Refinance Soon As Interest Rate Is Increasing Quickly!

Interest rates are going up!

For those who have not been following the market, the Federal Reserve is expected to raise interest rates by at least 25 basis points in each of the remaining 6 meetings this year. Together with the earlier which was raised, we are looking at approximately between 1.9% – 2.2% by the end of 2022 and even higher going to the following year.

What this means for homeowners like us (myself included) is that this will have a massive implications on how we will be financing our mortgage interest for the next foreseeable future.

To give a little context for those who are new to the blog, we’ve purchased our second home not too long ago right before Covid and we locked in a 2-years floating rate back at the time when interest rate was still very low.

This was in favor to us for about two years when interest rates remained low until recently when the Fed had announced that it is going to increase interest rates not once, not twice – but by up to minimally 6 times in this year alone!

This had me looking around for favorable fixed rate now that our lock-in period is over and the most sensible thing is to go for a fixed rate in the short to medium term given how much uncertainty the FED will be raising at any point in time.

I am sure many readers are no stranger to local brand breeders $PropertyGuru Group Limited(PGRU)$ – which happen to publicly being listed on Nasdaq just last month.

In fact, while listing and looking around for housing in the past, I usually browse their website a lot and many homeowners probably did the same too.

Property Guru has now gone on to a step further and introduce their auto Smart Refi Finance (https://propertyguru.sjv.io/c/3294128/1185608/14145) – which helps homeowners to source for the best available rates in the market so that we can save as much as possible in terms of potential cost savings.

Their website is relatively slick, seamless and easy to use as I had experienced it myself and documented it down.

First, after clicking the link here (https://propertyguru.sjv.io/c/3294128/1185608/14145), you will brought to a page which shows like the one below.

You do not have to create an account right away to see your results and recommendations but it is advisable to do so – even if you decide to drop-off at the last stage. The account creation is quick and simple.

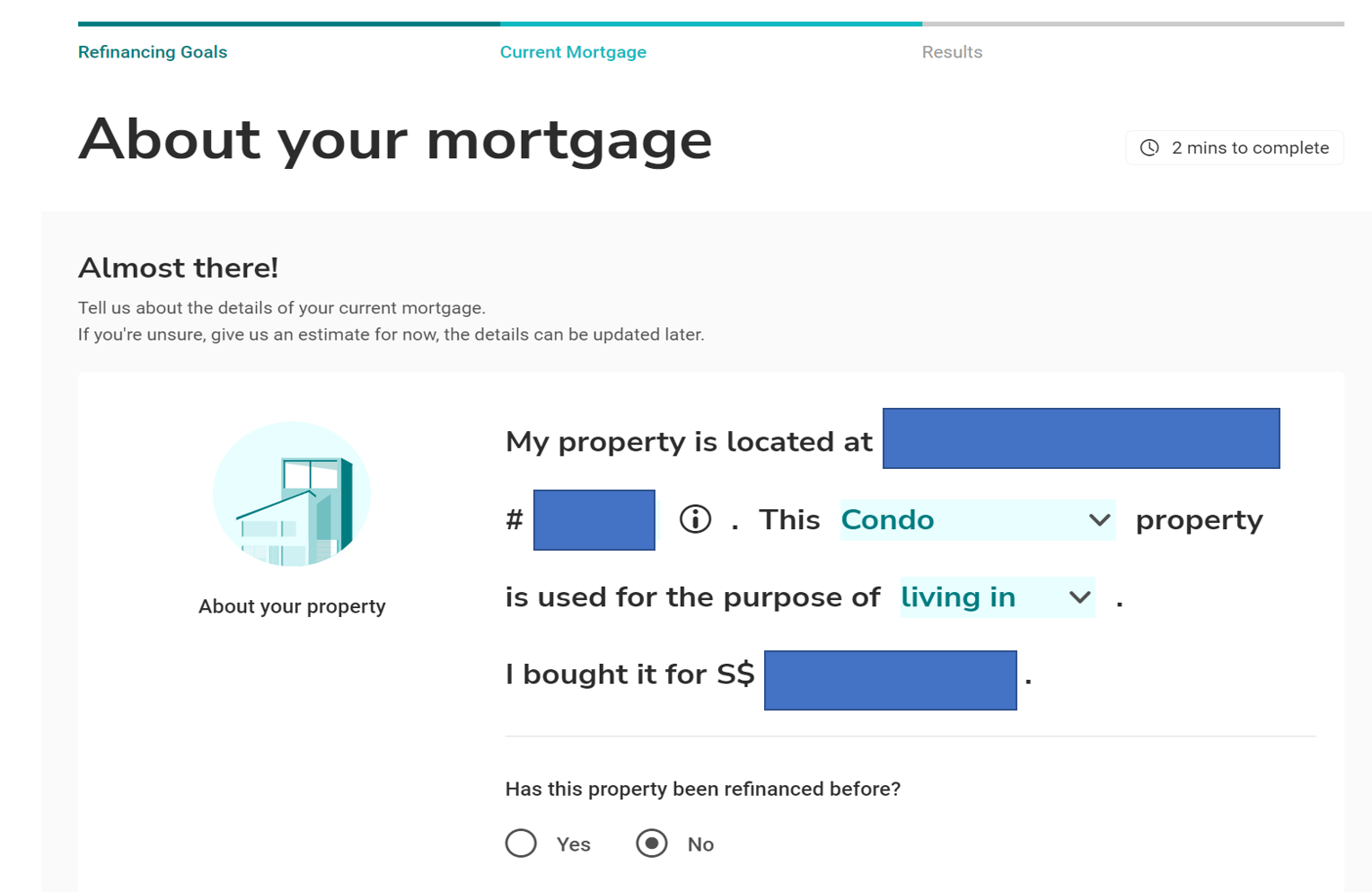

You will have to key in your information on the property you currently have mortgage with and then you can move on to the next step.

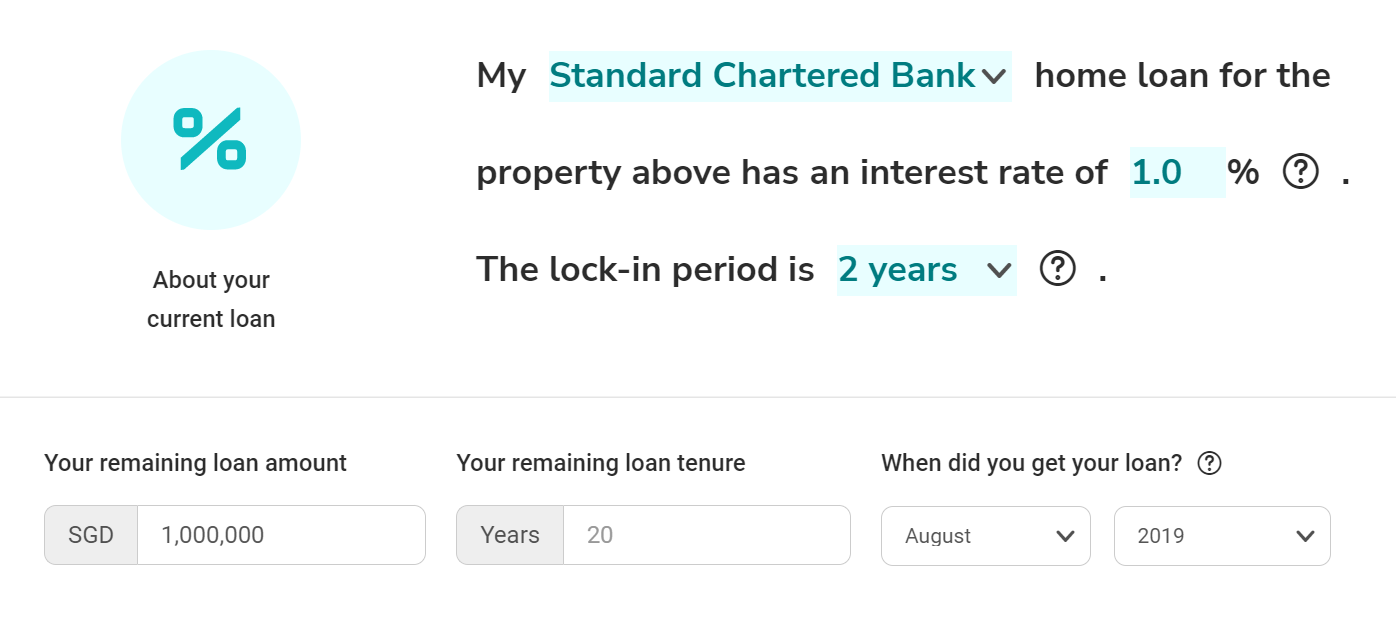

Next, they will ask you the current bank you have mortgage with, how much interest you are paying and if you are still under the lock-in period.

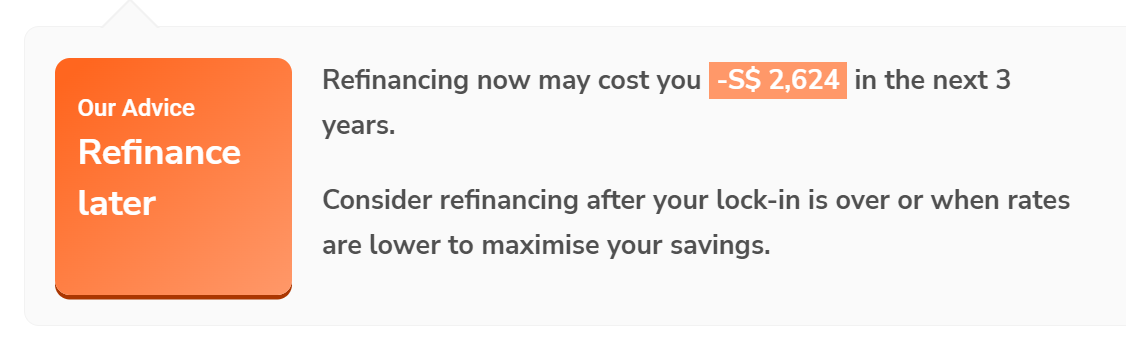

The system is smart enough to advice that if you are still under the lock-in period or if you are not going to have a potential saving, it will tell you to Refinance Later. This is obviously done automatically using a logic so you won't have someone giving you sentimental bias advice otherwise.

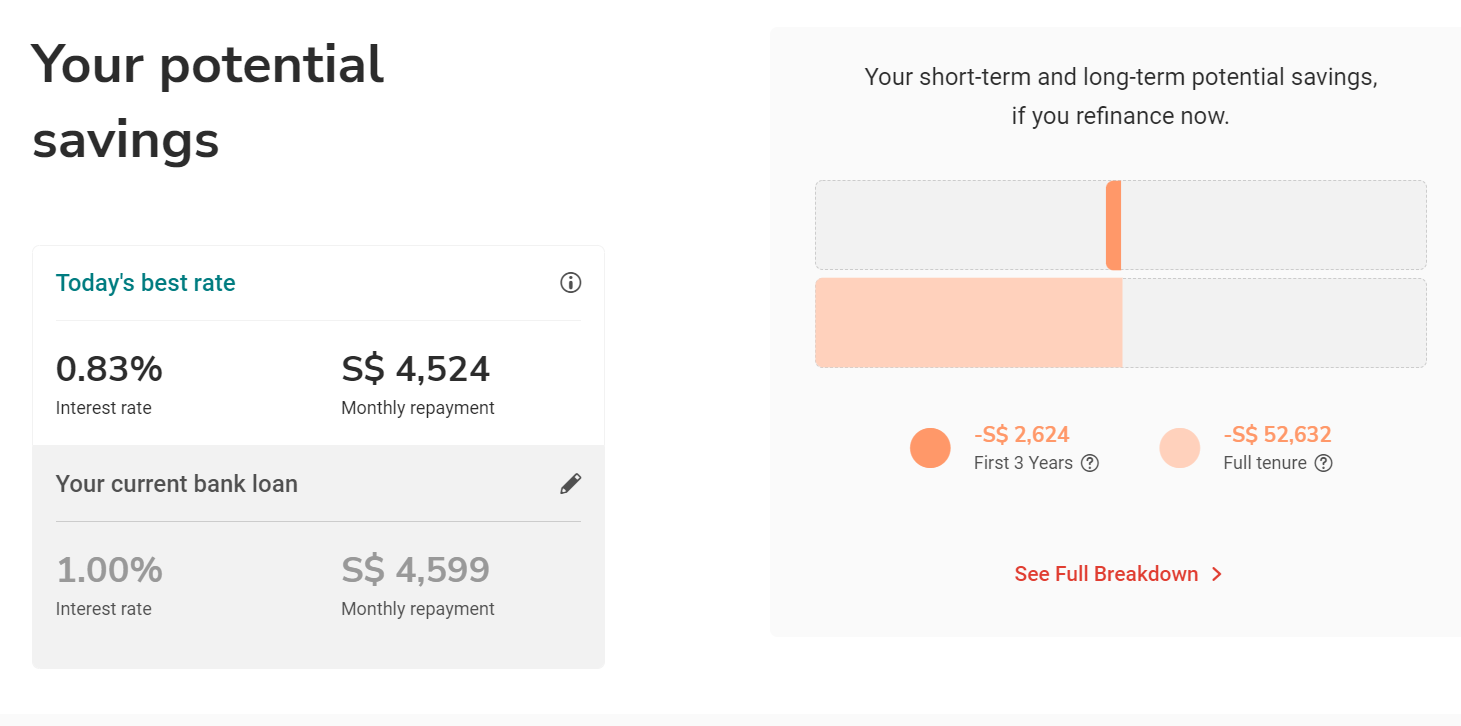

After that, the system will also tell you what is today’s best interest rate (do note these changes everyday so do check out your latest availability rates). For instance, as of this writing, today’s best lowest interest rate is with a certain bank on a floating 1M SORA + bank margin’s rate.

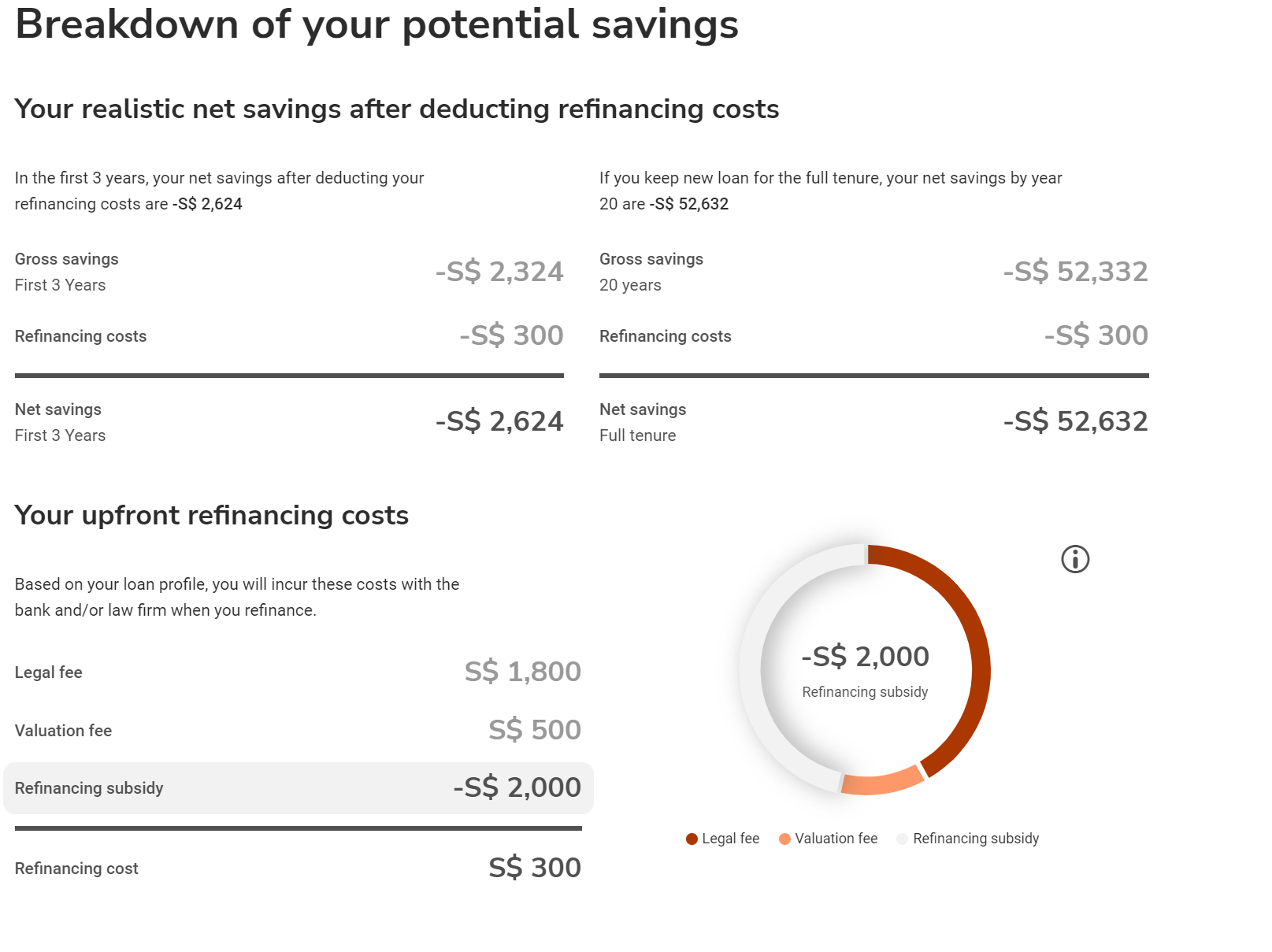

What I like about this is it also helps to break it down into potential savings so you can compare almost apple to apple of what you are paying today. They even gave the breakdown details of the one-off expense like legal, valuation fees for you to consider.

Now, up until this stage, you can play around with the calculator and change it around as and when you deem fit.

If you’d like to proceed to the next consultation stage (which is free by the way) and all done via a what’s app chat or call (if you prefer), you can key in your phone information and they will contact you.

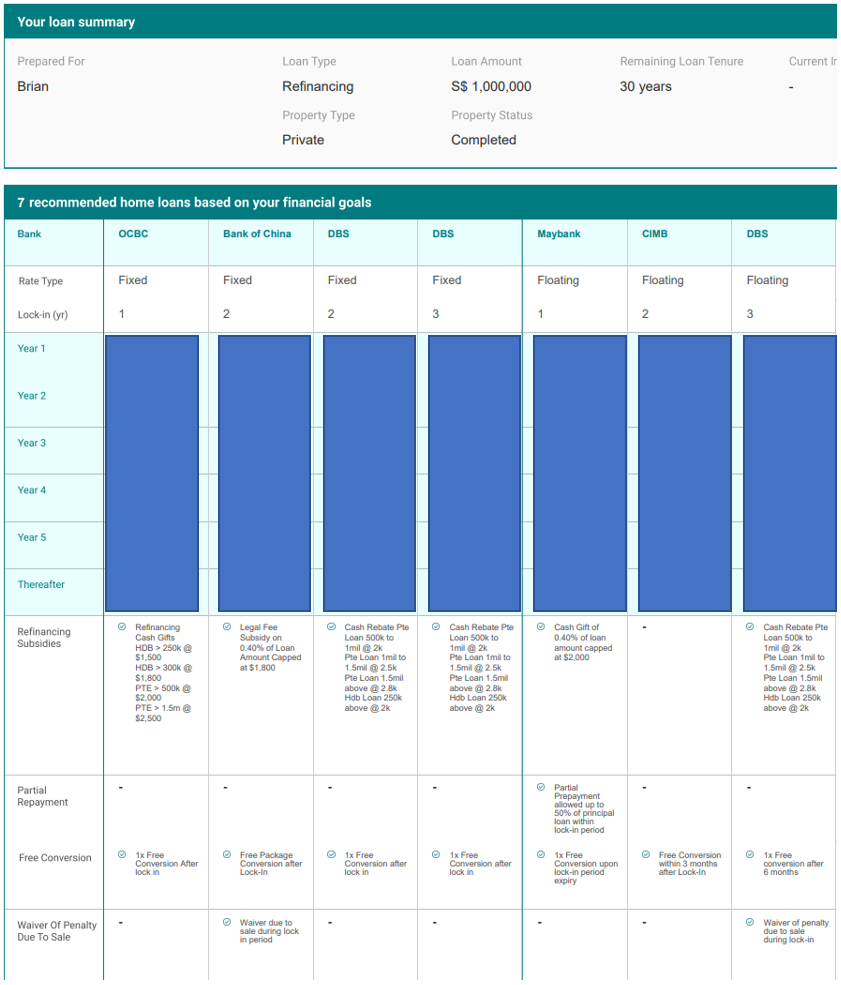

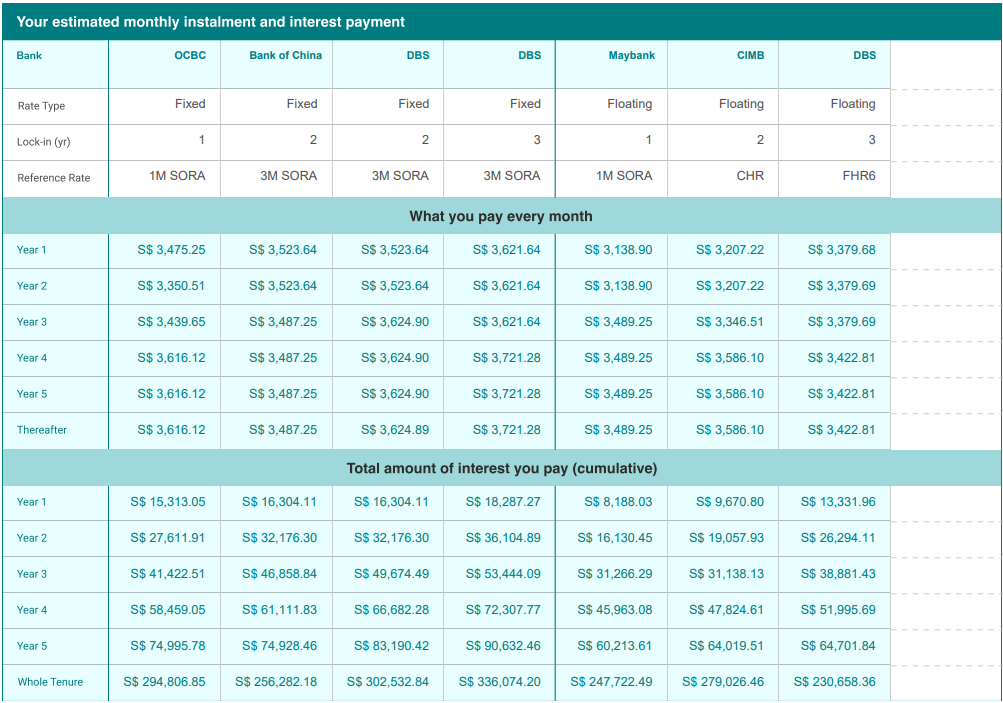

What you get is something of a recommendation like this.

The mortgage specialist will give you a run-down recommendation of the best 7-8 rates at that point in time with a combination of both fixed or floating.

The summary will also detail all the nitty-gritty details that you need to know – like whether you would qualify for a refinancing subsidies, partial redemption penalty, waiver of penalty due to sale, etc.

Best of all, the specialist might even have a special rate which you can take advantage of and negotiate with them.

All of these are for free! (you don’t have to pay a single cent to them for helping you to do all of these).

Final Thoughts:

I’ve personally done my own refinancing about a month ago but wish I did it earlier (since my lock in period had expired 6 months back).

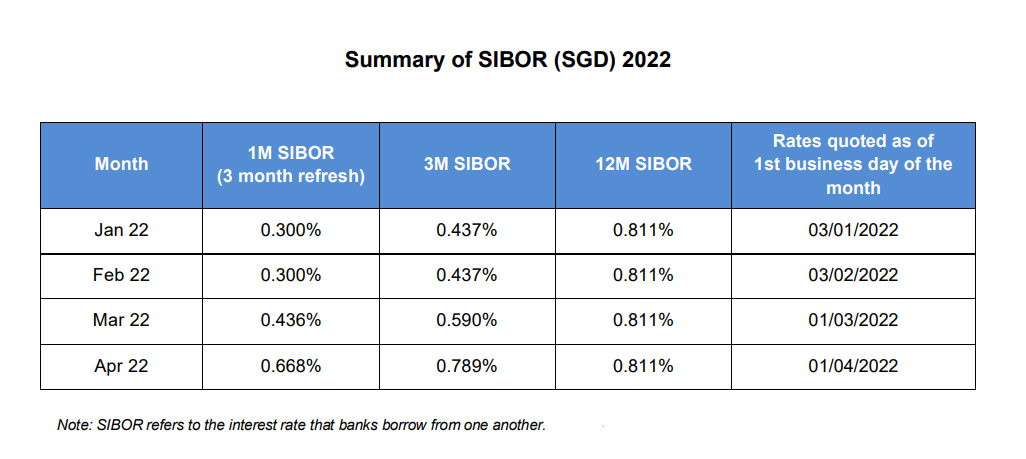

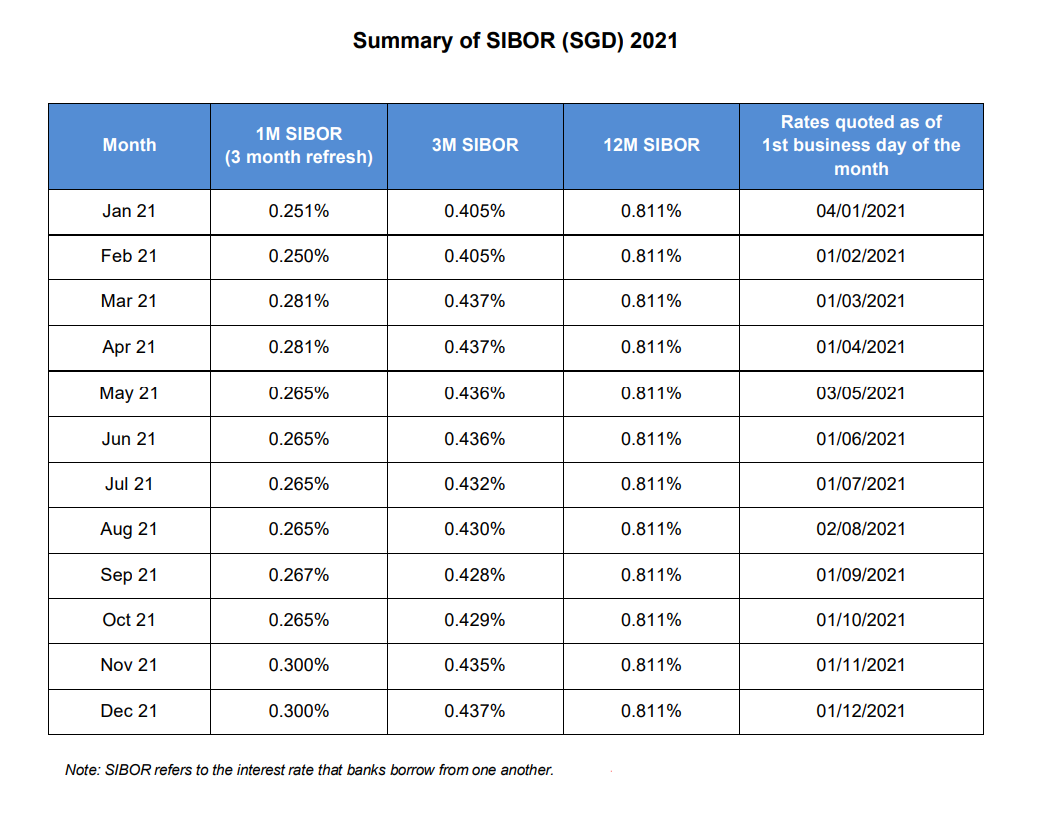

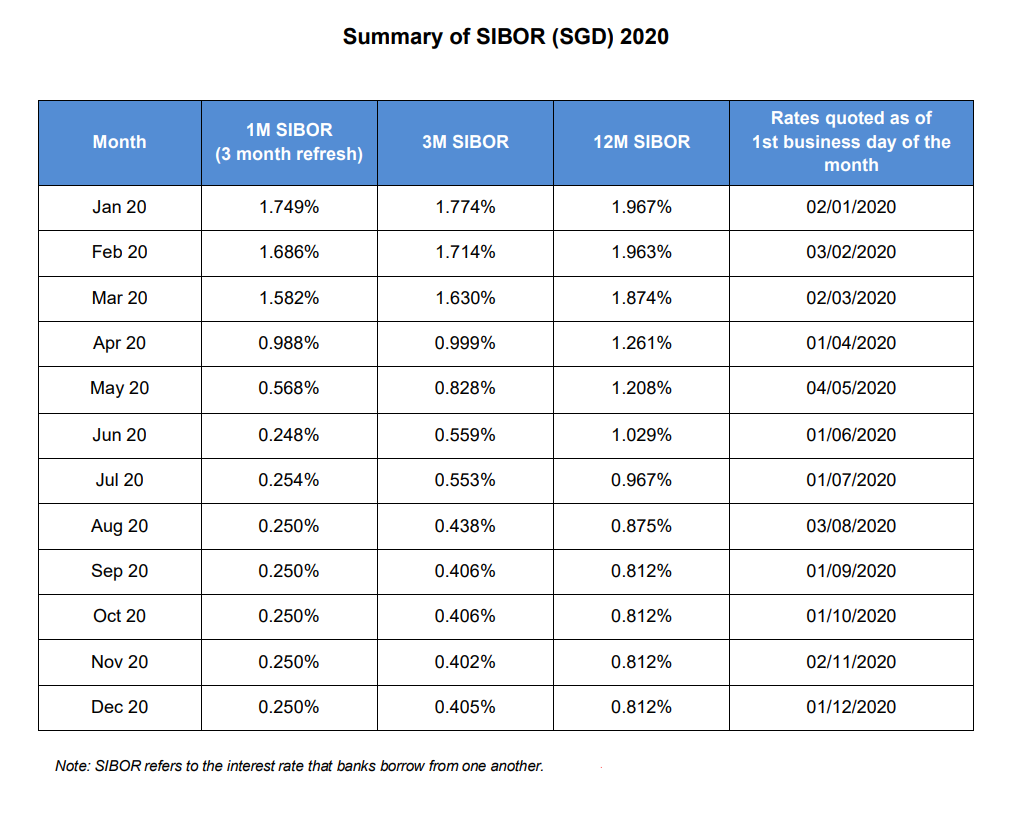

Interest rate is going higher and if you are under the floating rate, you will be under the mercy of the SIBOR (will be replaced by SORA in early 2024), given how closely they correlate to the increase in the Fed Funds rate.

To show just how high SIBOR can go to, just take a look at the reference of how high SIBOR goes up to back in 2018 – early 2020 when it hovers around 1.8% – 2.5%.

While things are good when interest rates are low for the most part of 2020 and 2021, things are beginning to look like the trend is going up again and in this case, we’ll have to plan in advance if we want to budget prudently.

www.3foreverfinancialfreedom.com

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。