-truck order by FedEx.

Also on the EV front, GM announced on December 7 a major investment at its Bedford, Indiana aluminum casting facility. The investment, of $51 million, is for modernization and upgrades that will allow the plant to produce drive unit castings for the upcoming all-electric version of the popular Silverado pickup truck.

These last few items bring us to an important point that Joseph Spak makes – that ‘automaking starts with product.’ Spak goes on to delineate GM’s upcoming EV product line. He writes, “GM has an onslaught of BEVs coming to market including the Hummer, Lyriq, e-Silverado/Sierra and several high-volume entries like e-Equinox/Blazer equivalents priced at $30k (and hinted at something priced even lower) as part of 30 EV models by 2025 (1mm units). Showing new Ultium (GM’s battery and motor tech platform) product with competitive pricing and better specs is key, in our view.”

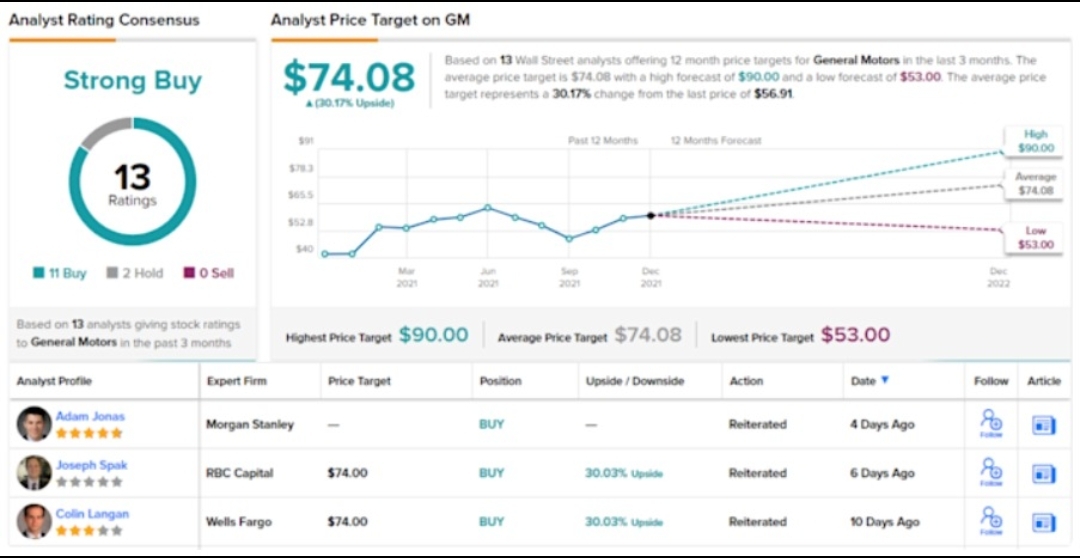

Spak rates GM shares as another Outperform (Buy), and he sets a $74 price target on this legacy stock, suggesting a 12-month upside of 30%.

Does the Street agree? It would seem so, as GM’s 13 recent analyst reviews break down 11 to 2 in favor of Buy over Hold, for a Strong Buy consensus rating. The shares are selling for $56.91 and their average target of $74.08 is practically identical to Spak’s objective.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

The traditional automotive manufacturer will fight for a share of the EV sector as seems their life depends on it. Don't count them out yet.