Stocks likely have further to sell-off but when should you look to buy-the-dip?🚨

Despite the S&P 500 being down 23% YTD - stocks are far from cheap according to one indicator (never just use one indicator).

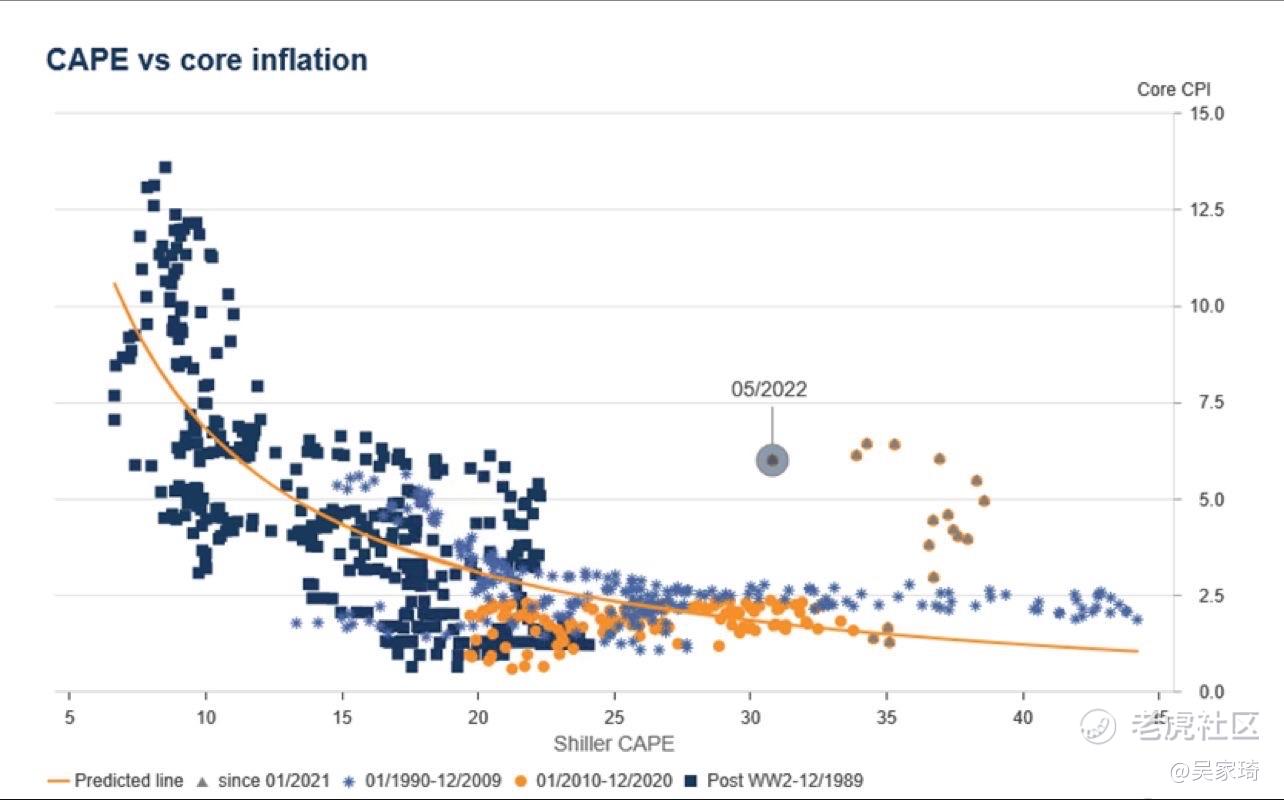

The Shiller CAPE Ratio which measures the P/E, has declined by ~20% in the last 6 months falling from: 39x at the 2021 peak —> 29x today.

However, if you look historically, this is far from cheap.

The dot-com bubble peak for example, stocks traded at a 44x, eventually falling to 21x in 2003 after the crash. Again not massively cheap. At current levels, we should be trading at roughly 10x if you look at the chart below. This would mean a drawdown of 50% if core inflation stubbornly stayed at this level of 5.4% - not my view.

On the flip side if you *didn’t* invest from 2018 - 2022 because stocks were too expensive, you would have missed out on a whole load of gains. Another reason why you should not look at one indicator.

Analyst estimates for 2022 S&P earnings are still around 10%. I believe, with pretty high conviction, these will be revised down in the coming weeks. This would put further pressure on the current multiples.

So when should you buy stocks or add risk? 🟢

It’s all about inflation and the Fed.

The Fed made it very clear on Wednesday that it’s now about MoM inflation figures, if we see a deceleration in these prints then this is a positive for risk assets.

The other, (slightly strange) scenario where it might be appropriate to add risk is if a recession/slowdown is severe enough to force them to reduce the velocity of tightening or pause. Rate CUT expectations could also then be brought forward from the expected Q4 2023 and this would be bullish for equities.

You could be in the odd scenario where, inflation is still +5-7% and stocks are rallying - weird but like I said it’s all about inflation deccelerating.

Stocks likely have further to fall but these are the signals I will be watching for.

In the meantime, if you didn’t know already, valuations and cash flows definitely matter so stick to high quality businesses.

Strap in.

Drop a comment if you enjoyed this longer-form post and you can hit the bell 🔔 icon on my profile if you want to be notified of any analysis I put out 🫡

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

转发