Treasury Yields Jump, Stocks Sink, But the Key Factor Affects the Market is…

In recent years, Tech-stocks have become the key sector to drive the rise of U.S. stocks, but since 2022, due to the strong market expectations for the Fed to raise interest rates, the Benchmark U.S. Treasury yields jumped which has slammed the tech-stocks.

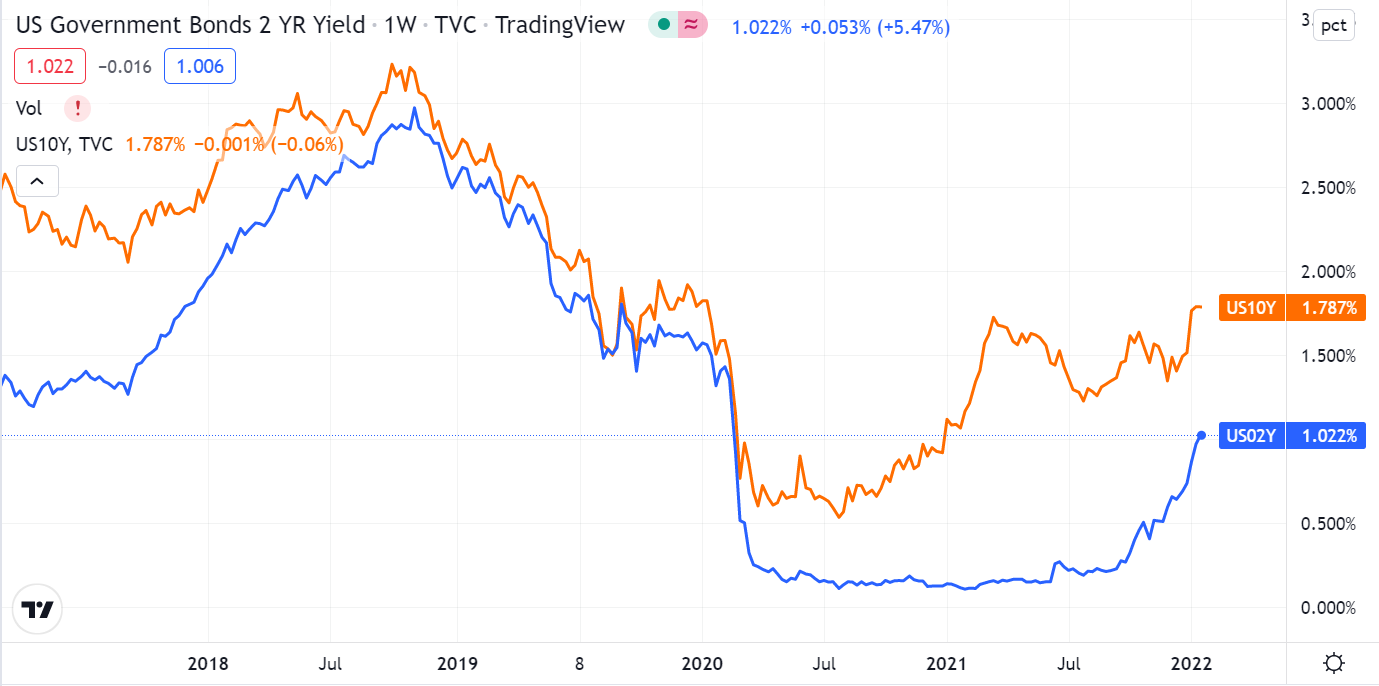

See the chart below,

U.S. bond yields rose rapidly, and U.S. stocks weakened collectively.However, under the expectation of strong interest rate hikes, the decline in US stocks may belong to a panic-style decline, which is normal market performance. In the future, U.S. bond yields are likely to rise.

In the future, U.S. bond yields are likely to rise.

According to Bernanke's framework, the main factors affecting the yield of ten-year US Treasury bonds are divided into three categories: the real natural interest rate, inflation expectations, and term premiums.

The main factor that drove the recent rapid rise in the U.S. Bond yields is inflation expectations.When inflation expectations rise, the Fed raises interest rates and the corresponding rate rises, and the yield requirements for U.S. bonds in the market will also increase.

But is the yields volatility of U.S. Bonds the most important reason for the decline in U.S. stocks?

The answer is NO.

But one period that needs to be pointed out is the end of 2000 to the beginning of 2021, due to the positive economic data and the large-scale economic stimulus plans in the United States, even if inflation concerns exist, the market believed that the pandemic was under control, and the economy was expected to rebound. Then, no major correction happened in the stock market.

History shows that the large impact of QE on bond yields usually occurs when the policy is announced, not when it is implemented. Therefore, once the market fully takes the rate hike expectations into account, the stock index may stabilize and rebound.

Overall, from a fundamental point of view, the economic recovery and strengthening fundamental background are the core factors to support the continued rise of U.S. stocks.

In the context of rate hikes and inflation, how do other sector stocks perform? Please review

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- ElsieDewey·2022-01-21精彩The change of stock price and bond yield is due to the problem of capital flow. Finally, the relationship between supply and demand in the market.9举报

- DaisyMoore·2022-01-21I don't quite agree that the impact of the policy on the stock price is when the policy is issued, not when the policy is implemented. Because the impact of the policy is continuous, it will gradually affect the stock price over a period of time.5举报

- PagRobinson·2022-01-21I quite agree with you. I have also been studying monetary policy and bond yields recently. Your analysis is in place and logical.4举报

- NinaEmmie·2022-01-21The ultimate reason for the change of stock price and bond yield is the change of fiscal policy and monetary policy.2举报

- plaispool·2022-01-23恐慌情绪蔓延1举报

- 小虎妮子·2022-01-25好2举报

- protac·2022-01-25什么时候是底3举报

- 路者·2022-01-22历害2举报

- 大大姐·2022-01-25这篇文章不错,转发给大家看1举报

- 实话·2022-01-25好,很好,非常好!1举报

- 云仙·2022-01-25这篇文章不错,转发给大家看1举报

- Dennisguan·2022-01-25才刚刚开始还是已经结束1举报

- 笑对牛市·2022-01-22股票昨夜一片红,太突然1举报

- 刘雪英·2023-03-04阅点赞举报

- 刘雪英·2023-03-04👍点赞举报

- 阿星学长·2022-01-25哈哈1举报

- 天一03·2022-01-25好1举报

- 小猪猪自由之路·2022-01-25学习2举报

- 南宁樱花·2022-01-25👌🧚🏻♀️2举报

- lengyue26·2022-01-25阅3举报