Singapore REITs Mar-2023

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 748.41 to 734.05 (1.91%) compared to last month’s update. After failing to break above the previous support turn resistance zone of 790-800 on February 3rd 2023, the S-REIT Index is currently retracing back and trading between the 730-744 zone for the past few weeks.

Short-term direction: Sideways (trading between 730-744 zone)

Medium-term direction: Sideways (50D SMA is sideways)

Long-term direction Down (200D SMA is sloping down)

Immediate Support at 730, followed by 714.

Immediate Resistance at 744, followed by 790-800 zone.

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on February 11th, 2023.

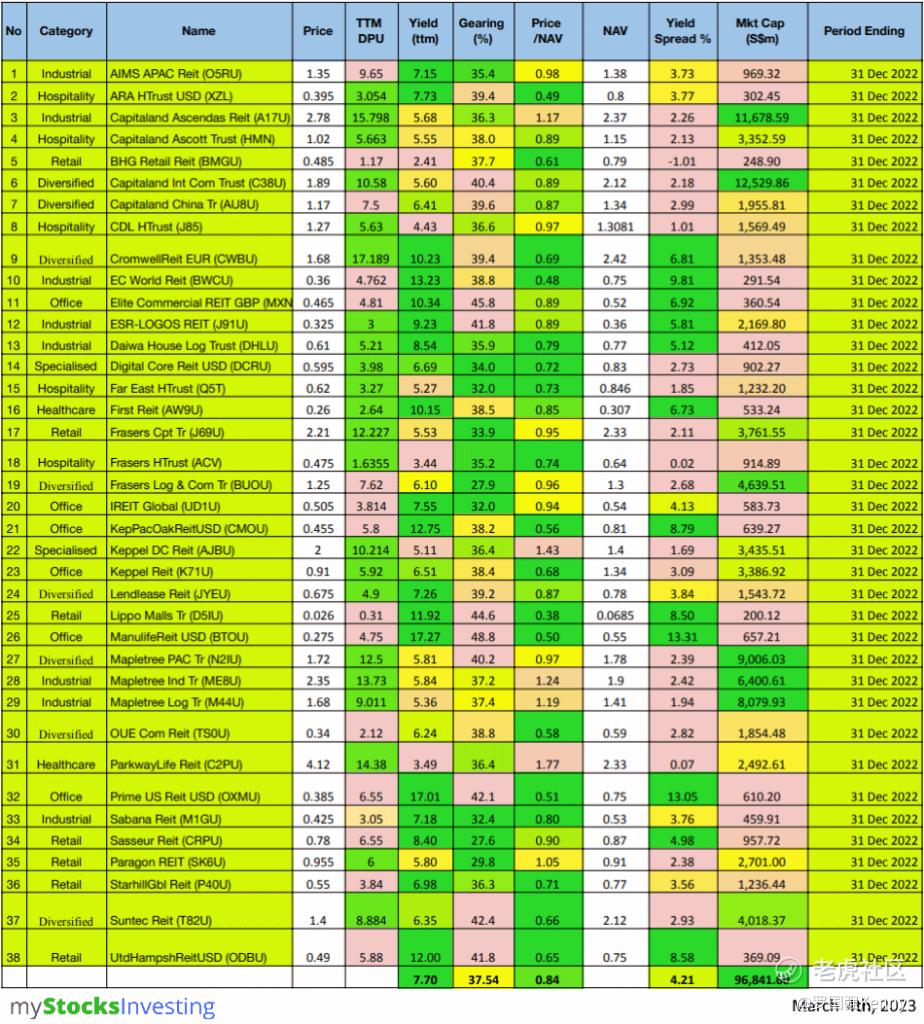

Fundamental Analysis of 38 Singapore REITs

The following is the compilation of 38 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

The Financial Ratios are based on past data and these are lagging indicators.

This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower for more affected REITs.

All REITs are now highlighted in yellow-green. All are now updated with the latest Q4 2022 business updates/earnings.

SPH Reit has been renamed to Paragon REIT since January 3rd, 2023.

Data from StocksCafe REIT Screener. https://stocks.cafe/kenny/advanced

What does each Column mean?

FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of March 3rd 2023.

Notes:

Mapletree Pan Asia Commercial Trust: Annualised yield. MPACT has recently reverted to quarterly distribution. Paragon REIT: Annualised yield. Calculated after converting from 13 months of distribution to 12 months.

Gearing (%): Leverage Ratio.

Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs trading in USD is referenced to US Gov Bond Yield, everything else is referenced to SG Gov Bond Yield.

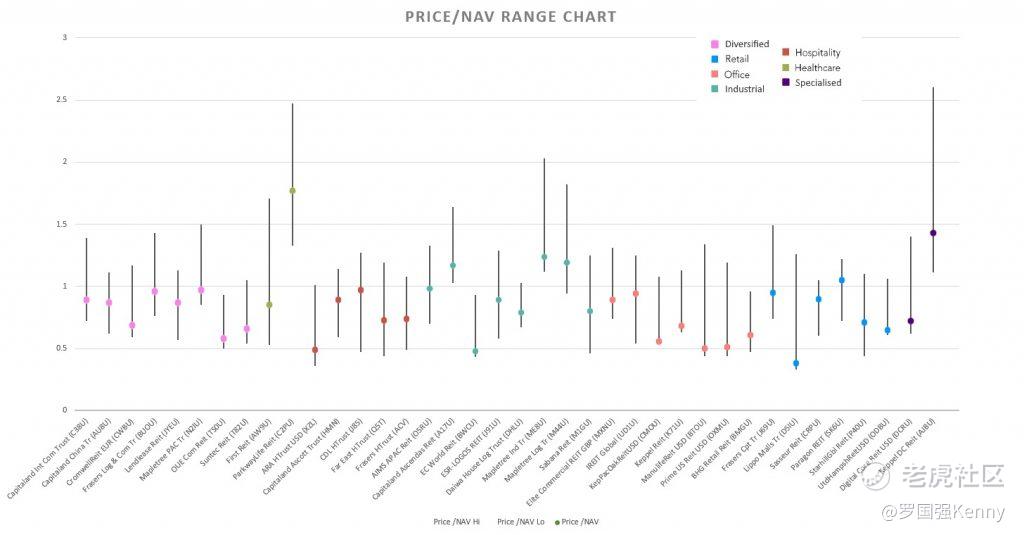

Price/NAV Ratios Overview

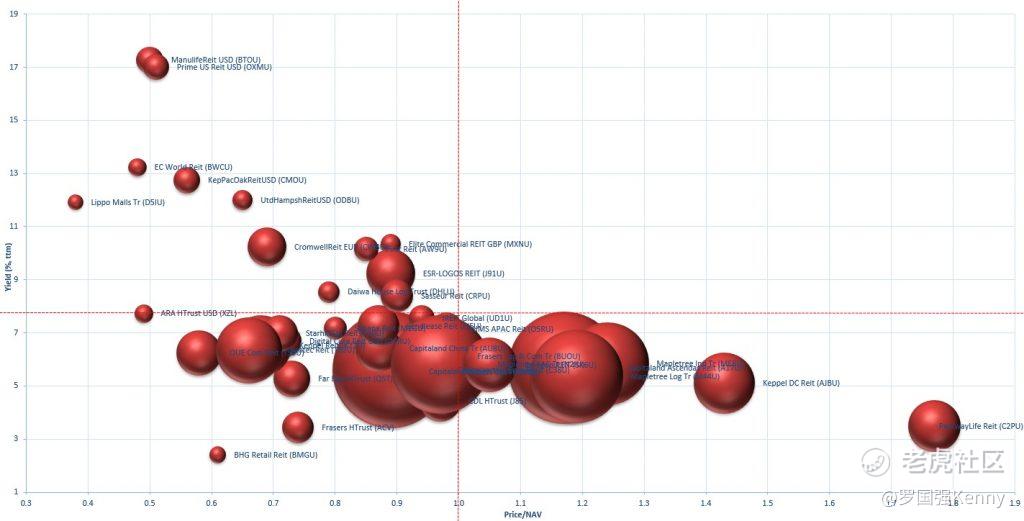

Price/NAV decreased to 0.84. Decreased from 0.85 in February 2023.Singapore Overall REIT sector is undervalued now. Take note that NAV is adjusted upwards for some REITs due to pandemic recovery.

Most overvalued REITs (based on Price/NAV)

Parkway Life REIT (Price/NAV = 1.77)

Keppel DC REIT (Price/NAV = 1.43)

Mapletree Industrial Trust (Price/NAV = 1.24)

Mapletree Logistics Trust (Price/NAV = 1.19)

Capitaland Ascendas REIT (Price/NAV = 1.17)

Paragon REIT (Price/NAV = 1.05) Only 7 REITs are overvalued now based on Price/NAV value. No change in the Top 6 compared to last month.

Most undervalued REITs (based on Price/NAV)

Lippo Malls Indonesia Retail Trust (Price/NAV=0.38)

EC World REIT (Price/NAV = 0.48)

ARA US Hospitality Trust (Price/NAV = 0.49)

Manulife US REIT (Price/NAV = 0.50)

Prime US REIT (Price/NAV = 0.51)

Keppel Pacific Oak US REIT (Price/NAV = 0.56)

Distribution Yields Overview

TTM Distribution Yield increased to 7.70%.

Increased from 7.33% in February 2023.

17 of 40 Singapore REITs have distribution yields of above 7%.Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and economic recovery.

9 REITs have a ttm yield of over 10%!

Highest Distribution Yield REITs (ttm)

Manulife US REIT (17.27%)

Prime US REIT (17.01%)

EC World REIT (13.23%)

Keppel Pacific Oak US REIT (12.75%)

United Hampshire REIT (12.00%)

Lippo Malls Indonesia Retail REIT (11.92%)

Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

Yield Spread widen slightly to 4.21%. Widened from 4.12% in February 2023.

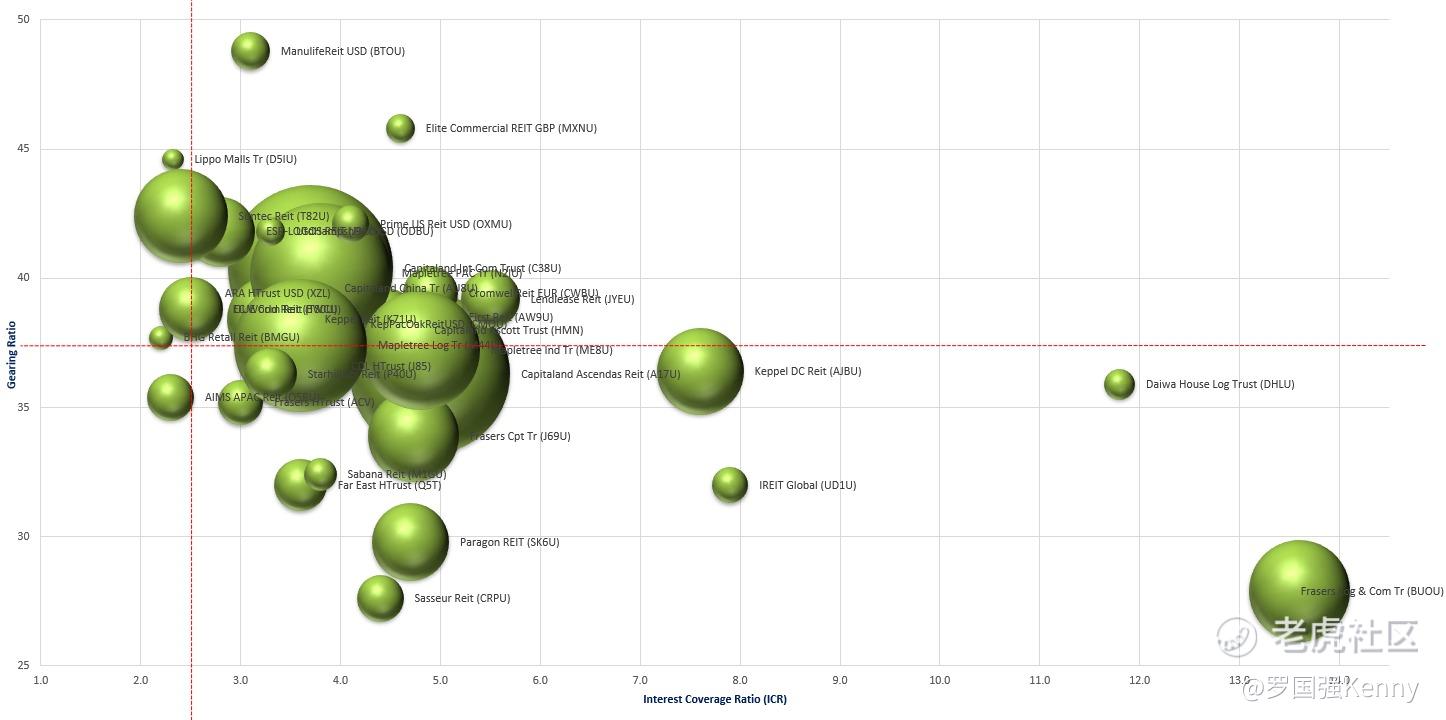

Gearing Ratios Overview

Gearing Ratio increased slightly to 37.54%.

Increased from 37.38% from February 2023.

Gearing Ratios are updated quarterly.

S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

Highest Gearing Ratio REITs

Manulife US REIT (48.8%)

Elite Commercial Trust (45.8%)

Lippo Malls Indonesia Retail Trust (44.6%)

Suntec REIT (42.4%)

Prime US REIT (42.1%)

United Hampshire US REIT (41.8%)

Market Capitalisation Overview

Total Singapore REIT Market Capitalisation decreased by 1.94% to S$96.84 Billion.

Decreased from S$98.76 Billion in February 2023.

Biggest Market Capitalisation REITs:

Capitaland Integrated Commercial Trust ($12.53B)

Capitaland Ascendas REIT ($11.68B)

Mapletree Pan Asia Commercial Trust ($9.01B)

Mapletree Logistics Trust ($8.08B)

Mapletree Industrial Trust ($6.40B)

F

rasers Logistics & Commercial Trust ($4.64B)

No change in the rankings since September 2022.

Smallest Market Capitalisation REITs:

Lippo Malls Indonesia Retail Trust ($200M)

BHG Retail Trust ($249M)EC World REIT ($292M)

ARA Hospitality Trust ($303M)

Elite Commercial REIT ($361M)

United Hampshire REIT ($369M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, here’s a subsidised 2-day course with all you need to know about REITs and how to start investing in them.

Major REIT News in January 2023

S-REITs earnings/results for Q4 2022 have wrapped up

All S-REITs have reported their earnings for Q4 2022. 22 out of 38 REITs (about 58%) reported YoY growth in DPU.

S-REIT Summary Charts

Below are 3 S-REIT Summary Charts. These show the current state of the S-REIT market.

Summary

Fundamentally, the whole Singapore REITs landscape remains undervalued based on the average Price/NAV (at 0.84) value of the S-REITs, with a very attractive DPU yield of 7.70%! The valuation and DPU yield are back to attractive level due to the correction in February probably caused by the increase of 10 year risk free rate.

It has been a bearish month for S-REITs. Poor performers include Capitaland Integrated Commercial Trust (-10.43% decline in market cap), Prime US REIT (-25.96%), Manulife US REIT (-14.06%), EC World REIT (-21.74%) and Keppel Pacific Oak REIT (-16.51%).

Yield spread (in reference to the 10-year Singapore government bond yield of 3.42% as of 5 Mar 2023) widened slightly from 4.12% to 4.21%.

Technically, FTSE ST REIT Index is trading in a short-term uptrend channel (higher high, higher low chart pattern) since finding the bottom in Oct 2022. Currently the REIT index is consolidating between 734-744. The short-term uptrend is still intact unless the 714 support is broken. If 744 resistance is broken, it is expected the S-REIT index to continue the bullish rebound with the next target 790-800 to breakout to enter into bull market.

Based on the current overall S-REIT P/NAV of 0.84 and the potential peaking of interest rate in Q2/Q3 2023, the probability to have a severe crash in S-REIT is low unless we are entering into severe recession with big drop in DPU and US Fed continues to increase the interest rate fiercely beyond 6%.) 2023 would be a cautiously bullish for S-REIT with fundamentally strong S-REITs.

Note: This above analysis is for my own personal research and it is NOT a buy or sell recommendation. Investors who would like to leverage my extensive research and years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- YanYanYanYan·2023-03-10[呆住] [流泪]点赞举报

- 南山小鱼人·2023-03-14[哟哟]点赞举报

- 曾启超·2023-03-13好点赞举报

- tsususu·2023-03-12好1举报

- 赵赵0429·2023-03-12学习了1举报

- 姜爱华·2023-03-1261举报

- Awesomebyc·2023-03-1011举报