Why you should own AMZN, GOOGL

Why now might be the time to buy AMZN and GOOGL shares?

2022 has not been a very good year for investors as the stock market pulled back on fears of high inflation and a more hawkish Fed. Last week, the yield curve inverted for the first time since 2019 as economic and inflation data continues to disappoint. Fearing a deeper correction in the stock market, I believe that now is the time for investors to rebalance their portfolios into high-quality names. With healthy balance sheets, strong operating cash flows and a wide economic moat, I believe that the FAANG stocks offer investors hope in a period of uncertainty. More specifically, after delving into the fundamentals of Facebook (Meta), $苹果(AAPL)$, $亚马逊(AMZN)$ , Netflix and $谷歌A(GOOGL)$, I posit that Amazon and Google offer the most value to investors and have the highest potential investment returns among the FAANG names.

Meta (FB)

In one of my previous articles, I initiated a HOLD rating on Meta due to cyclical weakness in its advertising revenue and uncertainty surrounding the profitability of its investments in the Metaverse. I continue to believe that Meta is facing an uncertain future as it embroils in battles regarding user privacy and is facing a mass exodus among its higher-level executives in its Metaverse space. These issues could become a thorn in the side of management and provide distractions from Meta's grand scheme of being the dominant platform in the Metaverse.

Apple (AAPL)

Following the start of the Covid-19 pandemic, Apple has performed tremendously well as customers rushed to upgrade their devices to work from home. Two years later, analysts predict that Apple's revenue growth is likely to slow down as people return to normalcy. Analysts are only predicting an 8% revenue growth in 2022 down a massive 33% in 2021. This highlights that Apple's main business, the smartphone market is becoming saturated and may not have much room for growth. Thus, Apple has to rely on its other services: streaming, music, iCloud, etc to fuel its growth. As it becomes more difficult to grow, the rise of Apple's share price is likely to slow in tandem.

Amazon (AMZN)

Amazon was another beneficiary of the Covid-19 pandemic as lockdowns meant that customers were forced to turn to e-commerce to purchase their goods. However, as the global economy reopened and people returned to normalcy, e-commerce sales have slowed. Last quarter, Amazon's revenue grew only by 9% compared to 44% the previous year. While e-commerce sales may have a drag on its profitability short-term, Amazon has been investing in the future of its business and venturing into new markets with high-profit margins. Its AWS business grew operating income by 48% last quarter and is expected to continue its current trajectory. I too believe that AWS has tremendous growth potential due to its scalability and solutions which increase business productivity.

Netflix(NFLX)

Similar to Meta, Netflix's investors have not been impressed with its operating results as competition in the streaming industry heats up. Companies such as Disney, HBO and Apple have launched their own streaming services which directly compete with Netflix. Furthermore, Netflix faces indirect competition from other entertainment services such as theme parks, cruises and cinemas as the economy reopens and people start spending more time outdoors. Coupled with the fact that Netflix has been spending aggressively to produce new content, free cash flows have fallen significantly. In an attempt to fight its competition, Netflix has ventured into gaming. However, there are also many players in the mobile and tablet gaming industry and Netflix has to distinguish itself from competitors such as Apple which is not an easy task.

Alphabet (GOOGL)

Google's parent company, Alphabet is another behemoth in the tech industry and owns lots of businesses across different industries including YouTube, Google Cloud and Waymo. Just like Amazon, Google has found ways to diversify its sources of revenue away from its core search engine business. Recently, it was announced that Waymo, which offers self-driving taxi services started offering driverless robotaxi rides to employees in California. Soon, Alphabet will be able to charge customers for robotaxi services, providing it with a new exclusive stream of income. With the potential to tap into new markets, I believe that Alphabet will be able to continue to deliver excellent growth for investors.

Valuation

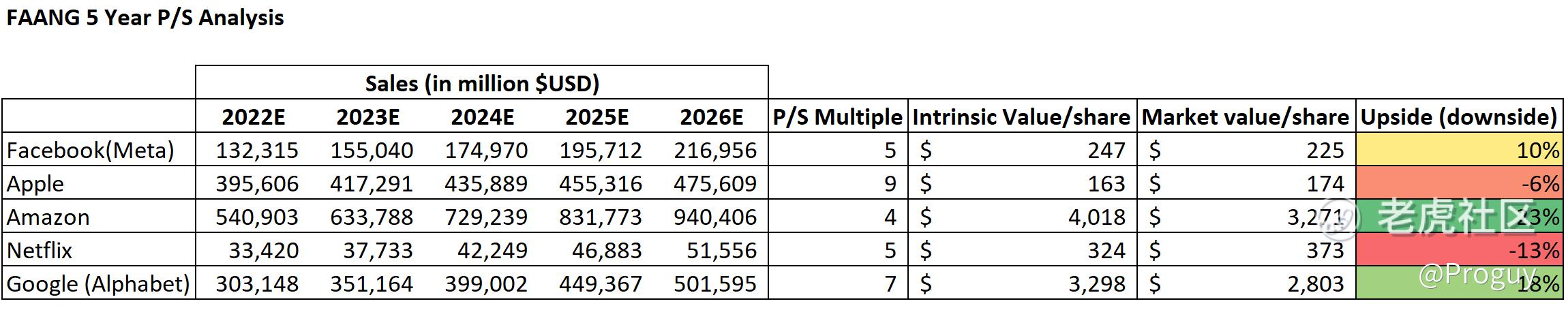

Using the sales estimates from analysts, I forecasted the revenue for each FAANG name for the next five years. I then assigned them a P/S multiple based on their historical average and calculated their intrinsic value based on a discount rate of 10%. Comparing the FAANG names to their current market value, it can be seen that Amazon is the most undervalued followed by Alphabet. Meta is slightly undervalued after its recent selloff but carries uncertainty regarding the future of its Metaverse business. Although Apple is a very good company, it is slightly overvalued at the moment while Netflix is the most overvalued after adjusting for its cash-burning streaming business.

Conclusion

With Amazon and Google both announcing a 20-1 stock split, I believe that this presents an opportunity for investors who have yet to own these stocks. Both these companies are excellent businesses that have a higher Return on Invested Capital and investments that are likely to pay off in the long run. Owning high-quality names will allow investors to weather the storm that is the stock market and come out with positive returns in the future.

Disclaimer: This article is for educational/informational purposes and does not constitute investment advice. Perform your own due diligence and seek financial counsel before making any investment decisions.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- leongoh·2022-04-06That's Cool.点赞举报