Inst Buy & Sell, Week of Jan 3

[Weekly]

The objective of the post is to observe market transactions of BBs, aka Institutional Investors, and RIs, i.e. Retail Investors.

Inst Buy & Sell

Week of Jan 3, 2022

My observations-

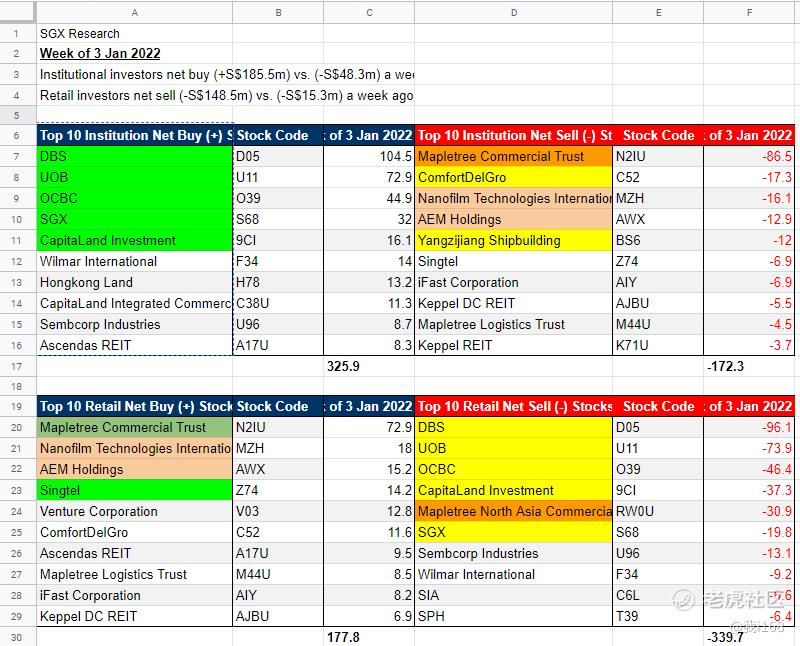

a). Institutional Investors, aka BBs, were on shopping spree on the key components of STI, DBS, UOB, OCBC, SGX, CLI, Wilmar, HKL, CICT and so on

b). On the other hand, Retail Investors, RIs, were the selling counterparties….Just wonder why? Maybe RIs had been working hard accumulating over the holiday weeks and were taking some profit off the table. Yes?

c). For the local tech stocks, Nanofilm, AEM & iFast, BBs seemed to follow US tech market script and sold these counters, while RIs bought over the same on accumulation.

d). For the big talk in town, the MCT merger with MNACT, RIs looked like taking profit from MNACT and switching to MCT to continue to have the exposure to the merged and enlarged portfolio MPACT.

e). For the BBs, nothing shown on their position movement of MNACT. Was MNACT never a part of BBs’ holdings or they are still holding it for the final settlement? Nevertheless, BBs sold BIG on MCT. Obviously they did not like the deal as announced.

All in all, at the end, STI rallied by 2.61% during the first week of 2022!

Roaring rally into the new year! Also a big Angbao for the CNY around the corner (Feb 1), the Year of Tiger.

Read on...

https://myinvestingnote.wordpress.com/2022/01/10/sgx-inst-buy-sell-week-of-jan-3-2022/

$星展集团控股(D05.SI)$ $大华银行(U11.SI)$ $华侨银行(O39.SI)$ $CapitaLandInves(9CI.SI)$ $凯德商用新加坡信托(C38U.SI)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。