AMC/APE: Limits To Arbitrage

Summary

The upcoming March 14 2023 vote should almost certainly cause APE and AMC values to converge because of specific language regarding how APE units will 'vote'.

Once the vote is complete the value of AMC shares could collapse.

However, implementation of any 'riskless' arbitrage is problematic given the absence of any borrow.

Once the vote is complete, AMC investors may face additional dilution and actually consider what the shares are worth. That may be under $1 (or $10 post reverse split).

Male chimpanzee in business clothes

Why APE Shares Should Convert On March 16

Why APE Shares Should Convert On March 16

On March 16, 2023, the upcoming vote will very likely collapse the gap between $AMC Entertainment Preferred(APE)$ and $AMC Entertainment(AMC)$ shares. That's because APE units will effectively become AMC shares if all goes to plan.

There was some concern that there may not be enough votes for the APE shares to convert. The reason why this shouldn't be a problem is buried in section 4.5 of the deposit agreement (and hat tip to Matt Levine who flagged this).

"In the absence of specific instructions from Holders of Receipts, the Depositary will vote the Preferred Stock represented by the AMC Preferred Equity Units evidenced by the Receipts of such Holders proportionately with votes cast pursuant to instructions received from the other Holders."

That's important. What it means is that whatever proportion of APE units vote yes, all APE units will vote in the same proportion. This eliminates any risk from non-voting, and it only applies to APE units not AMC shares. We already know that Antara's APE units (approx. 257M) are voting to convert to AMC shares. So given the way the voting process works that should be sufficient to get a majority of APE's voting in favor. There's really no reason for any APE holder to vote against and provided at least 57% of voting APE's vote yes, then the vote will pass. That's true even if AMC shareholders all voted no because there are more APE units than AMC shares (about 1.8 APEs for each AMC share). Voting no is arguably not in an AMC shareholder's interest either as AMC does need some capital to pay down debt.

Limits To Arbitrage

Now, knowing that two tradeable assets that trade around $6 and $3 should converge in price next month, should open up a golden opportunity, but putting on the trade is not that easy.

No Borrow To Short

First off we might want to short AMC and long APE. Indeed, that's something I suggested in October, and more recently there's also been a great write up on it from an more academic standpoint from Kevin Mak. The problem with that now is no AMC borrow is available. Borrow was getting very expensive, at the time of writing, now it just isn't there. That may change of course. It also makes sense that all the AMC stock that can be shorted should be, because there are 1.8x more APE units than AMC stock.

Put Options

Then you might want to use options. The challenge there is that there are no options on APE units, and options on AMC are now aggressively pricing in convergence if you buy put options. The options chain strongly suggests that AMC shares will be equal to APE shares at the time of the vote. As such after commissions and spreads, using put options on AMC to close the gap may not leave you with a profit.

Call Options

Call options are potentially interesting, you could potentially sell calls on AMC, though your losses would be infinite. You could manage that risk by buying a corresponding call at a higher strike. However, again at least one brokerage has blocked even this strategy, and there is a risk that your calls are assigned before expiry. However, Interactive Brokers do currently permit this.

Owning APE

Another strategy that has been suggested is to just go long APE. The problem with that, as we'll see below is the two securities very well may not meet in the middle. After the vote closes there's a chance AMC shares trade closer to fair value, and I'm not sure fair value is in the $3-$6 range we'll get to that next.

Resulting Value

However, even assuming that APE units do convert to AMC shares the resulting business may trade below where AMC and APE currently suggest. Here's why.

1. The Operational Challenge

Pre-COVID AMC did $200M-$300M of operating income annually relatively consistently. They haven't got back to that and the key headwind is that box office receipts are way below pre-pandemic levels. January 2023 saw 65% of January 2020 receipts according to Box Office Mojo. The best month of 2022 was July, and that was around 85% of pre-pandemic levels in terms of box office receipts, and that month was something of a one-off compared to the rest of 2022. Maybe a firm movie pipeline, strong pricing and reduced competition will enable AMC to get back to operational performance levels similar to pre-pandemic levels, but currently we're not seeing it. We'll learn more with AMC Q4 results in a few weeks.

2. The Capital Structure Challenge

But then even if AMC returns to around $300M of operating profit, their interest expense is approximately $315M ($4.5B of net debt at 7% interest). Even that is slightly charitable as they are unlikely to be able to refinance debt at 7% rates and I'm working of net debt rather than absolute debt levels. As such there may not be a return for shareholders as interest expense would consume any profits (and there aren't any profits currently).

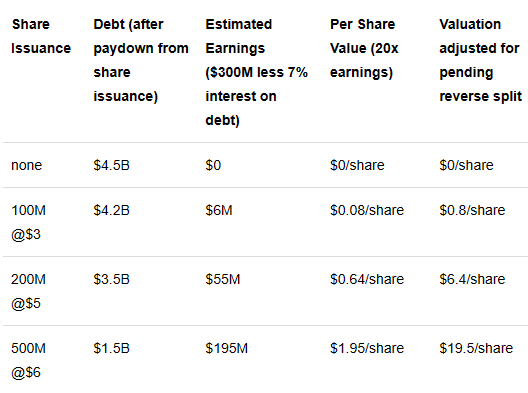

Share Issuance

The answer for AMC may be further share issuance, this may be anti-dilutive if it can be done at high enough prices. Assuming APE shares convert the company has 1.5 billion shares out and no real earnings if you believe the projections above. However, that can change with share issuance. The projections below assume 7% interest and that all earnings from any share issuance pay down debt.

So if after APEs convert then AMC can do share issuance, then AMC shares may have some value, even if those participating in any issuance itself may get a bad deal. However, I find it hard to create a realistic scenario where the shares are worth over $2/share (or $20/share post split). If you believe that it's one reason to be careful about just owning the 'long' side of the arbitrage trade only because once the smoke clears after conversion in March, the shares might trade lower when the focus is not arbitrage profits and short squeezes, but just a movie theater business willing and able to issue shares to pay down debt.

Short Squeeze?

And of course, prior to the March vote shares may trade anywhere. It's clear that pricing isn't rational today because of the spread between APE and AMC and maybe only the execution of the vote on March 14 can change that. However, after the vote a short squeeze is unlikely for two reasons.

Firstly, anyone implementing the arbitrage correctly will go from being short one AMC share and long an APE, to short an AMC share and long an AMC share. Hence they are perfectly hedged and not scrambling to buy AMC shares. Then secondly, management per the analysis above is likely to issue as many shares as they can to pay down debt and sort out the capital structure. A short squeeze may occur, but it may not last.

Risks

Final proxy for the special meeting has not been shared yet. There may be unforeseen issues with the voting structure or meeting preventing APE/AMC conversion, or the vote may simply fail depending on how people vote.

Management will likely report earnings before the special meeting and may announce other initiatives that impact the value of AMC/APE.

AMC and APE shares have been extremely volatile with various investors apparently actively trying to create a short squeeze.

Options trading and short selling of AMC/APE shares is currently constrained by rules imposed by brokerages and simply very limited borrow of AMC shares. Hence many trades here that should work in theory are not implementable in practice or not profitable after all the costs of the trade are considered.

Even trades that are implementable are subject to risks before the shareholder vote (margin calls etc.)

Conclusion

APE and AMC pricing should converge. The reason they haven't currently is the absence of borrow and limits to even option trading on AMC shares with no options on APE. Also there are approximately 1.8 APE units for each AMC share today. However, the March 14 vote should cause APE units to literally become AMC shares, closing any spread. It may be tempting to cut corners given the absence of borrow and simply long APE units. If implementing that strategy, it is worth noting that AMC shares could be subject to aggressive selling pressure once the vote is complete.

Source : AMC/APE - Limits To Arbitrage (NYSE:AMC) | Seeking Alpha

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 圣地麦加·2023-02-23这篇空头八股文写得就像放屁一样。通篇充满了敌意,作者好像就是肯格里芬的儿子,或者把母亲的卖身钱花在了做空上。你们注定要失败,唯一的悬念就是时间问题。点赞举报