We asked ChatGPT what will be AMC stock price in 2030

$AMC Entertainment(AMC)$ has faced challenges in recent years due to the rise of streaming services and other changes in the entertainment industry. Yet, over the last three years, the firm has seen a significant increase in popularity among retail investors, which has contributed to its stock price increasing.

In spite of the fact that AMC stock has dropped significantly from its near $60 peak in June 2021 to its $5.24 price on February 21, the company is still up $1.31 (33.33%) .year-to-date.

Since predicting the future stock price of any company involves many uncertainties and variables, Finbold has utilized artificial intelligence (AI) with ChatGPT in addition to a stock price machine learning algorithm to try and gauge a possible trading range for AMC’s stock price by 2030, based on available information and analysis.

Based on trends and analysis, ChatGPT noted:

“A possible trading range for AMC’s stock price by 2030 could be between $20 and $100 per share. This range is based on several assumptions and variables, including the success of the company’s efforts to adapt to changing market conditions, the level of interest and investment from retail investors, and the impact of potential risks and challenges on the company’s future prospects.”

Factors that could impact the cinema chains price

The sustained performance of AMC in adjusting to shifting market circumstances is one aspect that might affect the stock company’s success in adaptingeaming services and the introduction of new experiences like dine-in cinemas, AMC has been working to broaden its scope beyond just showing movies. The stock price might rise inif the firm succeedsn these endeavors and continues to innovate in response to shifting market trends.

Another factor that could impact AMC’s future stock price is the level of interest and investment from retail investors. ChatGPT highlighted:

“The initial surge in AMC’s stock price has been largely driven by retail investors, who have organized through social media platforms and other online communities. If this interest and investment continue, it could help to support the future growth of AMC’s stock price.”

At the same time, the AI tool pointed out potential risks and challenges that could impact AMC’s future stock price.

“One of the main risks is increased competition in the entertainment industry, as other companies introduce new services and experiences that compete with AMC’s offerings. Additionally, regulatory changes, economic downturns, and other factors could all impact the future growth of AMC’s stock price.”

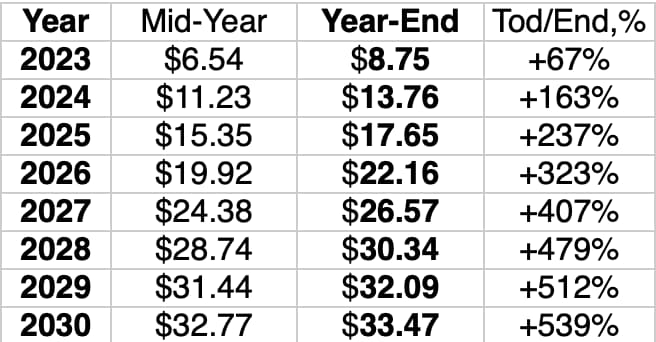

Projections made by CoinPriceForecast, the finance prediction platform that uses machine self-learning technology, indicate a significant increase for AMC stock by 2030, as per data retrieved by Finbold on February 21. The forecasted price prediction for 2030 is $33.47, a 539% increase from the stock price at the time of publication.

Having stated all of this, it is still difficult to determine what the future stock price of AMC will be by the end of 2023. Finbold carried out a deep dive overview of whether the stock could hit $30 in 2030 looking at specific short-selling strategies and retail sentiment. On Wall Street the consensus recommendation is a ‘sell’ from 7 analysts. Significantly, 4 industry experts recommend a “hold”. Elsewhere, four analysts suggest a “strong sell” rating.

Based on analyst stock evaluations for AMC over the last three months, the average price forecast for the next 12 months is $2.39; the target indicates a -54.39% upside from its current price. Interestingly, the highest price target over the next year is $4.50, -14.24% from its current price.

To be clear, there is no assurance that any predictions or projections made regarding a company’s stock price in the future will be correct or come to reality, since they are dependent on numerous assumptions and uncertainties.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。