Fed dovishness is a left tail event for markets

A dovish pivot for the Fed is not the base case, but recent market repricing indicates some investors are beginning to consider possible rate cuts early next year. This is a curious development given the Fed’s well-signalled resolve to fight inflation. But even if it did occur, it may not give markets the boost many investors assume. In fact, it could do the exact opposite.

The reason why any Fed dovishness may be bad for markets is that if the central bank oscillates between tackling inflation and supporting the economy, the policy uncertainty may lead to greater volatility in markets that have become highly dependent on reliable forward guidance. Moreover, any complacency towards inflation may simply boost expectations of price increases amongst the general public– and expectations are genie-out-of-the-bottle stuff.

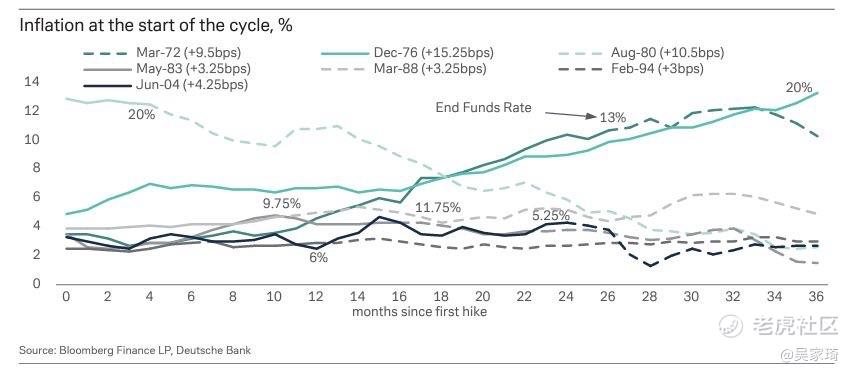

Most investors still underestimate how much interest rates may have to rise. Indeed, only half of the previous tightening cycles that have started with inflation meaningfully above two per cent saw a substantial reduction in inflation within three years. Crucially, all required a peak rate above the below 3.5 per cent currently priced in for next March. So broader and stickier inflation may warrant a Fed Funds Rate of above four or five per cent to crush it. This would certainly push the US closer to recession and be negative for both equities and bonds.

Some investors believe this recession risk will motivate the Fed into a dovish pivot this year. Yet, if the Fed did turn early, it would compound inflation woes and more tightening would be required to tame prices. This would only increase the magnitude of the subsequent slowdown and lead to higher uncertainty premiums across asset classes.

Be it a pivot or a pause, anything but continued anti-inflation action from the Fed could lead to a selloff in both equities and bonds. For the former, despite this year’s slide, corporate earnings estimates have not meaningfully receded and yet growth risks abound. Spreads may have room to go higher.

One of these has to break – either earnings must fall or growth (and thus inflation) must stay high amidst a Fed pivot. Both scenarios could hurt stocks. For credit markets, greater uncertainty could boost interest and credit risk. Similar risks may extend to alternative asset classes. That leaves few, if any, places for investors to hide. Even commodities may further retreat from their multi-year highs if recession hits early.

Hence, markets are fragile to not only a more hawkish Fed but also to a more dovish one. Instead of holding a Fed put, investors seem to have sold the central bank a straddle. This makes markets vulnerable to any outcome other than a soft landing, something that is devilishly difficult to pull off.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 思冬·2022-07-09阅点赞举报

- 且打且珍惜·2022-07-08好点赞举报

- 新哥365·2022-07-11好点赞举报

- Shirley磊·2022-07-09强点赞举报

- 绿茶西湖龙井·2022-07-09好1举报

- 恒稳升·2022-07-09[微笑]点赞举报

- s1·2022-07-08👌点赞举报

- 棒棒的杨杨·2022-07-08阅点赞举报