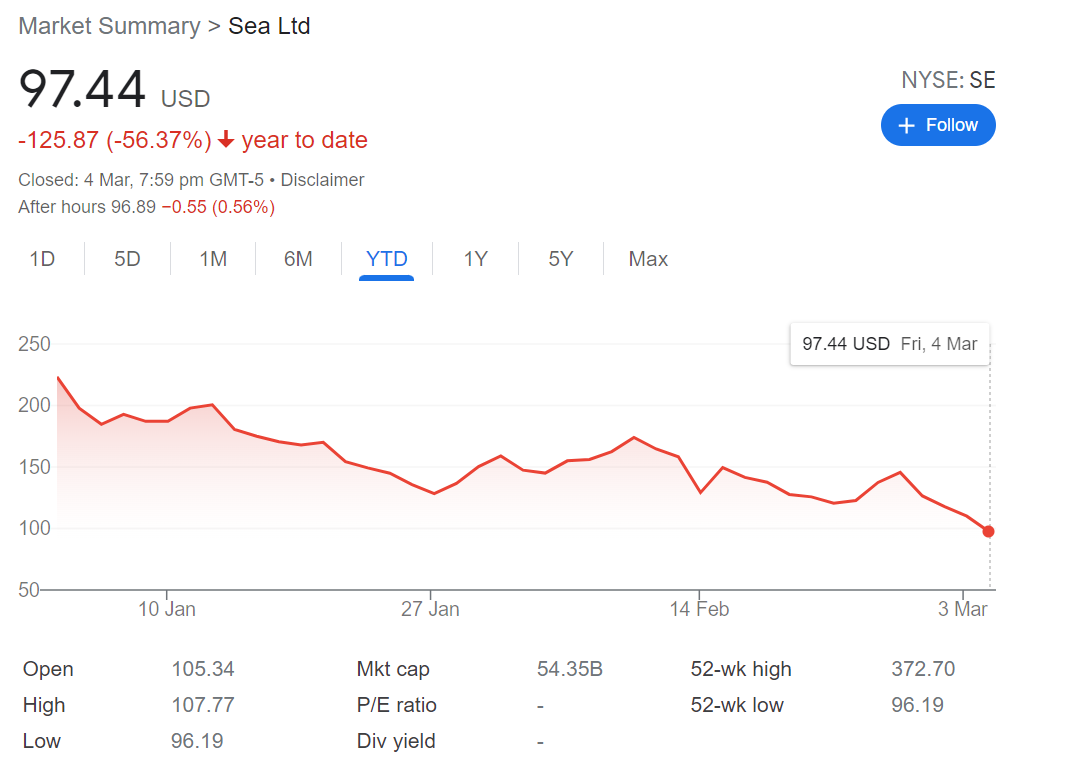

Sea Ltd: Why I Think There’s Good Margin of Safety at $100

On Feb 7 this year – right about 3 weeks before the announcement of their Q4 results – I posted an article about shorting $Sea Ltd(SE)$ at the range of about $160ish, which is at their top end of the resistance line.

Since then, the company has gone sideways in terms of the share price until the recent announcement of the Q4 results which sends the company plunging down to below $100 at yesterday’s closing.

It has since lost about 74% of its market cap since it last hit a peak of $372 on 19th Oct 2021 and it has lost about 40% since the announcement of the results just this week alone.

Macro & Micro Headwinds Create a Perfect Storm

There were signs during Q3 that Garena was slowing down in terms of sequential growth quarter to quarter. So investors shouldn’t expect a miracle otherwise that Garena was going to reverse that in Q4.

Garena’s Free Fire – which has been a cash cow for the company for a long time to fund its e-commerce and fintech business, also guided for a slower revenue in 2022 YoY, so that comes with a huge punishment for investors that value SEA Ltd as a growth company.

Management guided Garena bookings to decline to ~$3B mark in FY22, which is a reduction from $4.6B in FY21. This is attributed to the normalization of bookings post-Covid (which usually will come at some point for most companies) and also a banning issue from the recent India regulators on Free Fire.

Speaking of the India commissioner regulators, the commissioner has closed recent case filed for Shopee India against anti-competition due to it’s low pricing power that puts smaller enterprise out of business. You can find the full details here.

At least we now know the worst from the Free Fire and Shopee India has been priced in.

Other Macro Factors leading to inflation, rising rates and conflict war between Ukraine-Russia didn’t help the cause either for the stock market (at least in the short term).

When you have all these added up, it makes a perfect storm warrant for market decline.

Why I Think Sea Ltd at $100 Makes A Good Case

As investors, the hardest part about finding a decent entry price and being vested when market is bearish is to actually take action and get in.

The market will always price in the fact that it will continue to go up even when it feels so expensive, and it will push price down lower when it feels like it is already cheap.

Ultimately, it is about balance between the two and which prevails giving longer term returns for you.

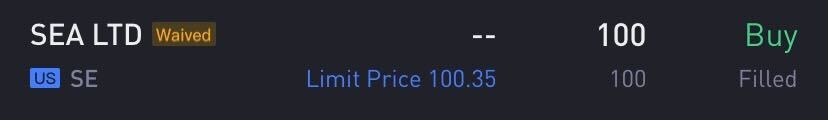

In my Facebook page last night, I have announced that Sea may have a psychological support at $100 and why I have decided to turn my shorts to long at $100. Clearly, this support doesn’t hold and I am now slightly underwater but I’ll explain why I think it’s still a good deal.

We can take a few approach of how we want to look at this several ways.

Comparison Metrics:

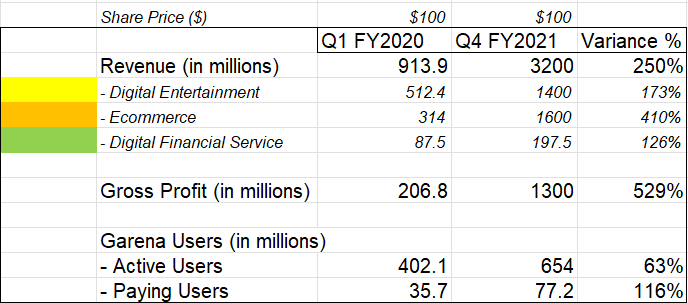

The first is a comparison across the unit metrics back when Sea was also trading at this same range ~ $100 – which was back in May 2020 right when Covid was still heavily rampant throughout.

Back then when they reported their Q1 FY2020 results, the company still look relatively small base and they were about to reach their first $1b revenue.

Garena was only reporting at $512m, Shopee at $314m and Sea Money at $87m.

Fast forward a couple of quarters later (7 quarters to be exact), Sea is today reporting $3.2b in total revenue will all metrics up triple digit in the right direction.

I guess what I am trying to say here is that the market may have been overly focused on Garena’s slowdown guidance and if you like the valuation at $100 back then, you should like it even more today with metrics significantly better and stronger.

Sum-of-the Parts:

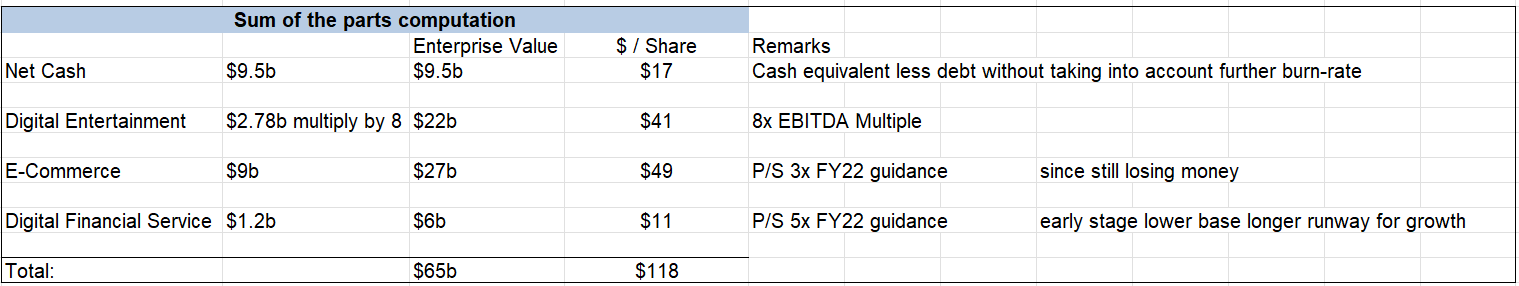

The other methods we can use is to break it down into sum of their different parts.

The easiest to chop from the parts is their net cash and cash equivalent less debts, which is today standing in at ~ $9.5b. At the current share price, this represents about $17 of their entire market cap today of $55b.

We can argue that the company is still burning cash at the moment and the burn-rate over the next few quarters might deplete this amount further. I’ll leave that to how conservative you want to come up with the scenario.

Garena’s is profit making – and in Q4 they booked in a total of $602.6m of EBITDA bottomline. For full year, the division is making $2.78b of EBITDA profits. If we assign a reasonable amount of enterprise value for this division at 8x multiple, we would get ~ $23b thereabout.

E-commerce Sea platform is still burning at a rate of $2.55b for FY2021 but have guided for positive adjusted EBITDA in South East Asia and Taiwan by 2022 and a positive overall EBITDA for the division by 2025 so at this moment, we can only depend on the Price to Sales revenue guidance to make our case.

E-commerce revenue guidance forward for FY22 is at ~$9b, so if we assign a conservatively 3x P/S (which I think is rather low), it will give us $27b. Once Shopee gets to positive EBITDA, we will look again at the margin and how much multiple they can fetch from their bottomline.

Digital Finance Service – Sea Money is still in the early stage so there will be room for growth in this segment for years to come. Prescribing a higher Price to Sales multiple (but still conservative) at 5x for this segment on FY22 guidance, we get a $6b worth of enterprise value or $11/share.

Totalling everything, we get a runway of about $118 worth of intrinsic value of what you are paying today for what I consider to be a conservative multiple. Given management’s execution and capital allocating ability in the past, this should relatively be a walk in the park, even if they are late going into profitability a quarter or two for the other two segments.

Baba to me feels like the cheaper play of the two if you want exposure in this sector but with the market punishing these companies so hard already, I think this makes a good long term play too for those who are willing to ride the storm.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- jolynnnnnnnn·2022-03-06good evening2举报

- 一池咸鱼·2022-03-05美股在这方面做的很好,一股就可以直接买入。1举报

- 存钱游乐场·2022-03-05100美元不算很多,但可以试一试股市的水。2举报

- 孙立冉·2022-03-05港股的门槛比美股要高一些,普及度远远没有美股大。1举报

- Soksok·2022-03-10like点赞举报

- 威威就好·2022-03-06

![[财迷]](https://c1.itigergrowtha.com/community/assets/media/emoji_003_caimi.53908f82.png) 1举报

1举报 - MN27·2022-03-06👍2举报

- JemLIm·2022-03-06cool2举报

- STORMER·2022-03-05[lovely]2举报

- psk·2022-03-05Thanks2举报